Mar 10, 2025

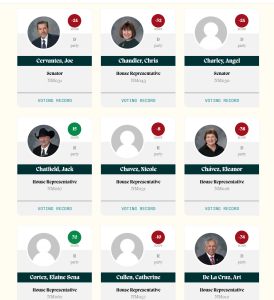

Senate Majority Leader Peter Wirth, D-Santa Fe, is again declaring war against free speech and privacy. Senate Bill 85, which recently passed the Senate, doubles down on a 2019 law that is already being challenged in federal court for violating the First Amendment.

The bill would enable the political establishment to seize even greater control of the agenda in Santa Fe by silencing many nonprofit organizations. Groups would be forced to choose between their right to speak about the government and the privacy of their supporters.

Privacy matters to nonprofits, regardless of their mission. Many groups will self-censor rather than risk exposing their supporters’ names and home addresses. This is not because they are nefarious “dark money” groups, as some media reports suggest, but because they rightly fear retaliation from the elected officials they criticize.

No less an authority than the U.S. Supreme Court has ruled repeatedly that donor privacy is essential to the First Amendment. In a famous Civil Rights era case, NAACP v. Alabama, the court unanimously observed “compelled disclosure of affiliation with groups engaged in advocacy may constitute as effective a restraint on freedom of association” as other forms of censorship. As recently as 2021, the court struck down a California regulation forcing nonprofits to submit their donor lists to the attorney general.

New Mexico’s 2019 law, also spearheaded by Majority Leader Wirth, already runs afoul of these precedents. Adopting terms from campaign finance statutes in a sleight of hand, the law regulates speech about elected officials and issues discussed in the Roundhouse. Now, the mere mention of a candidate in the months leading up to an election can trigger the public exposure of a nonprofit’s private donors. The law applies even when groups merely ask elected officials to support a piece of legislation or take a stance on a policy issue.

Campaign finance laws have been upheld by the courts, but they can only be stretched so far. The powers that be in New Mexico seem intent on testing the limits.

The nonprofit Rio Grande Foundation is fighting to overturn the state’s nonprofit disclosure mandates in court. Yet, lawmakers are already pushing to expand the law’s privacy violations further. Where current law covers “contributions,” defined to mean funds given for a political purpose, SB 85 would substitute the term “donations.” That seemingly trivial change would expand the law’s reach to cover a nonprofit’s entire donor base.

The Senate passed similar legislation in 2023. Only a narrow defeat in the House stopped the bill from reaching the governor’s desk. Let’s hope the House steps up to the plate to defend free speech once again.

If lawmakers truly want to reduce the influence of special interests in politics, SB 85 is a leap in the wrong direction. It specifically aims to force the disclosure of non-political donors. The chilling effect of the law will be felt strongly by groups working on issues ranging from immigration to education and every cause in between.

That means entrenched political interests will gain influence and dissenting voices will be silenced. Promoted under the guise of increasing transparency, SB 85 moves us closer to a world where only politicians, lobbyists and major media outlets get to speak about what happens in Santa Fe.

The real winners in this charade? Political leaders like Wirth. Surprise, surprise.