The year 2012 was a tough one for New Mexico’s economy. Without going through the litany of evidence, our state was the only Western state to be found on United Van Lines’ list of “top-outbound” states. And, while the US as a whole grew by an anemic 2.2% during the year, New Mexico grew by a downright pitiful 0.2%. Texas grew by 4.8%.

As the end of 2013 nears, new data from the Bureau of Labor Statistics indicate that 2013 is not looking to be much better.

According to the report, the state’s labor force participation rate, a measure of how many working-age residents are employed or looking for work, was the fourth-worst in the nation in October. And, between April and October, the state lost 20,382 jobs, or 2.4 percent, and nearly 24,000 labor force participants.

To top it all off, According to CoreLogic, New Mexico was the only state to show a decline in home prices from October 2012 through October 2013.

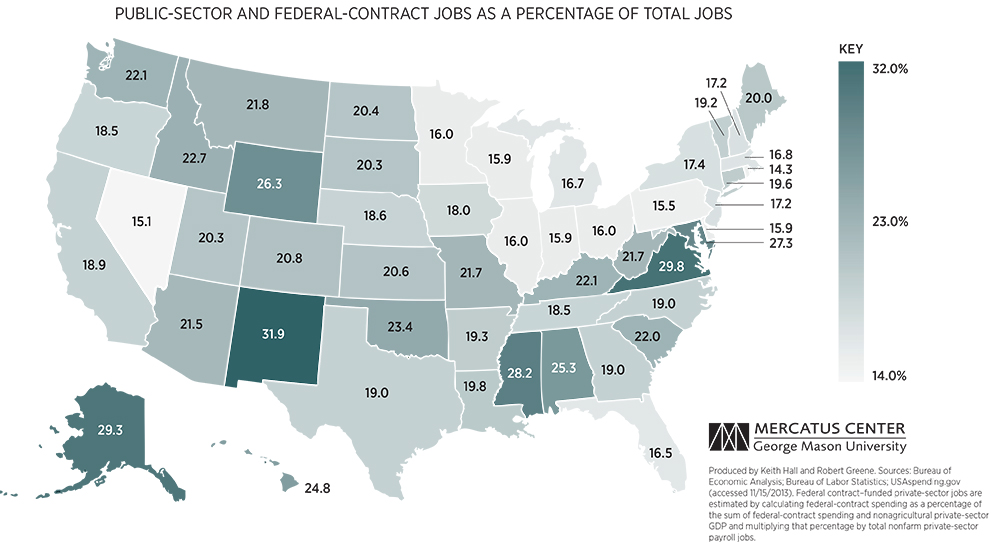

According to a report from the Mercatus Center at George Mason University, New Mexico is both the most reliant state on federal employment and has become even more so in recent years having lost more private sector jobs between 2007-2012 than all but eight states.

New Mexico has always been a relatively poor state, but it has not faced such a depressing economic outlook relative to the mildly-optimistic national outlook for at least two decades. What is to be done?

The Rio Grande Foundation has done groundbreaking research on New Mexico’s economy and is on record as supporting pro-growth tax reforms that address the massive disincentives for work and business formation in New Mexico’s tax code. We support adoption of a Right to Work law and broader regulatory reforms that would reduce the barriers to economic activity and employment. Lastly, we support dramatically-expanded school choice (Louisiana is a potential model) to improve workforce quality.

I certainly believe that these and other free market policies will move our state in the right direction. Other groups including Voices for Children and Think New Mexico have outlined ideas that they believe will, rightly or wrongly, spur our economy.

We have an election for Governor in 2014 and the New Mexico House is up for election as well. It is my firm belief that the poor state of New Mexico’s economy and what to do about it must be the top agenda item regardless of party affiliation.

Questions for Democrats, including the five who have entered the race for Governor, might include whether costly programs like the Richardson-era RailRunner and Spaceport are helping our hurting the economy. They also might be asked whether more regulations, more welfare, and more special interest subsidies like the one for film are really the answer to our economic woes, and why.

And, I would not let Gov. Martinez off the hook. Her significant economic development initiatives to date have involved attracting Union Pacific to Santa Theresa and a phase-down of New Mexico’s corporate income tax to 5.9% that will be completed by 2018. Obviously, these efforts alone have not done enough to improve our economic competitiveness.

I’d further ask Martinez what specific economic policy changes are needed to turn New Mexico around and why she hasn’t already introduced these reform ideas. Is political opposition from a hostile Legislature a stumbling block to even considering more dramatic reforms?

New Mexico is a beautiful state with a unique culture, but poverty has real, negative consequences for all of us. It is time to have an honest, far-reaching debate on our poor economic performance, our lack of a private sector, and our overreliance on Washington.

Our future depends on it.

Paul Gessing is the President of New Mexico’s Rio Grande Foundation. The Rio Grande Foundation is an independent, non-partisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility