New Mexico’s pensions remain problematic

As prospective gubernatorial candidate Duke Rodriguez pointed out in a recent Albuquerque Journal opinion piece, New Mexico’s PERA pension system’s solvency has worsened in recent years. This, despite reforms adopted in 2020 (that Rio Grande Foundation supported).

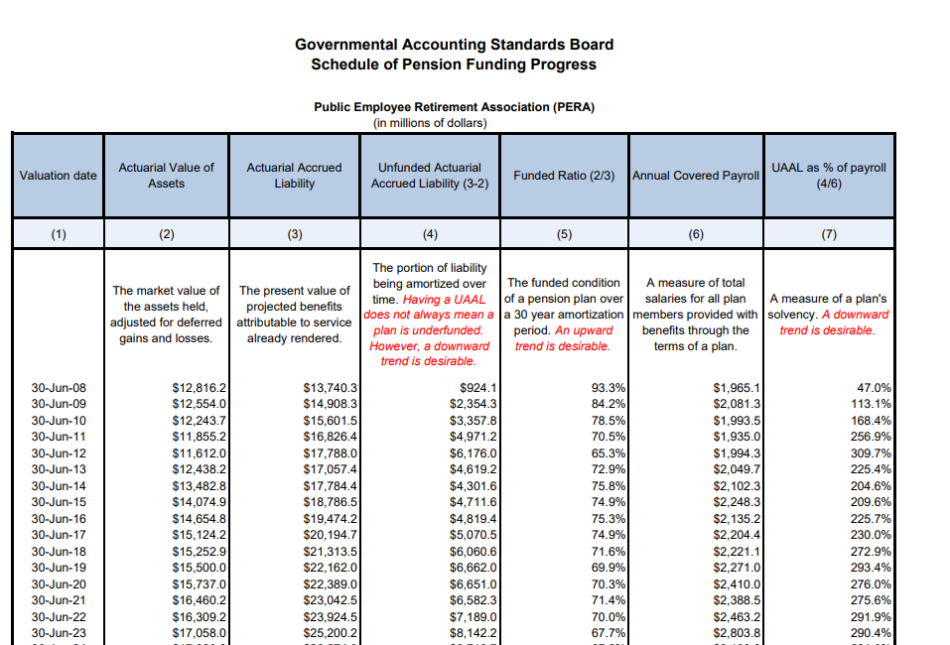

As the Albuquerque Journal reported, “Public Employees Retirement Association’s funded ratio — or its total assets divided by liabilities — has dropped from 70% in 2019 to 67% as of last summer. Its total unfunded liability has grown from $6 billion to nearly $9 billion during the same time frame.” That’s not good at any time, but considering the stock market’s performance during that time frame it is even more troubling.

I asked our friend Len Gilroy at the Reason Foundation (pension experts that we worked on pension reform with in 2020) for his thoughts and here’s what he said, “The benefit changes back then helped bend the cost and liability curves and built in some risk protections around new hires, but they didn’t fundamentally pour a bunch of money in to solve the current underfunding. It was a Phase 1 reform and then their leadership team left and they stopped pushing additional phases.”

At this point they (the Legislature) need to keep going. The first reform bent the liability curve, and the outcomes would have absolutely been worse had those not happened. But hovering out around 67% funded when markets are wildly volatile and closer to the next recession is no place to rest.”

Furthermore, the Journal story noted that “New Mexico’s other public retirement system, the Educational Retirement Board that provides benefits for retired educators, has also faced solvency concerns in recent years. The ERB had a 65% funded ratio as of last summer, which marked a slight improvement from the previous year.”

The Rio Grande Foundation has philosophical concerns with defined benefit pensions in the first place though we don’t expect the transition to a defined contribution plan to happen anytime soon. Rather than pouring money into the State’s myriad “permanent funds” perhaps showing up our pension liabilities would have been a better approach?

You can see the latest PERA funding chart below, it is found at page 34 of this document.