The following appeared in the Las Cruces Sun News on Sunday, February 4, 2024.

In recent years the “left” including most, but not all in the Democratic Party have turned sharply against traditional energy sources. Despite New Mexico’s status as a leading energy state, it has not been exempted from this trend.

In fact, while New Mexico has seen an unprecedented oil and gas boom (which has unlocked unprecedented government revenues) New Mexico’s political leadership has become virulently anti-energy. This is true for all five members of its congressional delegation which all reflexively support anti-energy policies that are contrary to the State’s interests.

But the Legislature, especially since Gov. Lujan Grisham became Gov. in 2019, has turned against traditional energy sources. The first step was the Energy Transition Act of 2019. Among other things the bill shut down the coal-fired San Juan Generating Station and eliminated nuclear from the list of “green” replacement power sources. Instead, the State has now embarked upon a plan to derive 100% of its electricity combination of wind, solar, and battery backup by 2045.

The Gov. doubled down on rammed her electric vehicle mandate through her appointed Environmental Improvement Board this past fall. The plan is to radically increase the number of EV’s sold in New Mexico from the current 4.8 percent of vehicles sold to 43 percent in less than three years.

But the Gov. and Legislature had generally left the oil and gas industry alone, at least until now. The oil and gas industry have created a flood of revenues for the State. A $3.5 billion surplus last year is followed by a similar surplus this year. New Mexico’s annual state government income has swelled by nearly 50% over just the past three years.

But, after decades of Democrat-run New Mexico politicians largely leaving oil and gas alone (while gladly spending the tax revenues the industry generates), the 2024 legislative session has seen more direct attacks on the industry.

Here are some of the bills introduced in the current session that would directly affect the oil and gas industry in New Mexico:

- HB 133 opens the New Mexico Oil and Gas Act which has governed the industry for decades and enacts language pushed by environmental groups that will have the effect of increasing regulations to the point where small operators can’t do business in New Mexico.

- HB 41 would impose a so-called “Clean Fuel Standard” directing the Environmental Improvement Board to impose regulations to regulate the “carbon impact” of gasoline. This will raise gas prices for consumers.

- HB 30 demands use of only recycled water in oil and gas operations. Using recycled water is exciting new technology, but the industry simply can’t use only recycled water at this time.

- HB 32 would require numerous onerous new regulations on most oil and gas facilities within a mile diameter of schools.

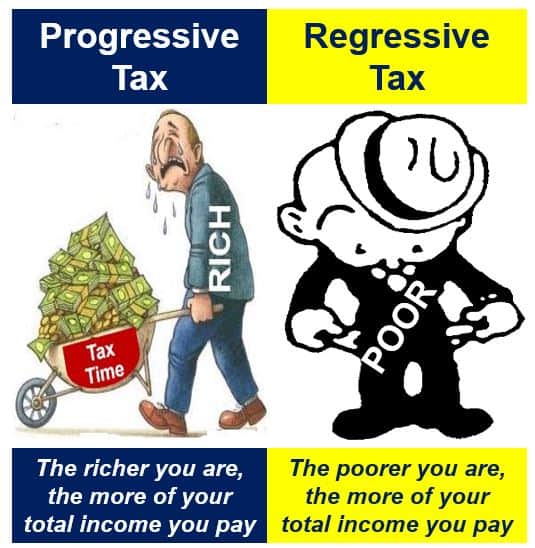

- HB 48 would dramatically increase “royalties” (taxes) on the oil and gas industry which already generates huge amounts for New Mexico.

Advancing such momentous legislation during a 30-day legislative session is a challenge. While Republicans are generally united in support of oil and gas, the industry splits New Mexico Democrats. After getting the Energy Transition Act and pushing EV’s Gov. Lujan Grisham clearly seems willing to “kill (or at least wound) the golden goose” that funds New Mexico.

This is likely only the newest front in the battle over even more restrictive policies that, if adopted, could do great damage to New Mexico’s economy.

Paul Gessing is president of New Mexico’s Rio Grande Foundation. The Rio Grande Foundation is an independent, nonpartisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility