New Mexico’s personal income tax SHOULD be reduced to be in line w/ neighbors

The current legislative session MAY see long-overdue changes to the State’s gross receipts tax. Reform may or may not happen this session, but it has been introduced and even Gov. MLG supports it.

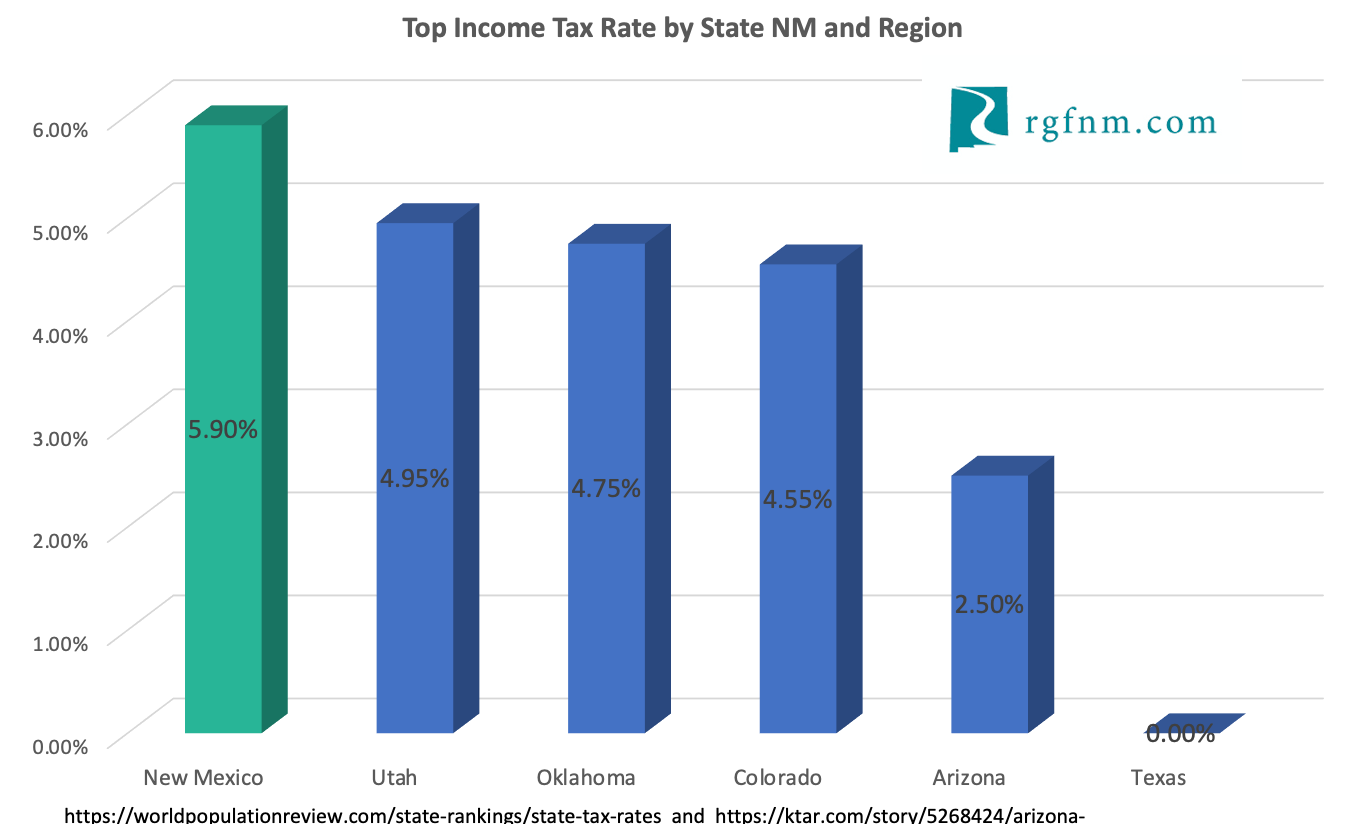

But New Mexico still needs to embrace further tax reforms including to its personal income tax. Texas is notable for its zero income tax and strong economy. Arizona just dropped its top income tax rate to 2.5%. Even in deep blue Colorado, Gov. Jared Polis has said he wants to eliminate his State’s personal income tax. Utah is considering income tax cuts and so is Oklahoma.

Despite New Mexico having a historically-large budget surplus, sadly, no serious income tax reductions are being discussed in the Land of Enchantment. Crazier still is the fact that HB 119 which would put NM’s top rate at 6.9% was not dismissed immediately as foolhardy. During Gov. Bill Richardson’s Administration New Mexico’s income tax was reduced from 8.2% to 4.9%. It was widely seen (by economists) as an economic success. Sadly, Democrats since then have been pushing to increase taxes on personal income.