The following article appeared in the Las Cruces Sun-News on April 26, 2020.

For all intents and purposes New Mexico is closed for business until at least April 30 per the Governor’s recent orders. Whether you agree with the way the Gov. has handled the COVID 19 crisis or if (like me) you think some of her measures have been unnecessary and heavy-handed, the fact is that New Mexico has done better than most other states in terms of preventing the spread of the virus.

The Gov. deserves credit for that.

But, every day that goes by the budget and economic state of New Mexico worsen. In addition to her focus on “flattening the curve” the Gov. needs to begin focusing more attention on the economy and State budget even prior to a potential special session when the worst of the virus has passed.

For the past two years with abundant revenues, the Gov. played the role of “Santa Clause” to her left-wing base. She benefited politically from the record amounts of oil and gas money flowing into the State’s coffers. With the Legislature’s help she created new programs like a modified “free college” program and a new pre-K entitlement. She also placated environmental groups by shutting down the San Juan Generating Station coal plant. She rewarded those in government by giving out 17% raises to members of her cabinet and spreading generous raises throughout the rest of New Mexico government.

The Santa Claus routine was fun I’m sure. But if Sen. Finance Committee Chair John Arthur Smith is right, and New Mexico faces a $2 billion shortfall, this could leave New Mexico with a smaller budget than the one signed by Susana Martinez ($6.3 billion). In other words, Santa Claus will have to become the Grinch very soon.

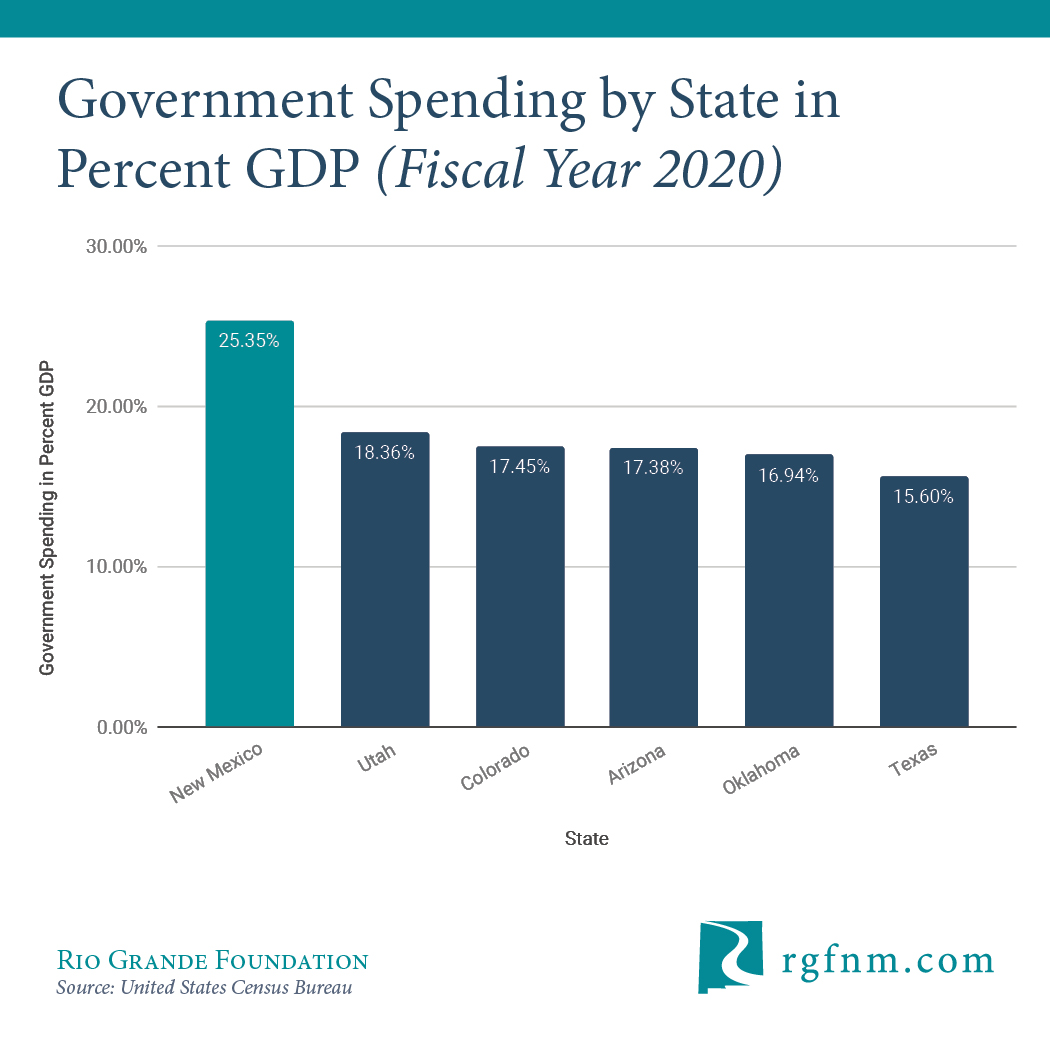

The fact is that spending must be cut dramatically and starting now. New Mexicans just can’t afford higher taxes. In fact, they couldn’t afford higher taxes even before the economic downturn and collapse in oil prices. A 2018 report by the Mercatus Center at George Mason University ranked all US states on their fiscal (overall financial) conditions.

New Mexico ranked a dismal 45th overall, but in the area of “service-level solvency” New Mexico ranked dead-last in 50th place. According to the report, this metric measured “If spending commitments demand more revenues, are states in a good position to increase taxes without harming the economy?” In other words, tax burdens in this State are already heavy. Raising them in this difficult time will inflict significant pain on an already reeling economy.

No politician enjoys cutting budgets or reducing funding for cherished programs. But the alternative of raising taxes in the worst economic downturn since the Great Depression is far worse.

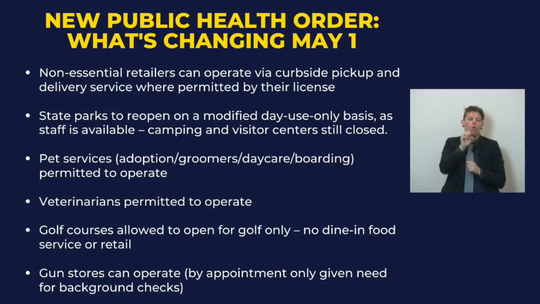

Businesses, especially small ones, are struggling to keep the lights on. For the sake of our society and the continuation of News Mexico’s unique culture, we need as many of those businesses to reopen after this crisis is over.

There seems to be agreement that a special legislative session is coming in June. We understand the Gov. may want to wait for the Legislature and (potentially) additional stimulus money. But, she needs to start explaining to the people of New Mexico the serious budget issues facing our State and outlining a plan of action.

The Virus may remain her top priority, but New Mexicans, especially those who own and work for small businesses, are scared for their economic futures. We want to hear her plans for minimizing the economic pain and maximizing the speed of the economic recovery.

The Rio Grande Foundation is asking all New Mexico legislators and candidates for the Legislature to sign a petition we’re circulating at https://riograndefoundation.org/pledge/ not to raise taxes until at least one year from now (after the 2021 session). Now is the time for fiscal restraint, not forcing hard-working New Mexicans and businesses to bear the burden of past overspending.

Gessing is president of the Rio Grande Foundation an independent, non-partisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility.