NM’s misguided push for “progressive” taxes (defining “progressive” vs. “regressive” taxes)

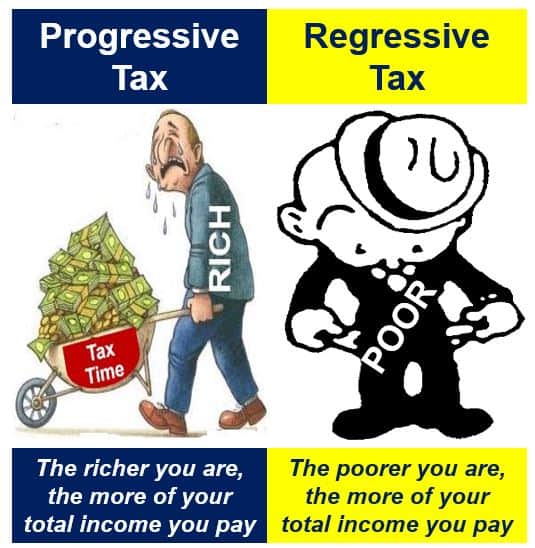

Over the weekend in the Albuquerque Journal ran this piece by a national, left-wing advocate for “progressive” taxation. He lauds New Mexico for making its tax code more “progressive” even though he appears to not know what the terms “progressive” and “regressive” mean when it comes to taxes.

According to none other than the IRS, a ” regressive tax—A tax that takes a larger percentage of income from low-income groups than from high-income groups.” A sales tax (or GRT) would be “regressive” because it taxes everyone at the same rate.

The “progressive” author misguidedly states that “regressive,” means the more you make, the less you pay. There are few taxes like that and certainly no tax structures where you pay less overall tax if you make more money.

So, how do New Mexico’s “progressive” tax changes impact job creation or overall economic health or the attractiveness of our state to economic relocation? Could New Mexico (blessed with massive oil and gas surpluses) make its tax structure less “regressive” by reforming and reducing its gross receipts tax? What is the appropriate level of taxation? These questions are left unanswered.

The author DOES trash Arizona for having made their tax structure more regressive in recent years (by cutting taxes, of course). New Mexico seems to be moving toward a California-style tax structure (according to the author’s own study, California has THE most progressive tax code) which has also made the state an attractive place to move out of.