‘Tis the Season for RTW Job Creation

12.01.2016

The Foundation is tracking announcements of expansions, relocations, and greenfield investments published on Area Development’s website. Founded in 1965, the publication “is considered the leading executive magazine covering corporate site selection and relocation. … Area Development is published quarterly and has 60,000 mailed copies.” In an explanation to the Foundation, its editor wrote that items for Area Development’s announcements listing are “culled from RSS feeds and press releases that are emailed to us from various sources, including economic development organizations, PR agencies, businesses, etc. We usually highlight ones that represent large numbers of new jobs and/or investment in industrial projects.”

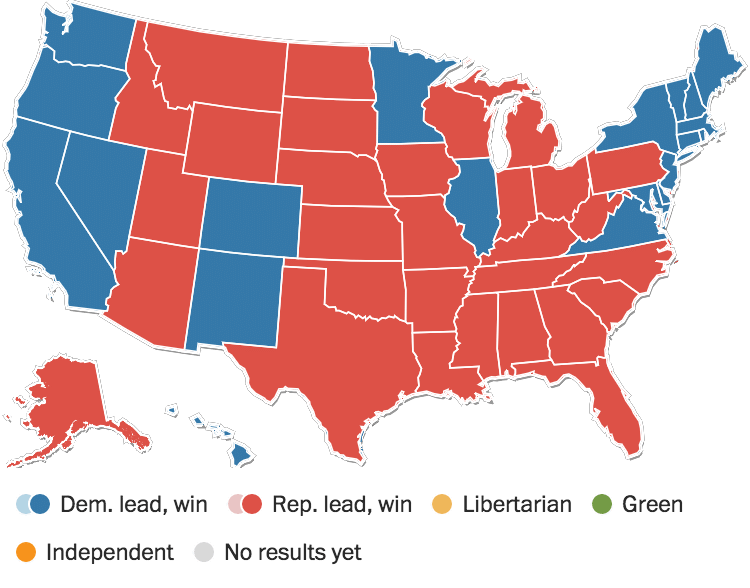

In November, of 16,780 projected jobs, 13,556 — 80.8 percent — were slated for right-to-work (RTW) states:

As for the sub-metrics the Foundation scrutinizes:

* Ten domestic companies based in non-RTW states announced investments in RTW states. Just two announcements went the other way.

* RTW prevailed in foreign direct investment, too. Fourteen projects are headed to RTW states, with five to occur in a non-RTW state.

Marquee RTW investments included:

* Lucid Motors, “a luxury mobility company applying innovative engineering, design and technology to define a new class of premium electric vehicle,” picked Arizona for its manufacturing facility (2,000 jobs)

* Citing “the advantages Arizona offers to businesses in terms of operating costs, light regulation and low taxes,” ADP announced a new operations center in Tempe (1,500 jobs)

* CSRA, an IT firm, dedicated its Integrated Technology Center (800 jobs) and announced it was building a Customer Engagement Center (300 jobs), both in Louisiana

* Credit One Bank chose to build a new, expanded headquarters in Nevada (500 jobs)

Once again, no investments were announced for the Land of Enchantment.

Methodological specifics:

* All job estimates — “up to,” “as many as,” “about” — were taken at face value, for RTW and non-RTW states alike.

* If an announcement did not make an employment projection, efforts were made to obtain an estimate from newspaper articles and/or press releases from additional sources.

* If no job figure could be found anywhere, the project was not counted, whether it was a RTW or non-RTW state.

* Non-border-crossing relocations were not counted, border-crossing relocations were.