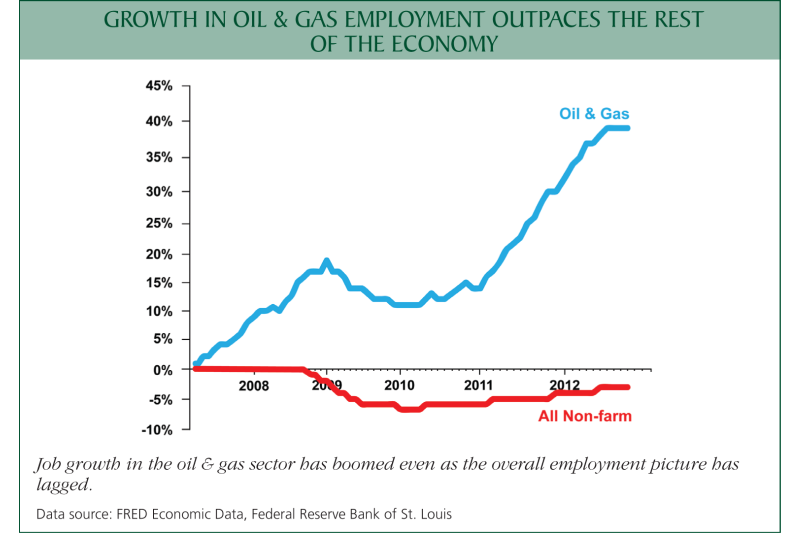

Though many New Mexicans may not be aware of it, especially given our state’s ongoing economic struggles, New Mexico is in the midst of a boom in energy development. New Mexico has vast deposits of oil and gas that can help our state transcend its struggling economy, leading to better jobs and higher wages.

Just ask the people of North Dakota, whose oil and gas production has resulted in an unemployment rate of less than 3% and fast-food workers being hired at $15 per hour. How important is New Mexico’s energy development? Nearly one-third of all state funding to public schools, as well as to New Mexico’s higher-education institutions, comes from taxes, royalties and fees paid by oil-and-gas operations around the state.

The main threat to New Mexico reaping this huge windfall is an anti-oil and gas movement in our nation’s capital, the same one that has put the Keystone Pipeline project in limbo. Leading this charge is Nevada Senator Harry Reid, who wants hand-picked energy novice Norman Bay to lead the country’s premier energy agency, the Federal Energy Regulatory Commission (FERC). With Bay at the helm of FERC, New Mexico’s energy boom can be stopped,

FERC regulates natural-gas pricing and pipelines as well as natural-gas export terminals. New Mexico’s ability to stoke its economy through the exploration and production of clean, efficient natural gas hinges directly on decisions made by FERC.

The Commission’s current, acting chair, Cheryl LaFleur, is a seasoned veteran of the energy sector and a respected expert on energy regulation who is on record in favor of quickly processing new export terminals to sell natural gas from New Mexico and other states amid surging world demand.

The White House, however, has nominated energy novice Norman Bay to chair the commission and set the agenda on such crucial policies. Elevating the largely unknown Bay— Politico calls him a “man of mystery”—to the pivotal position of chair could have significant, negative impacts on our State’s thriving energy sector. The chair of FERC holds powerful sway over its agenda and staff in ways that average members do not.

Unfortunately, perhaps as a personal favor to a former colleague, Gov. Martinez has endorsed the appointment of Bay to the FERC although not specifically the powerful position of chair.

The Obama Administration has a dismal record on the development of America’s energy assets despite the obvious importance these strategic natural resources play to states like New Mexico. The Washington Post says, “If foot-dragging were a competitive sport, President Obama and his administration would be world champions for their performance in delaying the approval of the Keystone XL pipeline.” Now the Obama White House—heavily lobbied on the issue by fringe activists—aims to do the same for liquefied natural gas (LNG) export terminals. As it is, there are two dozen applications for new export terminals awaiting FERC approval.

The Rio Grande Foundation has previously estimated that New Mexico could see an immediate increase in economic output of $200 million and the addition of 2,000 jobs immediately if LNG exports were encouraged rather than discouraged by Washington.

Senate Majority Leader Harry Reid said in an interview this week that he wants Norman Bay as Chairman of FERC, not Cheryl LaFleur. The last guy Reid picked for Chair, Ron Binz, could not get confirmed after calling natural gas “a dead end.”

An FERC chair who implements an anti-natural gas agenda—rather than serving as the neutral arbiter the FERC needs—could cut short our state’s strides in energy exploration.

To be sure, Bay’s appointment as chair over a commission on which he has never served, and has little background, makes little sense in terms of good government. Of even greater concern, though, are the troubling implications for New Mexico.

Ideally, Gov. Martinez should take a closer look at the views Mr. Bay holds as they relate to energy issues in general and LNG exports in particular. Absent a broader evaluation of Bay’s record, we hope that Martinez clarifies that her support for Bay is simply as a member of the FERC as opposed to its chair.

Paul Gessing is the President of New Mexico’s Rio Grande Foundation. The Rio Grande Foundation is an independent, non-partisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility

You are invited to join the Rio Grande Foundation for an evening celebrating what would have been Milton Friedman’s

You are invited to join the Rio Grande Foundation for an evening celebrating what would have been Milton Friedman’s  He is the author of three books, Cornerstone of Liberty: Property Rights in 21st Century America (2006), The Right to Earn A Living: Economic Freedom And The Law (2010), and The Conscience of The Constitution: The Declaration of Independence And The Right to Liberty (2013), as well as some 45 scholarly articles on subjects ranging from eminent domain and economic liberty to copyright, evolution and creationism, slavery and the Civil War, and legal issues in Shakespeare and ancient Greek drama. His articles have appeared in National Review, The Claremont Review of Books, The San Francisco Chronicle, The Washington Times, and Regulation among other places.

He is the author of three books, Cornerstone of Liberty: Property Rights in 21st Century America (2006), The Right to Earn A Living: Economic Freedom And The Law (2010), and The Conscience of The Constitution: The Declaration of Independence And The Right to Liberty (2013), as well as some 45 scholarly articles on subjects ranging from eminent domain and economic liberty to copyright, evolution and creationism, slavery and the Civil War, and legal issues in Shakespeare and ancient Greek drama. His articles have appeared in National Review, The Claremont Review of Books, The San Francisco Chronicle, The Washington Times, and Regulation among other places.