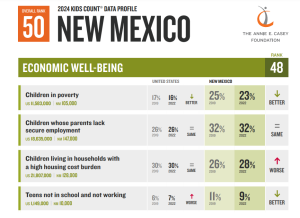

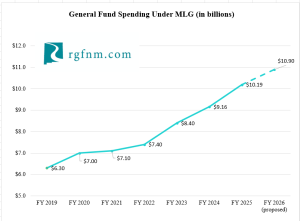

Despite consistent increases in spending, New Mexico continues to rank at the bottom in education. NM is around 33rd in per student spending nationally — surpassing all our neighboring states — but the results remain unchanged.

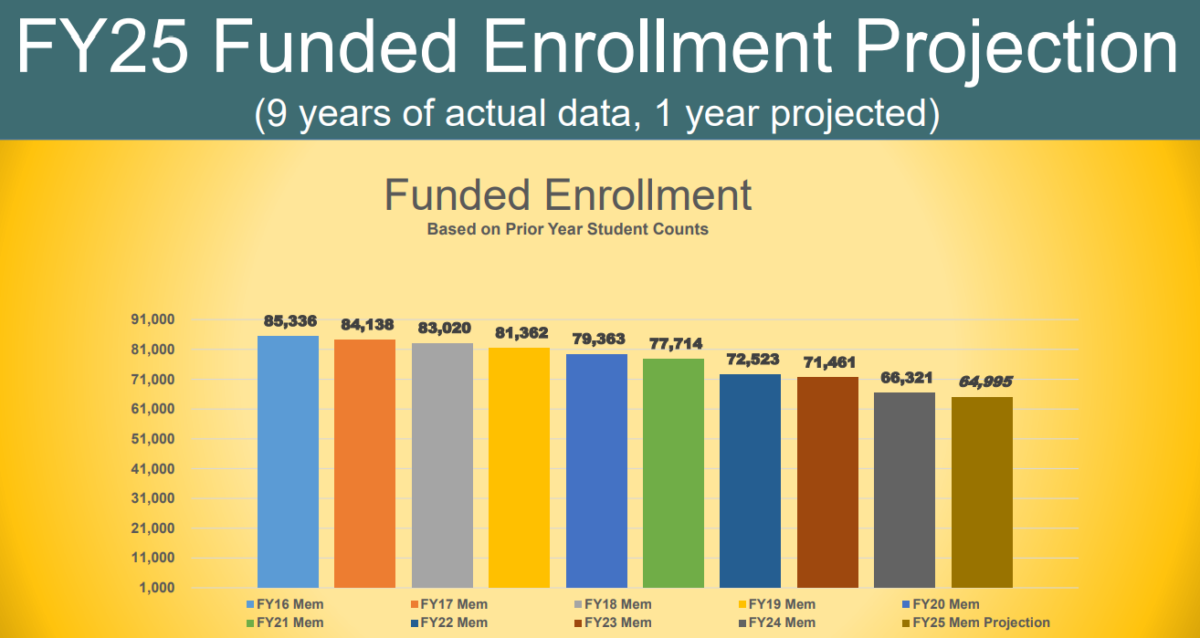

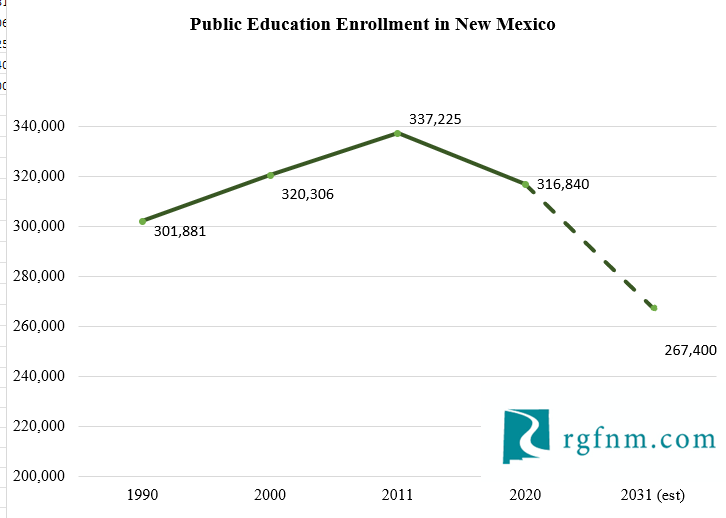

New Mexico’s government continues to push a broken system, hoping that more money and more time will finally do the trick. This coming fiscal year NM is projected to spend around $33,000 per student, and NM students will spend more time in class than almost any other state in the nation.

If the current approach was going to work, it would have. It is long past time for New Mexico to do things differently. But what is it that we are doing so wrong? This question should trouble New Mexicans. We should be trying to replicate the success states around us are having. States like Arizona, that spend less per student and perform better in basically all the metrics. Arizona finally decided to make some radical changes, whereas New Mexico clings to left wing ideals. We refuse to see what actually works.

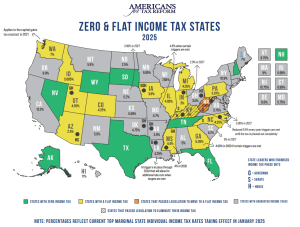

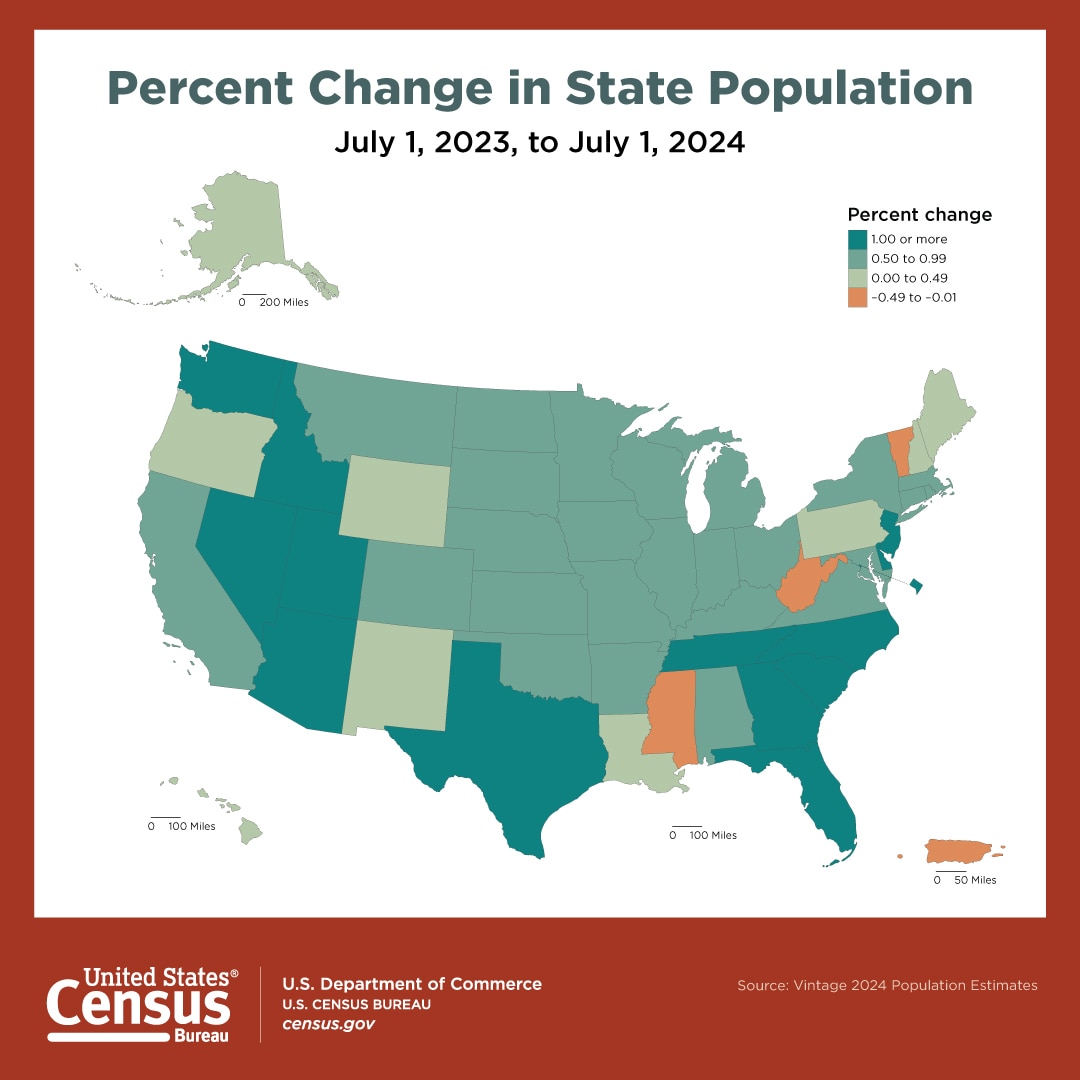

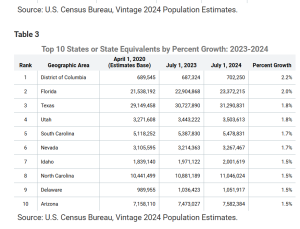

It is interesting to compare New Mexico to Arizona because the two states are very similar. Not long ago they had similar populations and economies. Today though, Arizona is booming. They have enacted sweeping education reform and adopted free market economic policy that has allowed for major growth. All the while, New Mexico remains adamant that policies of big government are working. Comparing Arizona and New Mexico is a stunning picture of how much damage an overbearing government can do.

50CAN, a nonprofit organization dedicated to building a student-centered American education system, put out a survey titled “The State of Educational Opportunity in America: A Survey of 20,000 Parents.” The survey asked parents questions about their kids’ schooling, because it is well documented that parents are the best indicator of student success.

50CAN data shows that, on average, only 35% of NM report satisfaction with their child’s school. Compared to 41% in Arizona, 43% in Texas, 44% in Oklahoma 40% in Colorado, 41% in Utah, and 45% nationally.

Only 54% of NM students participate in sports, compared to 62% in Arizona. That is a disservice to NM kids. While sports are not the central function of a school, they are an important factor in promoting mental and physical health. They are also an important part of the community and character building of NM students. A lack of participation in sports is just another example of the lackluster NM school experience.

Perhaps most importantly, only 27% of parents in NM are confident in their child’s preparation to go into the workforce, compared to a 34% national average. As it stands, schools in NM are not giving students the tools they need to flourish.

It is no surprise to anyone that NM trails behind other states in this survey. It has been that way for years, but the most frustrating part is NM’s refusal to change. Not only are we at the bottom of the list, but we are stuck there. States all around us are improving their schools, rather than mirror what they are doing, NM continues to double down. It is time to try something different.

Ultimately, New Mexico ranked below the national average in almost every single question asked by 50CAN. Questions that ranged from topics like school quality and opportunity, tutoring and mental health, out of school activities, parental engagement, and post school readiness. One exception being tutoring participation, which also doesn’t say great things about the education system. It does, however, say good things about New Mexico parents. They want their children to succeed. That is why school choice is an exciting idea. It invites parents into the broader discussion.

What Arizona has done differently than New Mexico is embrace school choice. They have made it easier to start charter schools; mandated open enrollment; established dollar for dollar tax credits for scholarships; and made it possible for parents to access the money that the state would be spending on their child. The successes of a system like this are undeniable. Arizona is moving in the right direction, while New Mexico is standing still.

The same survey from 50CAN breaks down responses to questions by school type, and it turns out, there are many things that private and charter schools do better than public schools. Without school choice and education dollars following the student, private schools are only an option for a small portion of the state. Private schools have a national parental satisfaction rate of around 65% compared to only 39% for traditional public schools. Charter schools need their charter renewed and public schools need students to pay tuition. That drives them to perform well.

School choice creates a sort of free market for the education system. The schools that serve parents and students best will stick around. Those that do not, become obsolete. In a competitive system, schools will be motivated to work for students. And they will be accountable to parents.

School choice is obviously not the only way to improve education. At the Rio Grande Foundation we believe that public school reform is the vital next step. Opportunity for All Kids NM (oaknm.org) is a project of RGF which is about improving education all over the state. This includes, but is certainly not limited to, educating parents about school choice. RGF is tired of seeing NM at the bottom of the list.