NM House Speaker Javier Martinez: Next 60-day session will include push for “single-payer healthcare”

03.04.2026

The medical malpractice bill passed in the recently completed legislative session hasn’t even been signed by the Gov. (she has one week left) and Democrat House Speaker Javier Martinez has already proclaimed his plan to push for “single payer” health care in the next 60-day legislative session. As Martinez told KRQE 13, “I believe that the fix for this is a Universal single-payer healthcare system.”

This is hardly surprising considering that Martinez decried the American “for profit” healthcare model and touted the benefits of the Cuban health care system during the recent 2026 session.

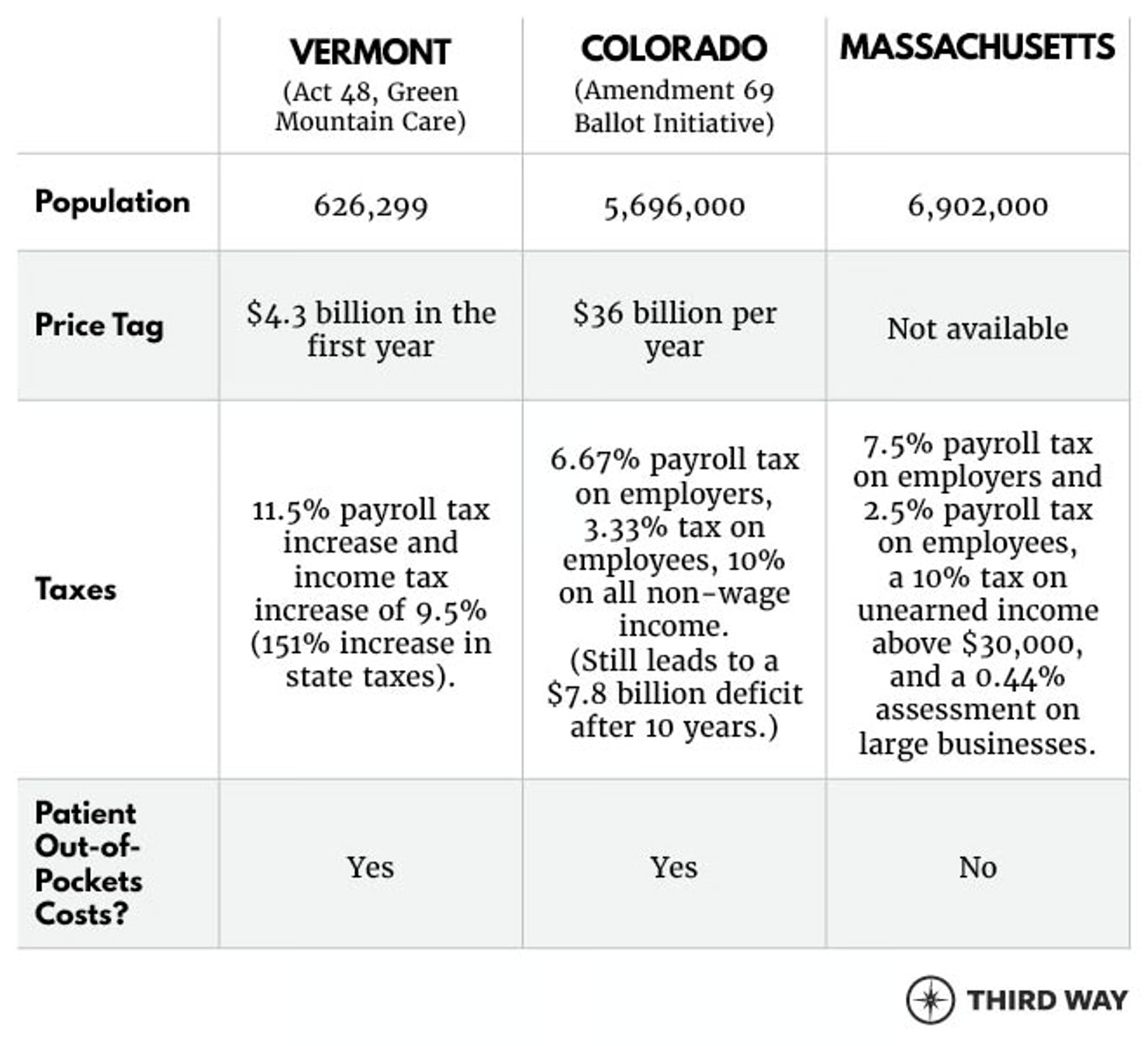

As a reminder, single payer health care means that one entity—usually the government—collects funds and pays for all essential healthcare services for every resident. While single payer systems exist in many countries no other US state has enacted and stuck with such a plan. A few relevant cases include:

- Vermont: In 2011, Vermont passed legislation to create “Green Mountain Care,” intending to be the first state with a single-payer system. However, the plan was abandoned in 2014 due to unsustainable, projected tax increases.

- In 2016, Colorado voters overwhelmingly rejected Amendment 69, a ballot initiative designed to create “ColoradoCare,” the nation’s first state-level single-payer healthcare system. The measure failed by a 4-to-1 margin (roughly 80% against), due to concerns over high tax increases, the elimination of private insurance, and economic impacts.

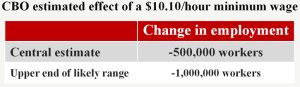

One thing that Martinez is undoubtedly going to rely on is the existence of New Mexico’s massive oil and gas revenues (and permanent funds which is now valued at a mind-blowing $70 billion). As mentioned above, cost concerns have been significant issues for past single payer efforts. Creating a costly single payer system in New Mexico would involve massive infusions of oil and gas cash in order to avoid unpopular, massive tax hikes that have torpedoed such efforts in other states.

The following image is from a group called The Third Way. Massachusetts has “RomneyCare” which is much more similar to “ObamaCare” and is NOT single-payer.