“Progressive” Hawaii Cuts income taxes

Like New Mexico Hawaii is a “deep blue” state. It also has no oil and gas to speak of. They certainly don’t have $15.2 billion in tax revenue from the industry in a single year. And while Hawaii’s income tax burden is heavier than New Mexico’s, under this plan their income tax burden will be lower than New Mexico’s once fully implemented.

Yet, Hawaii recently enacted significant income tax cuts. And, unlike New Mexico’s paltry cuts (which were partially offset by tax hikes and wasteful tax credits) Hawaii’s tax reductions are significant. Hawaii’s tax cuts dramatically expand the standard deduction under the income tax taking it from $4,400 joint or $2,200 single to $24,000 or $12,000 for joint and single filers respectively.

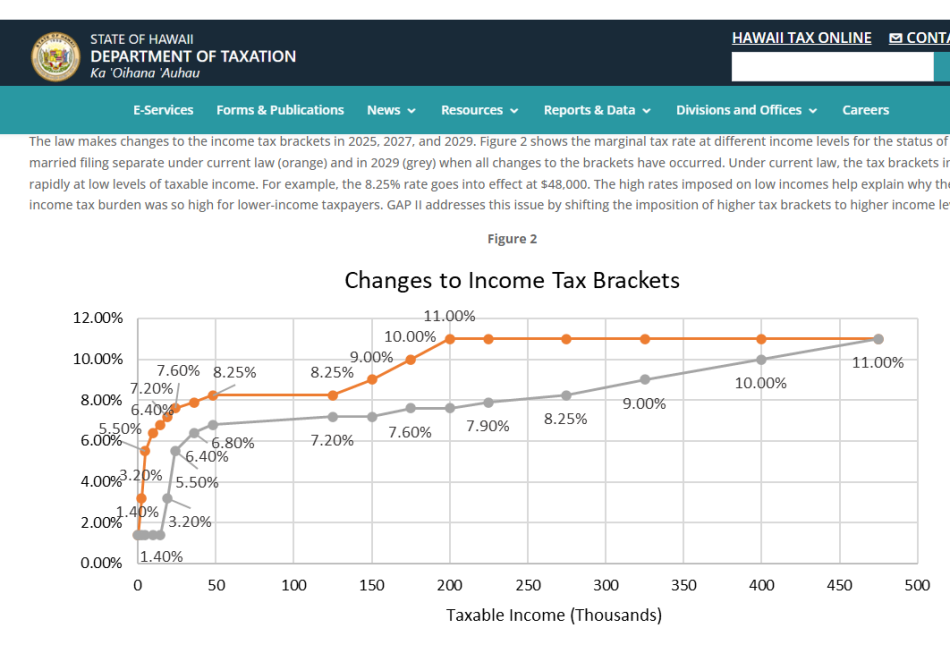

There are also rate reductions to Hawaii’s income tax although the top rate of 11% is far too high (at least fewer people will be paying it). Hawaii’s tax reform is not perfect. It is highly progressive, but it is MUCH better than nothing or the slight tax reductions we’ve seen since the oil boom really kicked into gear.

There are also rate reductions to Hawaii’s income tax although the top rate of 11% is far too high (at least fewer people will be paying it). Hawaii’s tax reform is not perfect. It is highly progressive, but it is MUCH better than nothing or the slight tax reductions we’ve seen since the oil boom really kicked into gear.

New Mexico remains in the midst of an unprecedented oil and gas boom. When will average New Mexicans see the benefit?