New Mexico mixed bag of tax changes adopted in 2024 take effect

As is so often the case at New Year’s new laws took effect with the start of 2025. This year New Mexico is among the growing list of states to reduce personal income taxes. That sounds great and is something that SHOULD be happening far more aggressively. But, while New Mexico is slightly reducing personal income taxes the full effect of the tax law passed last year is going to be rather mixed.

The tax cuts are explained here. The reductions are very slight and actually ADD a tax bracket which is not good. They will reduce taxes by an estimated $159 million this year.

Sadly, the Legislature did not stop there. They increased capital gains taxes by an estimated $61 million and corporate income taxes by an estimated $16.1 million. That is still a tax cut (on net) of $87 million annually (a drop in the bucket given the State’s massive budget surplus and spending growth, but there is more bad policy in the bill.

$13 million in geothermal credits;

$45 million for EV’s;

$18 million for solar credits;

$25 million for ‘advanced energy equipment’ (wind and solar) credits.

When taken together these tax credits for MLG’s preferred wind, solar, and geothermal industries (totaling $101 million in FY 2026) are greater than the $87 million being returned to New Mexicans.

Overall the tax provisions kicking in this year are nothing more than a missed opportunity and a variety of harmful subsidies.

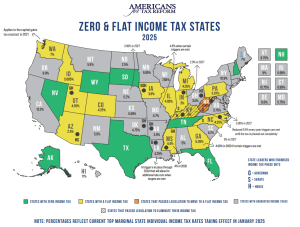

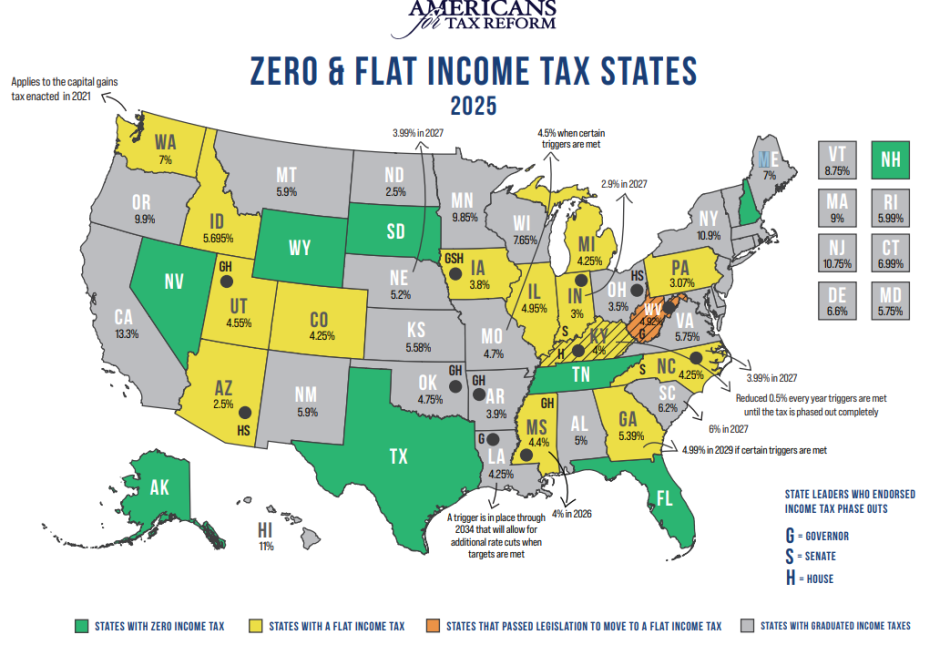

As the following chart from Americans for Tax Reform highlights New Mexico’s high 5.9% top income tax rate makes New Mexico uncompetitive with its neighbors. Neighboring Oklahoma with a 4.75% income tax rate is 20% lower than New Mexico’s top rate.