The following appeared in the Santa Fe New Mexican on Saturday, November 2nd, 2024.

The City of Española, at the behest of Mayor John Ramon Vigil, will soon consider adopting a ban on plastic bags like those used at grocery stores. While proponents of such bans typically support them on environmental grounds (cut down on plastic waste etc.) the Mayor seems to believe that banning plastic grocery bags will have a positive impact on the City’s litter problems.

According to the website Plastics Paradox, “A compilation of all of the statistically-based, scientific studies of litter in the U.S. and Canada over an 18 year period shows consistently that “plastic bags” (which includes trash bags, grocery bags, retail bags and dry cleaning bags) make up a very small portion of litter, usually less than 1%.” Banning plastic grocery bags will not impact litter issues in Española.

The first step toward solving the litter problem is educating the public on the harms of littering. While you may or may not like the new “Breaking Bad” themed litter campaign put forth by the Gov., it is the first major public initiative on litter in years. It is a step in the right direction.

But educating the public will only get you so far. The Mayor is correct that the so-called “homeless” who often occupy road medians and other public spaces are some of the biggest culprits. Enforcing laws against both littering and the occupation of public parks and rights-of-way would help with the litter problem. Enforcing litter laws would help as well.

Improving the litter situation is not just about appearance, there is abundant literature in the “Broken Windows Theory” of policing and public safety indicating that addressing “minor” issues like litter can ALSO have an impact in the form of reducing other crimes.

We share the Mayor’s goal of reducing litter and beautifying Española, but we’d prefer to focus on the root problems rather than arbitrarily banning a simple and useful item like plastic bags.

Besides, while it is not the stated reason for the Mayor’s plastic bag ban, reducing plastic waste is another worthwhile goal. Sometimes plastic bag bans have been used in hopes of achieving reductions in plastic waste. But, in at least two cases, those bans have had the opposite impact of increasing plastic waste.

In one case New Jersey passed a law in 2020 banning single-use plastic and paper bags in all stores and food service businesses. The law took effect in May 2022

But, as a study by Freedonia Research found that while the total number of plastic bags did go down by more than 60 percent to 894 million bags, the alternative bags ended up having a much larger carbon footprint with the state’s consumption of plastic for bags spiking by a factor of nearly three. Plastic consumption went from 53 million pounds of plastic before the ban to 151 million pounds following the ban.

New Jersey is not alone in having a plastic bag ban backfire with the result being more plastic waste, not less.

A similar thing happened in California. The Los Angeles Times editorial board recently highlighted the failure of California’s plastic bag ban. Not surprising is the fact that California banned single-use plastic grocery bags back in 2016, becoming the first state to adopt such a law.

But, as the Times noted in its editorial, “In 2014 California tossed about 157,385 tons of plastic bag waste into the trash. In 2022, plastic bags accounted for about 231,072 tons of trash. That’s nearly 50% more.”

Good public policy isn’t just about passing policies that feel good. Hopefully Española’s City Council will do some research for themselves and reject this harmful bag ban.

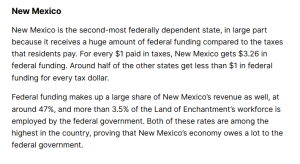

Sam LeDoux is an Española City Councilor representing District 4. Paul Gessing is president of New Mexico’s Rio Grande Foundation, an independent, nonpartisan, tax-exempt research and educational organization