Yes, New Mexico can/should eliminate the personal income tax

As the 2025 legislative session looms most are buckling up for another “bumpy ride.” The Legislature is populated more than ever with leftist so-called “progressives” who don’t understand basic economic policies or why New Mexico so often tends to be at “the bottom of the good lists and top of the bad ones.”

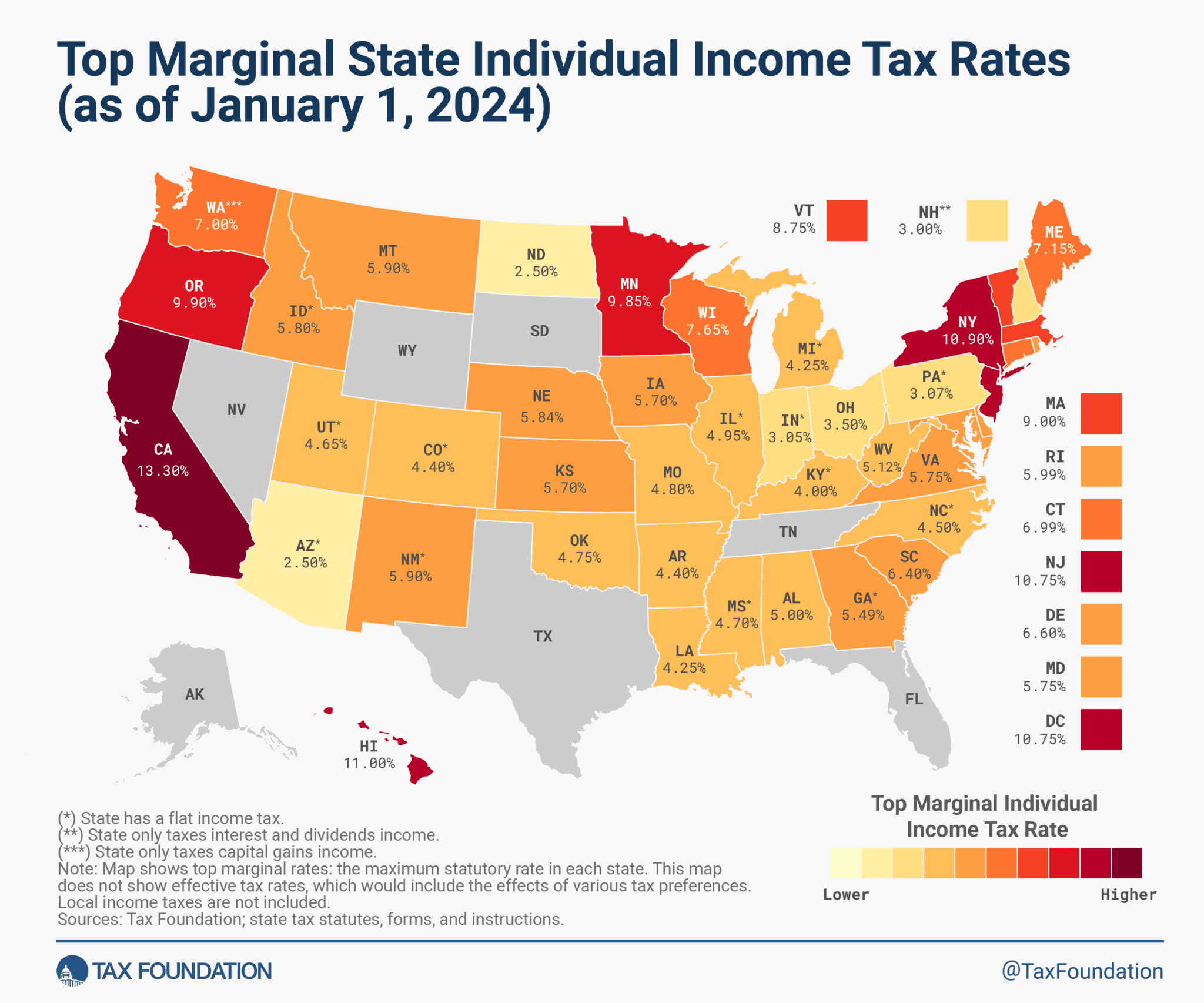

But, there are some bright spots. A newly-minted legislator from Hobbs, Rep. Elaine Sena Cortez penned an excellent opinion piece in the Albuquerque Journal calling for total elimination of New Mexico’s personal income tax. It is a long-shot given the proclivities of the Legislature, but such a move would make New Mexico the 10th state with no income tax (see below). Currently our top income tax rate of 5.9% is the highest in the region and MUCH higher than economically booming Texas which has NO income tax.

New Mexico HAS plenty of money to do it. The PIT is expected to bring in $2.1 billion in FY 2026. MLG’s proposed general fund budget is $10.94 billion which is a fat budget fueled by rapid revenue growth (thanks oil and gas). With the State expected to bring in $13.4 billion in FY 2026 you could eliminate the whole personal income tax this session and STILL have about $400 million available above and beyond what the Gov. wants to spend.

That’s assuming that eliminating the income tax would have no effect on New Mexico’s economic growth and that there is no way find savings in New Mexico government relative to what MLG wants to spend. Of course the Legislature could also phase in tax cuts over a few years assuming future revenue growth remains strong.

Lots of people in Santa Fe TALK a big game about “diversifying” New Mexico’s economy, but few are actually willing to do it. Kudos to Rep. Sena Cortez for taking a bold step as an incoming freshman.