EV sales plummeted in Q1 of 2025

Back in May the US Congress voted to eliminate California’s (and thus the ability of other “blue” states like New Mexico) to force motorists to purchase electric vehicles (43% starting in 2026). A new report from the pro-EV trade group Alliance for Automotive Innovation finds that in Q1 of 2025 auto buyers didn’t just slow the growth of EV purchases, but shifted back to gas vehicles in overwhelming numbers.

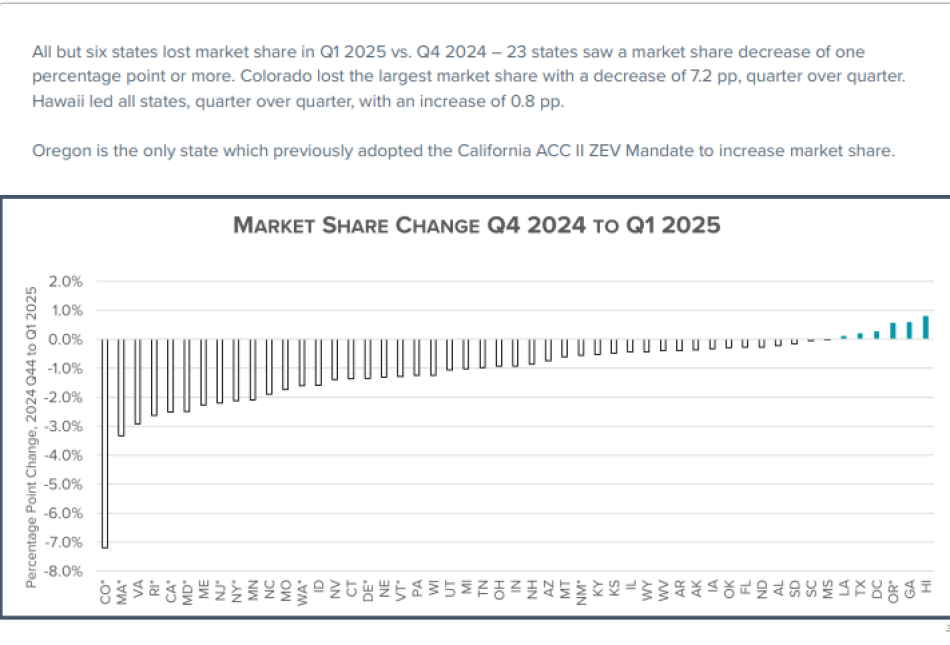

This was true in mandate states like New Mexico and across the country. In fact, according to the chart below, the ONLY state to mandate EV’s that saw and increase over the 4th quarter of 2024 was Oregon. Also, using the same group’s information RGF sees a 10% quarterly decline in New Mexico from 5.53% in Q4 2024 to 4.98% in Q1 2025 (p. 8).

Notably, while the state-level EV mandates may have seemed to be on their way out given the inauguration of President Trump in January, the fact is that numerous federal and state subsidies for EV’s remain in effect. The following is verbatim from an email sent out by the New Mexico Environment Department:

Under current federal policy, tax credits of up to $7,500 for new EVs and up to $4,000 for used EVs are only available through September 30th, 2025. That window is closing fast.

These savings apply at the time of purchase for eligible vehicles and income-qualified buyers, meaning you don’t have to wait for tax season to benefit. It’s real money back in your pocket, right when you need it.

Need a charger too? You can also get a tax credit of up to $1,000 to help cover the cost of purchasing and installing a residential or commercial EV charging station. But that time is limited: this federal tax credit is only available through June 30, 2026.

If you are considering an EV and/or charger, visit Plug in America’s EV tax credit guide to see which vehicles qualify and whether you’re eligible.

The savings don’t stop there!

New Mexico’s Energy Conservation and Management Division in the Energy, Minerals and Natural Resources Department offers a tax credit of up to $3,000 for the purchase or lease of a new or used qualifying vehicle and a tax credit of up to $25,000 for the purchase and installation of clean car charging units. This program has helped over 700 New Mexicans save thousands of dollars as they transition to cleaner modes of transportation. Visit the Clean Car and Charging Unit Tax Credit webpage to see if your next purchase qualifies.

In New Mexico’s case the subsidies and breaks will remain in effect and are augmented by recently-enacted building codes which require EV charging stations and/or infrastructure in new construction.