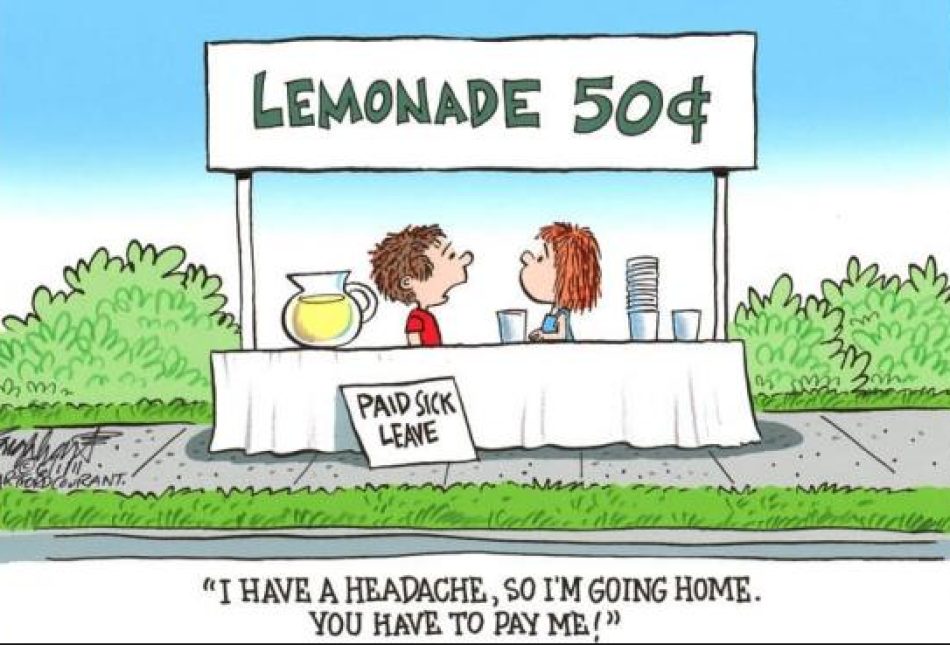

Paid Family Leave Mandate bill the same bad policies by a different name

After weeks of delay sponsors of HB 11, formerly Paid Family and Medical Leave, the bill has been reintroduced under the same number but with some significant alterations. You can read the newly minted “Welcome Child and Family Wellness Leave Act” for yourself. It is an attempt to placate businesses which have been (and remain) nearly universally opposed to HB 11 by whatever name.

We’ve looked closely at the bill and have put together a few thoughts:

It now provides 6 weeks per year, except for welcome child leave, which allows for up to 12 weeks.

Contributions from businesses and employees start out somewhat lower but can rise starting in 2030.

The revised bill ADDS a $3,000 welcome child refund, to be paid to one of the child’s parents each month for the three months immediately following the birth or adoption of the child for a total of $9,000.

The biggest problem with the revised bill is that the numbers just don’t add up. It is impossible to tell if the plan will be solvent in the future with the numerous different figures being thrown about and a lack of actuarial analysis.

What IF the program is insolvent? Is there an assumed source of revenue to make up the difference? The bill limits how quickly premiums can be raised. Shouldn’t there be a backstop if the plan is insolvent? As the original FIR notes: Other states have had to increase their payroll taxes to cover increasing utilization of their PFML programs. Washington State’s rate has increased from 0.4 percent to 0.92 percent since the start of the program due to high usage. Actuarial studies in Washington predict the rate will reach its statutory cap of 1.2 percent by 2028. Rhode Island, Massachusetts, California, and Rhode Island have all experienced rate increases.

Democrats remain steadfastly opposed to allowing Social Security to invest in the stock market to generate increased returns for recipients but the bill calls for these funds to be invested by the state investment officer.” So, if the stock market tanks?

Then, “an applicant shall not be required by the Welcome Child and Family Wellness Leave Act to use any leave consecutively.” So, someone can take off work, come back to work for a few weeks, and then take off again????

Finally, why even include self-employed New Mexicans? Being self-employed by itself implies a willingness to take on a certain amount of risk. Why bother with them one way or the other? Worse, self employed individuals only need to pay into the fund for six months to qualify for benefits, opening the door for people, especially those who are expecting a child or have upcoming medical needs, to pay in for six months, claim the benefit, and then opt out of the system.

This bill remains an expensive and dangerous tax hike on New Mexicans and New Mexico businesses. Sadly, it appears to be heading to the House floor after recently passing out of the House Commerce Committee with all Democrats except Rep. Marian Matthews supporting and all Republicans opposed.