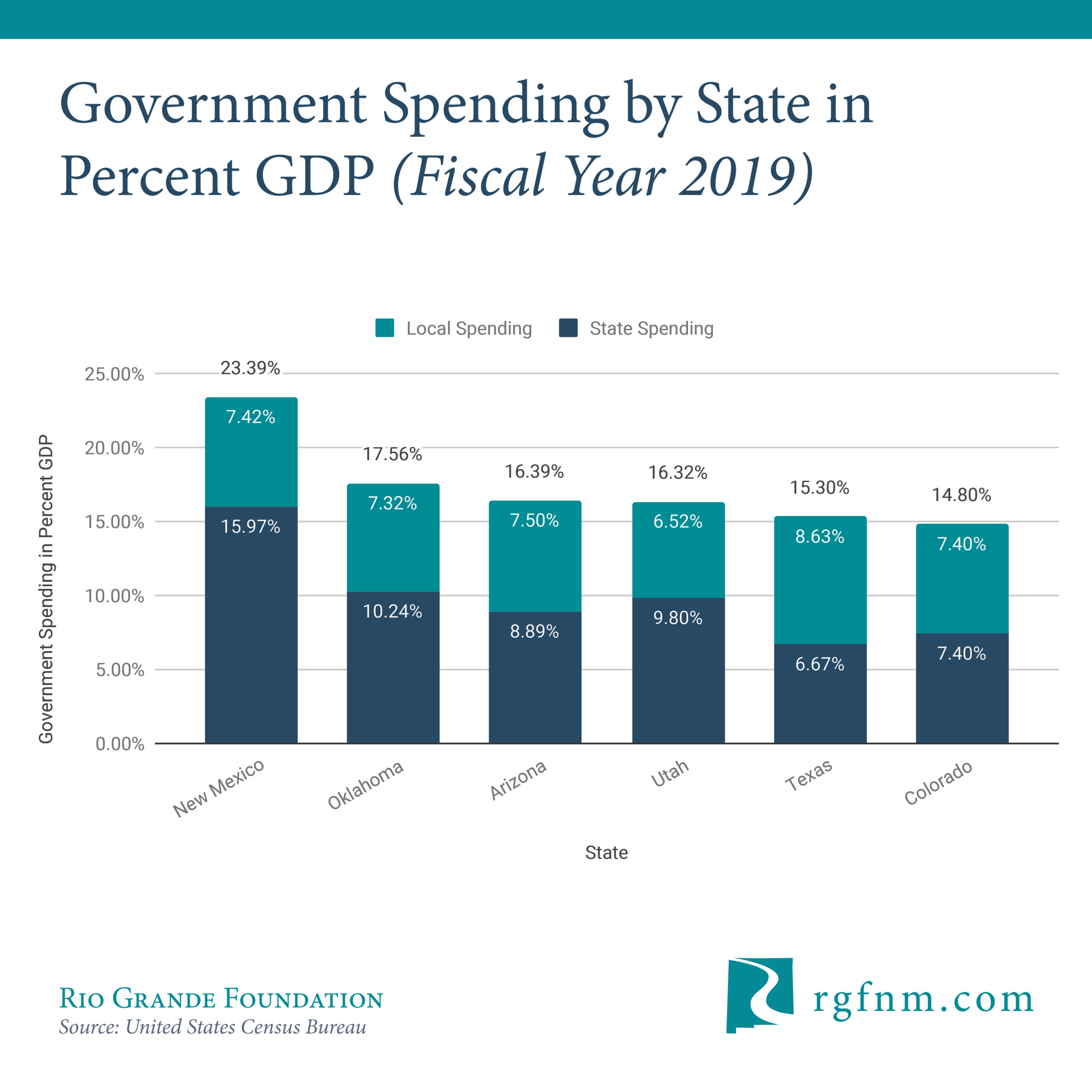

When Governor Michelle Lujan Grisham announced the formation of two tax advisory committees in the fall, she said they would “study the state’s tax system and recommend changes to ensure fairness, efficiency and equity.” Legislation to create an electric vehicle (EV) tax credit (such as Senate Bill 2 and House Bill 217), however, will have the opposite effect and make New Mexico’s tax code less efficient and more unbalanced.

If passed, the legislation would create a $2,500 tax credit for the purchase or lease of an electric vehicle, and another $300 giveaway for an at-home charger. This initiative, like similar policies at the national level, will function as a special interest carve-out for wealthy residents living in urban areas and only further alienate rural parts of the state.

Electric vehicle subsidies will benefit wealthier residents. Congressional Research Service data shows that nearly 80 percent of the federal EV tax credits are claimed by people who make over $100,000 per year. Both bills attempt to prevent the disparity in New Mexico by offering a higher credit for lower income buyers, but with an average price of $55,600, most electric vehicles would still be out of reach for many in our state where 400,000 receive federal food assistance.

In addition to tipping the scales toward high earners who can afford to buy cars without a tax credit, EV tax credit legislation also favors New Mexicans in urban areas. Of the 53 public charging stations in New Mexico, 39 are in the Albuquerque/Santa Fe area. The remaining 14 are scattered throughout our massive state, putting residents of the majority of New Mexico at a disadvantage. Designating more money for public charging and issuing $300 for home-charging investments aims to correct the problem, but it’s a solution that won’t work for a lot of people.

Beyond that, electric vehicles are also an impractical choice for thousands of farmers and ranchers who rely on their pickups to haul livestock and equipment, often in extreme temperatures. Many others rely on their vehicles to do jobs that electric vehicles simply aren’t cut out to do.

According to a just-released study by the non-profit Road Improvement Program, a nonprofit research organization, “more than half of major locally and state-maintained roads are in poor or mediocre condition,” which is costing us as much as $2,114 per driver.

Electric vehicle ownership only exacerbates the problem, because unlike other cars, EVs do not pay into our state’s road repair fund or the federal Highway Trust Fund, even though they contribute to wear and tear on our roads. Both EV tax credit bills would impose an annual registration fee on electric vehicles, but that falls far short of the $500 a typical New Mexico family pays in federal and state gas taxes each year.

Even without the subsidy, New Mexicans around the state are already subsidizing wealthier electric vehicle owners in Santa Fe and Albuquerque. If EV tax credit legislation passes and succeeds in its goal of putting more electric vehicles on the road, it will further tip the scales way from rural communities.

Coming on the heels of a 33-percent increase in New Mexico’s vehicle sales tax — which was supposed to fund road projects — it’s counter-productive to now consider providing tax refunds to the few people who can afford electric cars and to charge them less for infrastructure upkeep.

Electric vehicles have struggled to take off in New Mexico for reasons unrelated to federal or state subsidies. Fewer than 1,000 electric vehicles were sold in our state in each of the last two years, even with a federal incentive of up to $7,500. Adding a $2,500 rebate isn’t going to make our state more electric. Our policymakers have already hinted that they may follow in California’s footsteps and mandate that a minimum percentage of all state vehicle sales need to be electric. An electric vehicle tax credit is an ineffective and unfair precursor to that sort of extreme policy making.