The following appeared on September 14, 2025 in the Albuquerque Journal:

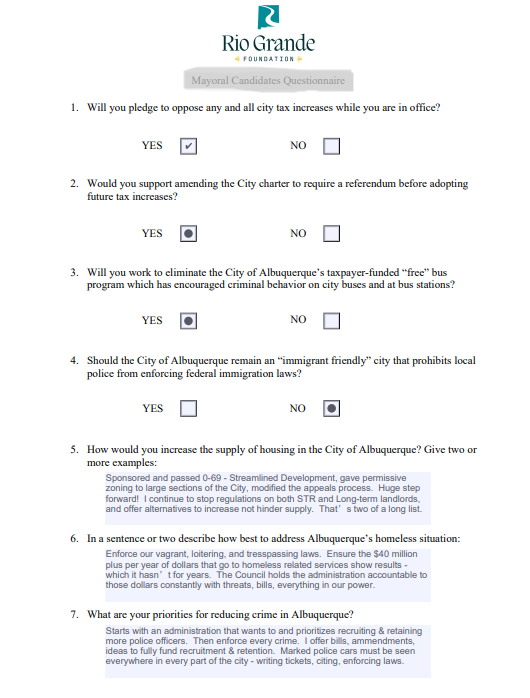

This fall’s city elections are critical for the future of Albuquerque. A further shift to the left could do great harm to our city. Polling indicates that a majority of voters in Albuquerque want change, but it is critical that voters turn out not just on Nov. 4, but in what most analysts expect will be a runoff between the top two candidates for mayor (with a council district runoff or two possible).

Progressive policies (not just those of Mayor Tim Keller) have done tremendous harm to Albuquerque in recent years. In fact, Albuquerque’s previous mayor, Republican Richard Berry, (against our advice and the advice of numerous businesses along Central) rammed the Albuquerque Rapid Transit system through.

The idea was to “remake” Central into a more transit friendly area. It failed miserably as Central has seen numerous businesses close and homelessness and crime explode. Sadly, while Route 66 (Central in Albuquerque) is celebrating its 100th anniversary in 2026, there is not much to celebrate on the “Mother Road.” Things are so bad that the Balloon Fiesta celebration of Route 66 will be held along an older part of the route in Los Ranchos, not the modern 18-mile route through Albuquerque.

Of course, Keller has had eight years to solve the crime and homeless situations along Central and throughout the rest of Albuquerque. Not only has he not done so, but the problems continue to worsen despite (or because of) massive spending. The city and county combined just received an eye-popping $80 million from the Legislature for the benefit of serving an estimated 1,000 homeless people.

Will this infusion of $83,000 per previously homeless person have a significant impact on the situation? Under Keller, spending on services for the homeless has increased sevenfold — from $3.6 million a year to $25 million a year. Some (including this author) believe that increased funding and the addition of new services has led to the presence of more homeless people.

Another progressive policy failure is the so-called free city bus program which Keller has championed. The program, which of course is paid for by taxpayers, has led to massive safety issues on city buses with buses being used as getaway vehicles for shoplifting. As of July 2025, the city’s Transit Department was working to hire 25 new security guards for city buses after a bus driver allegedly stabbed a passenger to death. Finally, the city is using a combination of private security guards and National Guard troops to assist with security on the bus system during the State Fair.

Problems with free buses, an explosion in the homeless population, and the deterioration of Central Avenue are of course directly related to the fundamental failure of the Keller administration: The decline in public safety. While the number of murders has dropped in recent years, property crime and vagrancy remain two serious problems.

Concerns have been expressed among many about the accuracy of data collection around these “lesser” crimes, but the fact is that crime and vagrancy remain serious problems in Keller’s Albuquerque.

Keller’s progressivism has failed his city in numerous other ways from doubling the city budget over his eight years in office with nothing to show for it, to using federal COVID-19 funds to give bonuses to his top staffers, to unnecessarily raising taxes immediately upon taking office, and ridiculously slow permitting wait times for businesses and building.

The state of the city is not good thanks to misguided “progressive” policies. Keller is not the only cause of the problems facing Albuquerque, but he is the only one running for a third term as mayor.