New Mexico ranks 30th in Wallethub tax burden report

According to Wallethub New Mexico’s overall tax burden is 30th-highest in the nation.

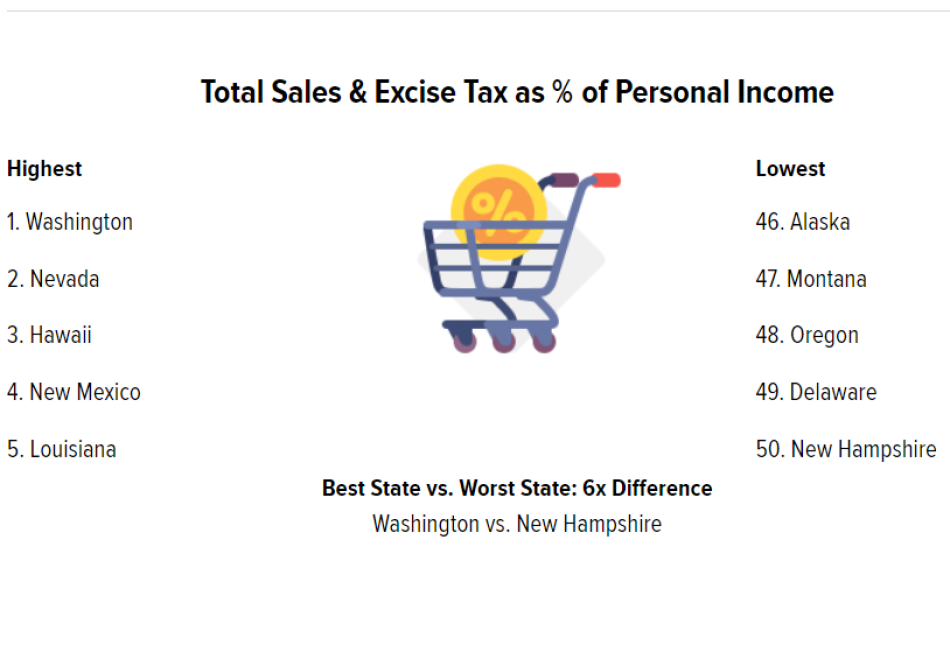

Specifically, New Mexico’s property tax burden ranks 44th, it’s income tax burden is 40th (both of these are relatively good), but the sales/grt tax is 4th-highest overall.

30th is indeed a relatively low tax burden when compared to other states, but the situation could be so much better. For starters, the oil and gas industry alone generated $13.9 billion in revenue for the state in 2023. New Mexico could and should have a much lower tax burden overall. No other state has a budget that could easily be covered by oil and gas taxes alone.

Furthermore, while NM’s income taxes aren’t particularly high not only is the GRT high, but it also is a tax that impacts businesses.

Finally, as Milton Friedman pointed out, “The true size of government is measured not by how much it rakes in currently in taxes by how much it spends.” To grow and diversify its economy New Mexico could and should reduce taxes, especially by reforming and reducing the GRT. But to really spur economic growth New Mexico needs to reduce the size and scope of government.