The following appeared in the Santa Fe New Mexican on January 10, 2026. It has appeared in several other publications as well.

![]()

After years of failure to land a “big fish” business for New Mexico’s economy (or effectively use the oil and gas revenues to grow the economy) Gov. Michelle Lujan Grisham, with the help of Economic Development Secretary Rob Black, have lured no fewer than three large data centers to New Mexico.

These data centers are being built to serve the booming world of artificial intelligence, and they will have profound impacts on New Mexico.

It is our view that having these data centers locate in New Mexico is better than having them locate elsewhere. While we have many differences of opinion with this governor, we are pleased to see her get serious about growing and diversifying New Mexico’s oil-dependent economy, albeit quite late in her second term.

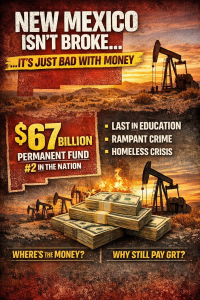

Sadly, the governor and Legislature have chosen not to use broad-based economic reforms like deregulation or tax cuts to improve New Mexico’s competitiveness. But, with the failure of her “preferred” economic development “wins” like Maxeon and Ebon solar, both of which the governor announced a few years ago but haven’t panned out, the focus on a more realistic strategy is welcome and long overdue.

Currently, three new data centers are slated to be built in New Mexico:

- Oracle’s Project Jupiter in Santa Teresa with an investment of $165 billion.

- Project Zenith, slated to be built in Roswell, amounts to a $11.7 billion investment.

- New Era Energy & Digital Inc.: While the overall investment is unclear, the energy requirement is the largest of the three at 7 gigawatts (that’s seven times the power used by the city of San Francisco).

What is a data center? Basically, they are the real-world computing infrastructure that makes up the internet. The rise of AI requires vast new computing power. It is critical that these facilities have uninterrupted electricity.

That electricity is going to be largely generated by traditional sources like natural gas and possibly nuclear. That contravenes New Mexico’s Energy Transition Act of 2019, which was adopted by this governor and many of the legislators still in office. Under the act electrical power emissions are supposed to be eliminated in a few years.

With the amount of money being invested in these facilities, there is also the simple fact that wind and solar and other “renewable” energy sources aren’t going to get the job done. In 2025, the Legislature passed and Gov. Lujan Grisham signed House Bill 93, which allows for the creation of microgrids that won’t tax the grid and make our electricity more expensive, but the Energy Transition Act will have to be amended or ignored to provide enough electricity for these data centers. There’s no other option.

New Mexicans have every right to wonder why powerful friends of the governor can set up their own natural gas microgrids while the rest of us face rising costs and decreased reliability from so-called renewables. Don’t get me wrong, having these data centers come to New Mexico is an economic boon.

But the boom comes tempered with massive subsidies, including a 30-year property tax exemption and up to $165 billion in industrial revenue bonds. New Mexico is ideally suited as a destination for these data centers, with its favorable climate and lack of natural disasters like hurricanes, tornadoes and floods. We shouldn’t be giving away such massive subsidies.

Welcoming the data center boom to New Mexico is better than rejecting them and pushing them to locate in other states. There is no way to avoid CO2 emissions, whether they happen here or somewhere else. But, there are questions about both the electricity demand and subsidies that must be addressed as New Mexico’s data center boom begins.

What will the Legislature, radical environmental groups and future governors of our state do to hinder (or help) bring these data centers to our state? That is an open question that depends heavily on upcoming statewide elections. It is important New Mexicans understand and appreciate these complicated issues.