The economic ignorance killing New Mexico

Check out this opinion piece from Democratic Senate Majority Leader Peter Wirth. It is the height of economic ignorance as it depends corporate income taxes on the grounds that they take on “out of state corporations.” (His piece is a response to this from Tom Clifford and Richard Anklam)

While opinions can differ regarding which taxes to cut in New Mexico, Wirth doesn’t focus on ANY tax cuts. He simply asserts that keeping the job-killing corporate income tax (which raises just $325 million annually) in place makes economic sense. New Mexico has had massive budget surpluses (thanks to oil and gas) in recent years, but has done nearly nothing to reform/improve its tax structure. This leaves New Mexico as the poorest state in the nation while the State has grown MORE dependent on the left’s hated oil and gas industry.

As the Cato Institute notes:

Economists Christina and David Romer (who once served in the Obama Administration) found that a $1 tax increase in the United States has historically decreased GDP by about $3. Entin notes that widely accepted estimates of labor’s share of output imply that labor pays about $2 of the total economic cost or 200 percent of the $1 tax increase. Corporate income taxes are even more economically damaging than the average result from Romer and Romer, which lumps many types of tax increases together.

Would reducing or eliminating New Mexico’s corporate income tax be the BEST tax reform for the Legislature to enact right now? Economists believe it would do a lot of good at a low cost to the treasury. But so would reform of the GRT. So would cutting or even eliminating New Mexico’s personal income tax. Sadly, Wirth is emblematic of a Legislature that prioritizes attacking businesses and productive taxpayers, not growing the economic pie and diversifying New Mexico’s economy.

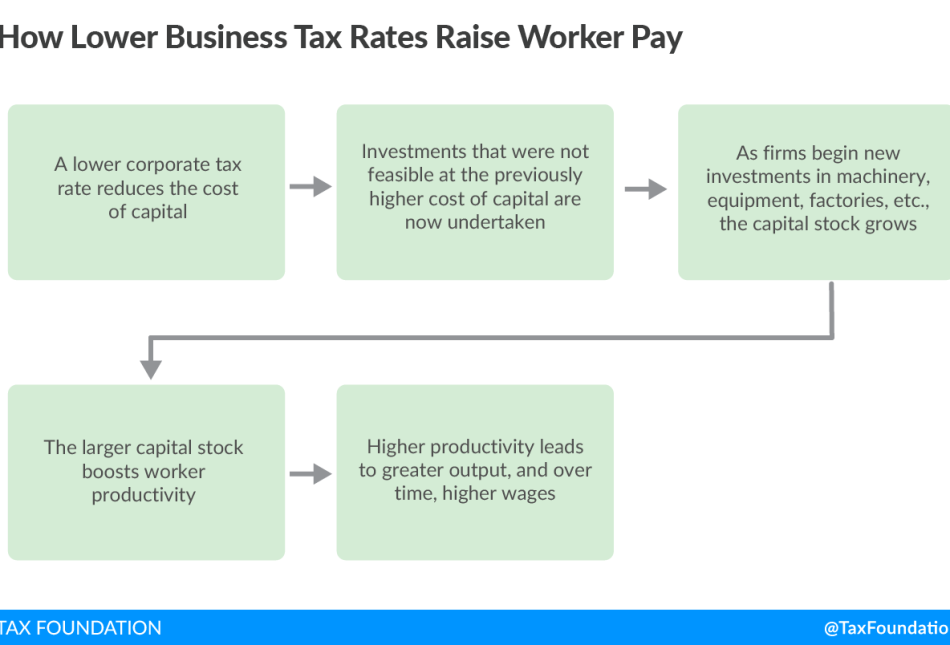

The Tax Foundation notes that “Many economists, including those at the Organisation for Economic Co-operation and Development (OECD), agree that the corporate income tax is one of the most harmful and least efficient ways to fund our priorities.” Check out their brief explainer video below: