The Foundation is tracking announcements of expansions, relocations, and greenfield investments published on Area Development‘s website. Founded in 1965, the publication “is considered the leading executive magazine covering corporate site selection and relocation. … Area Development is published quarterly and has 60,000 mailed copies.” In an explanation to the Foundation, its editor wrote that items for Area Development‘s announcements listing are “culled from RSS feeds and press releases that are emailed to us from various sources, including economic development organizations, PR agencies, businesses, etc. We usually highlight ones that represent large numbers of new jobs and/or investment in industrial projects.”

In June, of 10,678 projected jobs, 6,139 — 57.5 percent — were slated for right-to-work (RTW) states:

Last month was, far and away, the best performance by non-RTW states since the Foundation began its tracking in January 2015.

What accounts for the “impressive” performance of compulsory-unionism states? A harmonic convergence of huge projects — including Amazon’s pick of Illinois for two fulfillment centers (1,000 jobs total), Novavax’s choice of Maryland for “research, development, and clinical trial support operations” (850 jobs), and Shell’s announcement of an ethylene cracker near Pittsburgh (600 jobs.)

It was such a “strong” month for compulsory-unionism states, even New Mexico landed two investments. Mako Medical Laboratories plans to establish operations in Albuquerque, and create 100 jobs, and Wildflower International announced the addition of 81 positions in Santa Fe.

Still, in the three sub-metrics we scrutinize, RTW remained dominant.

Sixteen domestic companies based in non-RTW states announced investments in RTW states. Just four announcements went the other way.

RTW prevailed in foreign direct investment, too. Fifteen are headed to RTW states, with five to occur in non-RTW states.

Two relocations are to cross the barrier from non-RTW to RTW, with none headed from RTW to non-RTW.

Marquee RTW investments included GE Digital’s choice of Atlanta for its “first global Digital Operations Center” (250 jobs), China Jushi’s selection of South Carolina for its “first fiberglass manufacturing operation in the U.S.” (400 jobs), and Dexcom’s announcement of “a new state of the art manufacturing facility” in Arizona (500 jobs).

Do June’s data mean a sustainable turnaround for non-RTW states? If history is any guide, the chances are slim. Watch this space!

Methodological specifics:

* All job estimates — “up to,” “as many as,” “about” — were taken at face value, for RTW and non-RTW states alike.

* If an announcement did not make an employment projection, efforts were made to obtain an estimate from newspaper articles and/or press releases from additional sources.

* If no job figure could be found anywhere, the project was not counted, whether it was a RTW or non-RTW state.

* Intrastate relocations were not counted, interstate relocations were.

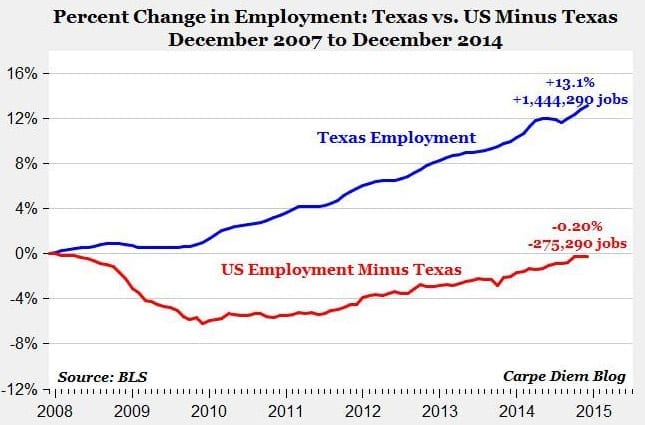

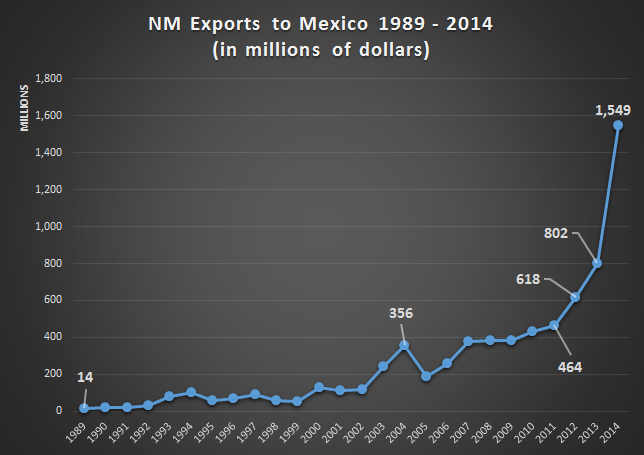

In celebration of Milton Friedman Day 2016, the Rio Grande Foundation is hosting a discussion of Texas’ economy, what makes it so dynamic, and what New Mexico can do to catch up and, surpass it at some point in the future.

In celebration of Milton Friedman Day 2016, the Rio Grande Foundation is hosting a discussion of Texas’ economy, what makes it so dynamic, and what New Mexico can do to catch up and, surpass it at some point in the future.