RGF testimony on eliminating New Mexico’s personal income tax

We know that New Mexico’s “progressive”-controlled Legislature has zero interest in robust tax cuts or tax reform. But, HB 275 which was introduced by several Republican legislators (with the effort led by Rep. Elaine Sena Cortez of Hobbs) was heard in the House Tax Committee on February 27, 2025. If adopted the bill would eliminate New Mexico’s personal income tax. The comments below are those of RGF president Paul Gessing who provided expert testimony to the Committee in support of HB 275:

For years NM has had massive budget surpluses thanks largely to its booming oil and gas industry. This year is no different. NM has an estimated $13.6 billion in GF revenue while the Gov’s proposed budget is $10.9 billion. That means $2.7 billion left over. And, of course the state is sitting on $58 billion in its sovereign wealth funds and has another $6 billion sitting unspent in capital outlay money.

If you go to page 6 of the Gov.’s budget you’ll find that the State of New Mexico generates $2.1 billion annually in personal income tax revenue. That not only means there is nearly $600 million left over even AFTER the PIT is eliminated.

New Mexico SHOULD eliminate its income tax and even generate additional tax revenues to diversify and grow its non-oil and gas economy. Cutting spending is not necessary and should not be necessary moving forward.

NM has the third highest poverty rate. It has a slower growing population than any of its neighbors and the main business area in its biggest city is struggling. New Mexico needs to do something bold to bring economic growth to the State.

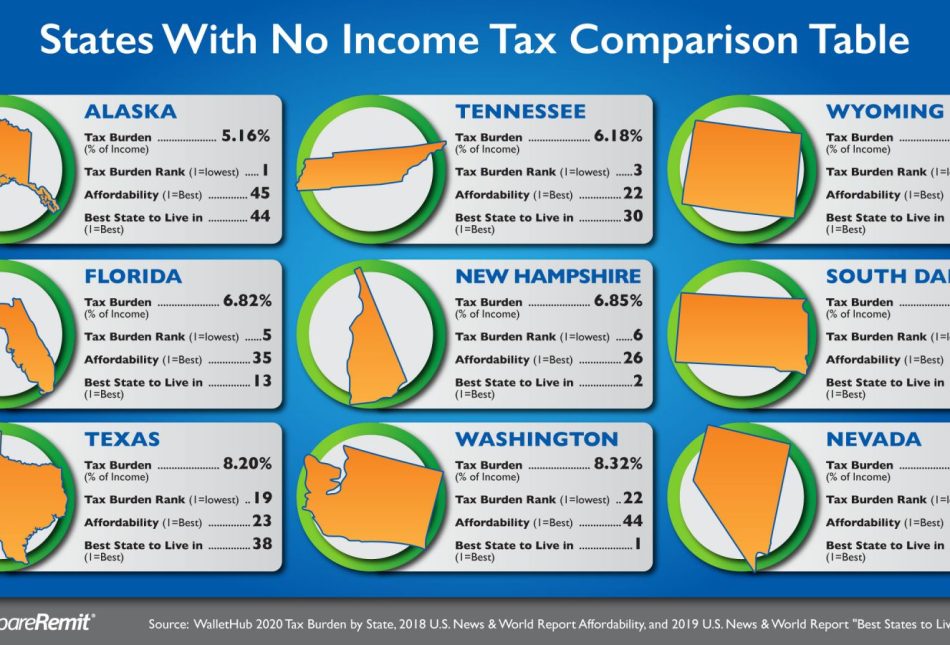

It has the highest PIT in region at 5.9% Colorado is 4.4%, Utah at 4.65%, Texas Zero, Arizona 2.5% Nine states have no PIT, none of them aside from Texas have oil and gas $$ like we do. Two states (Alaska and New Hampshire have no PIT and no sales tax)

According to World population review four of the fastest growing population states in the nation (TX, NV, FL, and WA) have no personal income tax.

Economically speaking things point even more dramatically toward zero income tax stats. In 2023 5 of the top 10 fastest-growing states economically had no income tax. These were Washington, Wyoming, Texas, Alaska, and Florida.

NM has a serious workforce participation rate challenge. Eliminating the income tax as a disincentive to work would help address that issue.

If we are serious about addressing our health care workforce problem these high earners will be more likely to work in New Mexico thanks to no income tax.

And, of course, New Mexico is one of the fastest aging states in the nation. Eliminating the PIT would give New Mexico’s economy a shot in the arm and make it competitive nationwide as a destination for jobs and businesses to locate bringing jobs and economic opportunities.

If you’d like to watch the testimony for yourself you can click here.