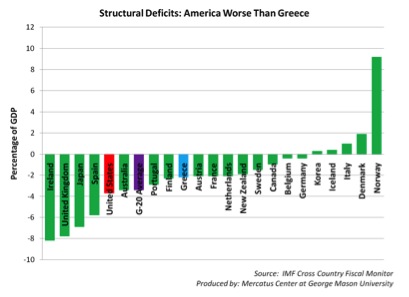

America’s Budget Situation: Worse Than Greece?

The above chart by Mercatus Center senior research fellow Veronique de Rugy uses data from the International Monetary Fund’s Cross-Country Fiscal Monitor to compare projected 2010 structural deficits across the G-20. These structural deficits reflect each nation’s long-term attitude toward deficit spending, with the effects of business cycle fluctuations removed. When taking into account entitlement and all other obligations, America’s structural deficit as a percentage of our GDP is far bigger than almost any other country’s; it is, in fact, worse than Greece’s.

The United States’ high level of structural deficit means that our level of debt is projected to grow into the future. This massive deficit reflects a baseline level of spending that is not feasible at current levels of taxation. Even if no new spending increases are enacted, we will still be required to borrow; in turn, this borrowing will continue to increase our level of debt.

The increasing level of debt, when coupled with the fact that our current debt has a far shorter maturity than that of most other countries, means that our country is spectacularly vulnerable if the market suddenly decides it doesn’t want U.S. debt. The short maturity of U.S. debt means that even if it the level of borrowing weren’t growing, we would still have to refinance large amounts of debt over very short periods of time. Any change in investors’ attitudes towards the riskiness of United States’ debt will cause our costs of maintaining debt to skyrocket. Throughout the financial crisis, investors have viewed U.S. debt as a relatively safe asset; it doesn’t mean that things won’t change.

Investors judge default risks on a curve. They will assess one government’s risk against other’s (for instance, the United States vs. France, Germany, China, and Norway). When the markets do lose confidence in a government’s fiscal rectitude relative to others, a crisis can arise quite quickly, forcing countries into painful political decisions. And this could very well happen to the United States.

Learn about our dangerous cycle of deficit. If you want to make a difference, take part in the upcoming America Speaks townhall meeting in Albuquerque.