Trump’s tariffs: a New Mexico perspective

At their most basic level tariffs are taxes on foreign goods brought into another country (in this case the United States). The Rio Grande Foundation supports lower taxes, not more. Thus, we are firmly opposed to these tariffs and support low/no tariffs in general.

But other countries impose high tariffs on American goods, you might say. Yes, that’s unfair, but ultimately a majority of the harm done by high tariffs is inflicted on those who pay the tax, not those who impose it.

Even if you believe that imposing tariffs is a “small price to pay” for “fair” trade, we believe that the better route would have been to negotiate reduction/elimination of tariffs across-the-board, not by imposing the tariffs and their costs first and then seeing what happens. We’d be thrilled to see tariffs reduced worldwide and here in the US. The evidence that this is Trump’s plan is simply not there.

But let’s talk about New Mexico in particular:

- New Mexico is not a major manufacturing state. Few companies based here will benefit from the protection tariffs afford. Any manufacturing operations that DO relocate to the US to avoid tariffs aren’t likely to come to New Mexico anyway.

- But, New Mexicans will pay the cost of higher prices for the items they buy.

- New Mexico is primarily an energy producing state. Trump specifically exempted foreign energy from the tariffs. To the extent that other countries either slap tariffs on American energy or look for other sources, this could profoundly impact energy politics and New Mexico. And, if a recession or economic slowdown hits this would impact the price of oil and New Mexico as well.

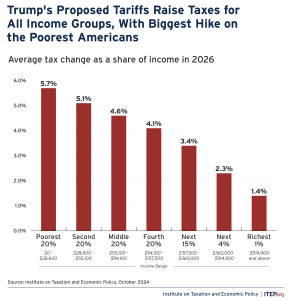

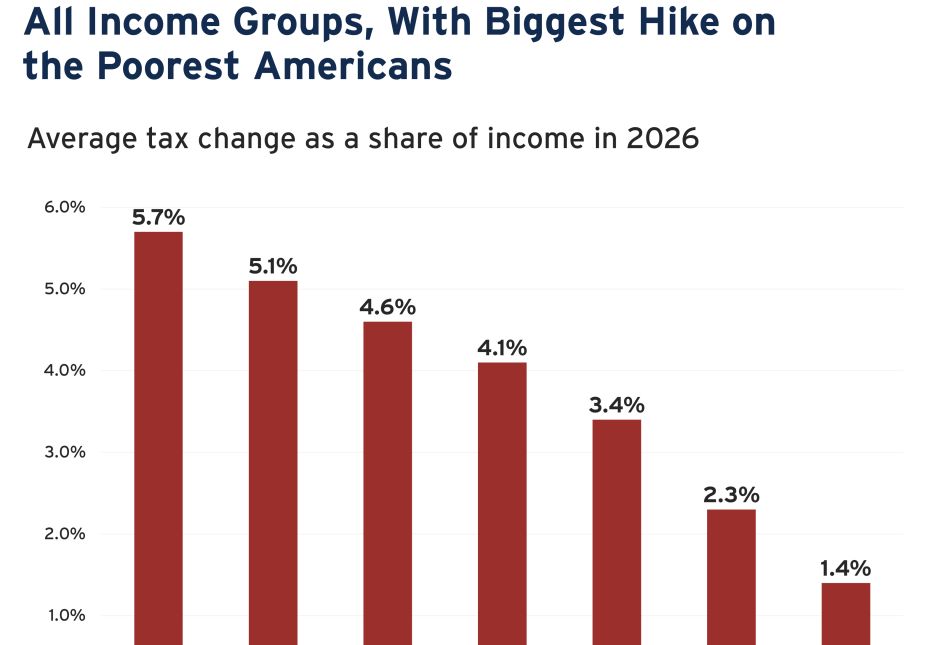

- Tariffs are “regressive” meaning they are borne more heavily as a percent of income by those with lower income. As a poor state New Mexicans are going to be more impacted than most by tariffs.

But then there’s the political aspect. Americans don’t support Trump’s tariffs. If the US economy goes into a recession New Mexico is going to move even FURTHER to the left politically (if that’s possible). But certainly Deb Haaland is a threat if elected governor with a potentially even more left-wing Legislature. It is a long way to the fall of 2026, but the party in power tends to not do well anyway in that first midterm. As a reminder, New Mexico’s statewide offices are up in 2026 as is Sen. Ben Ray Lujan and the New Mexico House. We want a strong, Trump-led economy at that point, not a Trump-caused recession.

Also, we SHOULD note that Congress is responsible for raising and lowering taxes. The president (of either party) should not be allowed to take such drastic action without congress.