Update and fact check on child poverty in New Mexico

New Mexico’s Tax and Revenue Department just released new data on child poverty rates in New Mexico. The press release highlights poverty reductions in New Mexico in both the “supplemental (including government benefits)” and the “official (not including government benefits)” rates. This is a bit of good news and of course Gov. Lujan Grisham is VERY pleased with herself.

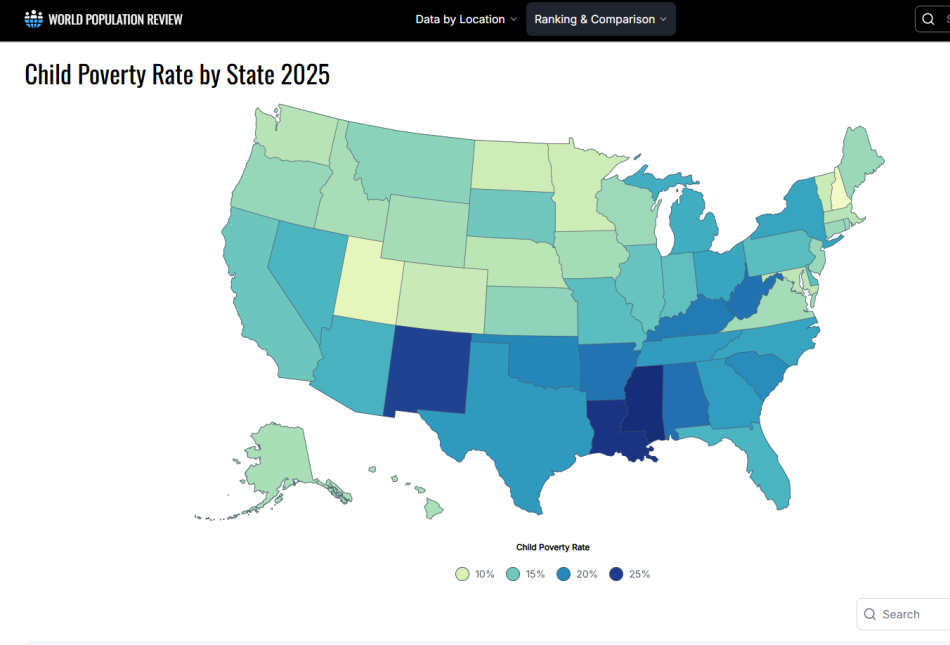

As we noted back in January, the Gov. had previously claimed more significant reductions in child poverty rates that were an attempt to conflate the two poverty rates and mislead New Mexicans and the media. This time around the data are accurately represented. Notably, as the release points out, “the national official poverty measure for children improved just 0.4% in the new survey, New Mexico reduced child poverty by 3.2%.” So, with an ongoing oil and gas boom that has generated unprecedented revenue for the State and the Permian Basin, New Mexico’s children are finally seeing some positive momentum in terms of poverty rates. New Mexico’s children remain the third most impoverished in the nation.

On the Supplemental side of things the release touts the fact that the difference between supplemental and official poverty rates is “the largest difference of any state — and an indication that recent initiatives have effectively moved thousands of New Mexico families out of poverty.”

New Mexico has expanded direct benefits to low- and moderate-income families, such as food and housing assistance, free college tuition, affordable health insurance

coverage, and expanded early childhood education in recent years. New Mexico’s tax code has been extensively revised since 2019 to become more progressive, benefitting low- and moderate-income families. Since 2019, the state has twice expanded its working families tax credit, created a targeted child income tax credit, expanded the low-income comprehensive tax rebate, reduced the statewide gross receipts tax for the first time in 40 years, and exempted most Social Security income from taxation.

Indeed, thanks to oil and gas surpluses New Mexico has had the money to enact positive tax reforms and reductions like the GRT rate reduction and reducing Social Security taxes for most people. The question is whether the panoply of government policy measures will have long-term positive impacts on New Mexico children or whether government dependency is a poor replacement for jobs and economic independence.

A recent report by New Mexico’s Legislative Finance Committee found that “To improve the state’s wages and thus its poverty rates, New Mexico will likely need to increase educational attainment, particularly for those at or near the poverty level. ”