The following article appeared in the 2020 legislative preview edition of New Mexico Indepth. You can read the full paper online or by picking up a copy at the Roundhouse in Santa Fe.

In economic policy terms New Mexico’s 2019 Session was a disaster. Massive expansion of film subsidies, new mandates on electricity generation, a higher minimum wage mandate, tax hikes, and 12 percent spending growth were the lowlights.

Of course, with fast-growing oil production and a strong national economy, New Mexico’s economy remains strong and surplus revenue will again be available when the Legislature convenes in January.

At the Rio Grande Foundation, we see numerous opportunities for bipartisan reform, but 2020 could also result in another spending binge that does nothing to address the systemic policy problems facing our State.

The most obvious opportunity is gross receipts tax reform. This must involve lowering rates and elimination of taxes of services provided by contractors and other business inputs. These taxes can be avoided by purchasing services (like bookkeeping and web hosting) from out-of-state providers in order to avoid the GRT which is applied at rates above 7.5% in most New Mexico communities.

Sadly, in 2019 the Legislature eagerly imposed GRT on several businesses, consumers, and industries. These included non-profit managers of Los Alamos National Lab, non-profit hospitals, and purchases made over the Internet.

But, the GRT remained unchanged in any systemic way. Rates remain high and the problem of taxing business inputs and “pyramiding” remains unchanged. With a billion dollar surplus available and both Gov. Lujan Grisham and Speaker Egolf making noise about tax reform, now is the time to act. And, while details may vary, the general model outlined in bipartisan legislation introduced by Rep. Jason Harper (R) and Sen. John Arthur-Smith (D) remains the logical framework for reform.

Another bipartisan reform opportunity should include public employee pensions (specifically PERA and ERB). Gov. Lujan Grisham should be applauded for naming a task force to take a serious look at PERA which covers public workers NOT employed in the education system (and thus covered by ERB). Given its weaker financial position and importance to public education budgets, ERB deserves a similar look.

Both systems are seriously underfunded, a situation which must be addressed. Also, both need to be updated to better serve the 21st Century work force. Colorado and other states have successfully done this. New public employees in New Mexico should be offered more portable benefit options outside of the traditional pension system, which rewards longevity as opposed to those who may want to “give back” for a few years and then move on to other career goals as younger workers wish to do these days. Both types of employees should have retirement options that work for them.

Finally, there is the issue of occupational licensure reform. Bipartisan legislation (SB 385) made its way to the Governor’s desk in 2019 only to be vetoed. We hope to make another push to address the unnecessary obstacles licensing often puts in the way of willing workers and willing customers/employers.

While there is potential common ground for economic reform in 2020, there are numerous serious issues, particularly with the Gov’s proposal for “free” college. Here are two:

-

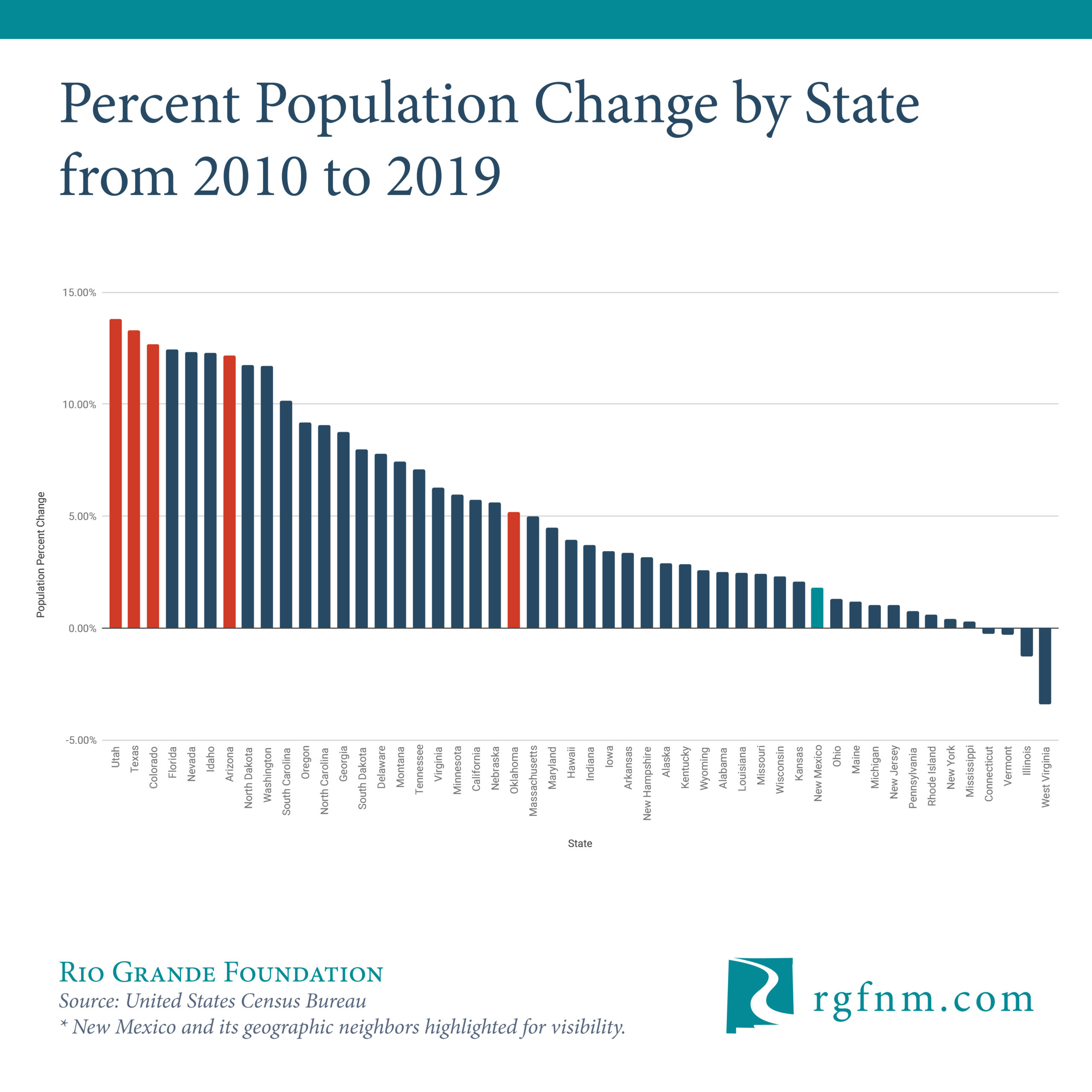

- While the oil boom as perked up the State economy in recent years, job opportunities are still more diverse, plentiful, and generally better-paying in neighboring states. Absent economic reforms (see GRT discussion above) how can we be sure that “free” college will actually benefit New Mexico’s economy?

-

- New Mexico’s biggest education challenge is the performance of its K-12 system. Absent much more ambitious reforms than those currently being discussed to raise student outcomes “free” college won’t do much good.

While this oil boom is driven by production as opposed to prices, all good things eventually come to an end. What happens when oil prices or production decline due to environmental concerns, the global economy, technological advances, or some other unforeseen change?

This 30 day session will go a long way to determining New Mexico’s economic future.

Paul Gessing is the President of New Mexico’s Rio Grande Foundation. The Rio Grande Foundation is an independent, non-partisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility