As Sen. George Muñoz, D-Gallup, told the floor as debate over this year’s budget wrapped up: “You’re not a poor state. Quit telling other people you’re a poor state.”

He’s right. The state of New Mexico is not poor. But what about the people of New Mexico?

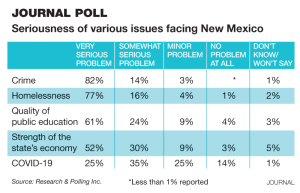

Among the citizens poverty remains high. According to World Population Review, New Mexico has the third-highest poverty rate in the U.S. Crime remains troubling and the education system is in dire straits.

The state of New Mexico — meaning the government itself — has had massive surpluses in recent years. Sadly, the government has either held onto or spent a majority of those dollars. The Legislature and its policies keep New Mexicans poor while the state retains massive wealth. A 2023 report stated that New Mexico’s permanent funds amount to $43 billion.

That number is only going to grow. Heading into the 2024 session New Mexico was blessed with a $3.5 billion surplus. A similar surplus existed last year. This session the Legislature adopted a 6.8% budget increase spending about $659 million. Furthermore, the Legislature adopted a “tax omnibus” that contained various tax cuts, credits and hikes, which will reduce state revenues by approximately $220 million.

I might wish to see less spending and a more aggressive approach to tax cuts than that pursued in the budget, House Bill 2, and tax bill, House Bill 252, but the two combined amount to “only” $880 million or about 25% of the available surplus. Where is the other $2.6 billion?

The fact is that money, and other surplus revenues like them in recent years, has been stashed away in various government funds. Call them whatever you want, but they amount to future government spending.

Instead of keeping our money, New Mexico’s leadership should be using these dollars to diversify and grow the economy in the here and now. There is bipartisan agreement that we are too dependent on oil and gas and federal spending. This session the Legislature had opportunities to use that surplus to spur economic growth.

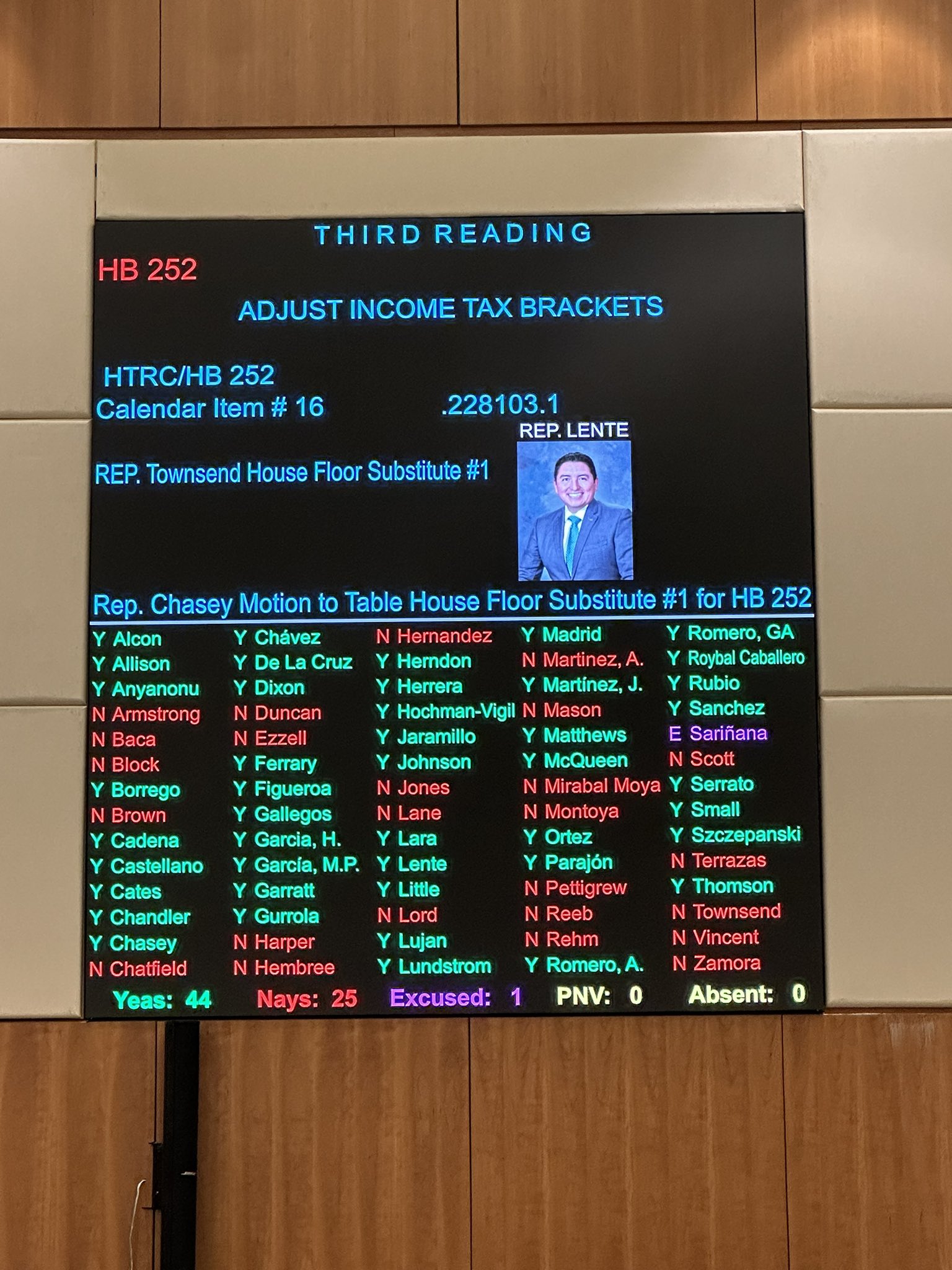

In the House, an amendment was offered to the tax omnibus bill, HB 252, by Rep. Townsend, R-Artesia, that would have moved New Mexico’s personal income tax to a flat 1% rate. That’s the kind of bold economic policy reform that puts a state like New Mexico “on the map” for businesses and people considering relocating. It would mean real economic diversification and quickly.

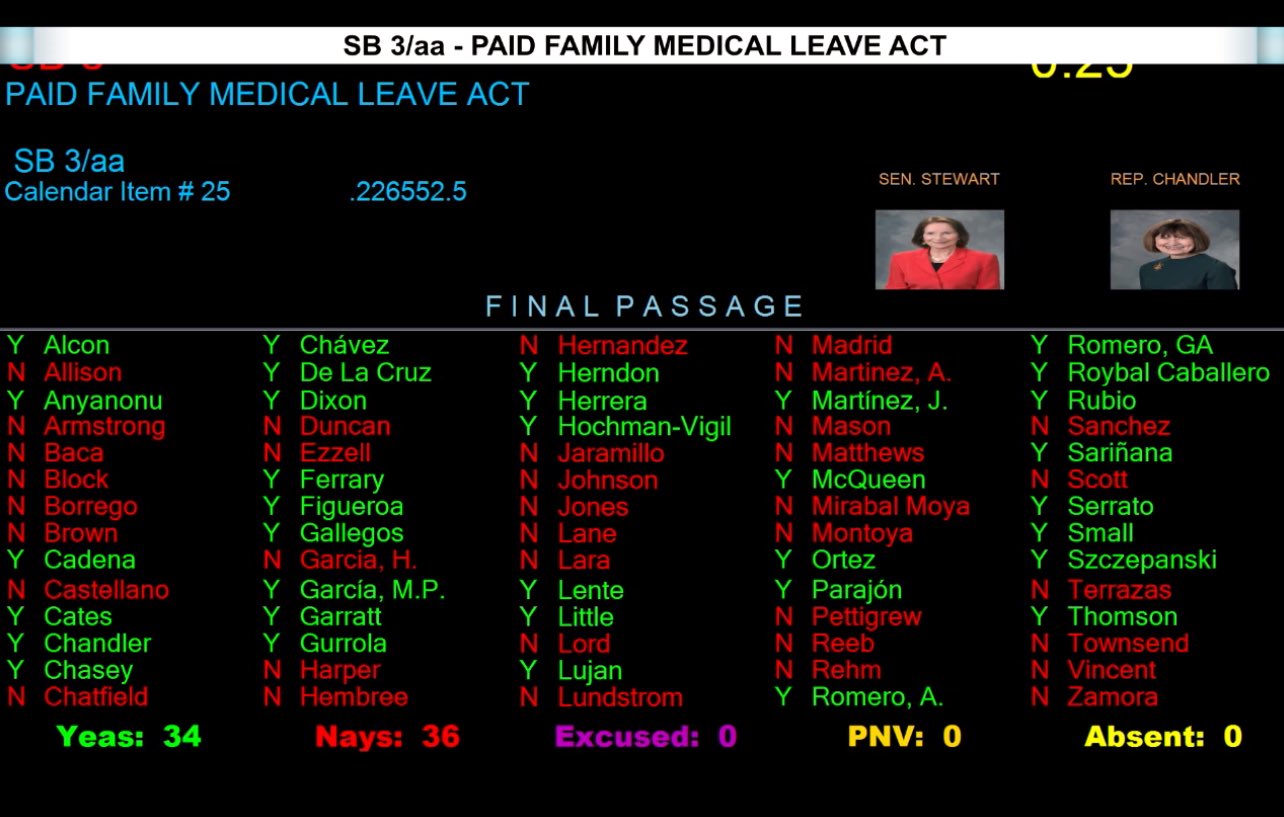

Better still, the amendment would have only reduced revenues by $1.75 billion, leaving $1.75 billion available to spend or save. Sadly, it died along partisan lines on the House floor.

Another amendment, this one offered to the “tax omnibus” by Sen. Cliff Pirtle, R-Roswell, would have simply indexed New Mexico’s tax on Social Security to the rate of inflation at a negligible “cost” to the state. Two years ago New Mexico reduced this tax, but it remains one of just 10 states to tax Social Security at all.

Over time, because it is not indexed to inflation, New Mexico’s tax code would catch greater numbers of people in the tax. That is especially true as inflation has increased rapidly in recent years. Sadly, the amendment failed 20-15 with all Republicans supporting it and several Democrats avoiding voting, but enough of them opposed the idea to kill it.

Sen. Muñoz is right. New Mexico is not a “poor” state. But our state government is obese and gluttonous while it remains dependent on oil and gas and federal spending. New Mexico is poorly led and it continues to miss opportunities to diversify and grow its economy right now to instead grow government now and into the future.

Paul Gessing is president of New Mexico’s Rio Grande Foundation, a research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility.

The site is full of useful information. What other states should we compare with New Mexico and why?

The site is full of useful information. What other states should we compare with New Mexico and why?