Government broke the housing market: can it fix it also?

-

- Impose an eviction moratorium during COVID 19 (which exacerbate housing affordability problems in the rental market and ultimately hurt the very people they were intended to benefit.);

- Increase inflation (including the cost of construction materials and interest rates on home purchases) dramatically: according to the legislative finance committee construction prices have gone up dramatically.

- Impose costly new (supposedly green) regulations on construction of homes and apartments.

- Unnecessarily limit land use via zoning and “open space” rules.

- By allowing crime to run rampant in certain areas there is a lack of interest in living in certain areas.

- Retain a tax regime that unnecessarily increases costs on builders.

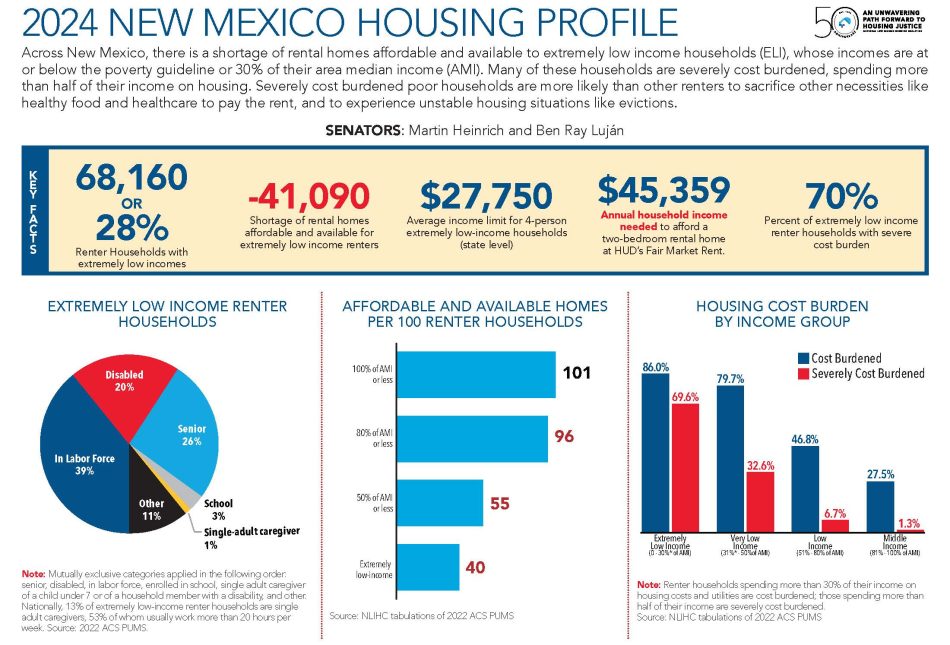

So, there is a housing “shortage” and prices are rising. Enter government. Albuquerque recently enacted significant tax breaks on a few housing projects. Of course, if similar tax breaks were offered to ALL home/apartment construction that would immediately have a positive impact on housing availability. And, Kamala Harris has offered her own housing plan which also includes a variety of subsidies and some undefined ideas for increasing the housing supply.

These problems are created by various federal, state, and local policies. While everyone recognizes there is a problem, there is a clear lack of willingness to actually solve the root causes of the issues. Instead, the plan (to the extent there is one) appears to be to simply throw more money at housing and hope that solves it. The obvious solution is to reduce taxes and unnecessary regulations on housing construction, not just on “favored” projects, but on ALL housing.