The following appeared in the Santa Fe New Mexican on December 1, 2025.

![]()

Among other things, the recent federal shutdown highlighted just how dependent New Mexico is on the federal government. According to the website Virtual Capitalist, New Mexico is the most dependent state in the nation on federal dollars.

There are some good reasons for this. Our state has three major Air Force bases plus White Sands testing range. We also have two major national nuclear labs, Los Alamos and Sandia. Forty one percent of our state is managed by the federal government, and a significant portion of that includes tribal lands.

But, as many New Mexicans recently saw for themselves, being reliant on the deeply indebted federal government ($38 trillion at last count) is not a comfortable place to be. New Mexico is not just dependent on Washington to manage its lands and military/national security operations, it is far too reliant on federal welfare programs like Supplemental Nutrition Assistance Program and Medicaid.

New Mexico is far and away the most reliant state on SNAP (food stamps) at 21.2% of the population. No other state has as much as 20% of its population on SNAP while neighboring Utah has just 4.8%. Colorado and Texas have less than half as many people by percentage on food stamps.

And then there’s Medicaid, the joint federal/state health care program for the poor. Medicaid which in New Mexico is funded on a 3 to 1 basis by the federal government is considered an “entitlement” and thus was not impacted by the federal shutdown nonetheless poses a huge challenge for New Mexico.

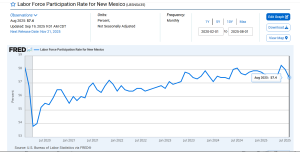

Even if the federal government never shuts down again and somehow the federal government’s massive debt is paid off someday, New Mexicans would be better off not relying so heavily on federal welfare programs. The fact that so many New Mexicans are reliant on these programs points to a failure of the State’s economic policies.

Never has that been truer than now with New Mexico still in the throes of an oil and gas boom that is pumping revenue into the State economy and budgets. According to the latest estimates lawmakers will have another $500 million in “new” money to spend in the upcoming 2026 session. The state is also sitting on $66 billion in funds invested in various sovereign wealth funds. We have the money to do better.

The governor recently called not one but two special sessions of the Legislature to shift the cost of federal health care subsidies and SNAP payments to New Mexicans if the federal government doesn’t keep the cash flowing. Gov. Michelle Lujan Grisham has the problem exactly backwards, though.

She’s been in office during seven legislative sessions, all of which saw big oil-and-gas-driven budget surpluses. Over that time span she has done nearly nothing to improve New Mexico’s economy and reduce New Mexico’s over-dependency on federal welfare programs. This is not to say these welfare programs don’t have a purpose. They do, but New Mexico is not a poor state. Its people shouldn’t be poor, either.

A few examples highlight the problem. One is a KOAT news story about a seemingly healthy woman who has been receiving SNAP benefits for a mind-blowing 30 years. She’s been on SNAP since the 1990s and there are likely many like her. Unfortunately, New Mexico has not complied with the Trump Administration’s efforts to root out fraud and abuse in the SNAP program.

And there is plenty of fraud and abuse. KRQE news recently highlighted a case of SNAP money being traded for drugs like fentanyl.

While these cases of fraud are problematic and sadly divert resources away from those who need the help, the best solution is to encourage New Mexicans to become productive citizens and to leave dependency behind. It won’t happen quickly and it may not always be easy to lure people out of dependency but doing it will benefit all New Mexicans whether they depend on welfare or not.

Luncheon: Connor Boyack, Author of the “Tuttle Twins”

Luncheon: Connor Boyack, Author of the “Tuttle Twins”