While the courts have yet to have their say, one of the Trump administration’s most important accomplishments, perhaps second only to his successful crackdown on illegal immigration, may turn out to be the restoration of vehicle choice in a large swath of the country. A total of 17 states (including my home state of New Mexico, which, as a large, poorer, and empty state, is not a natural market for EVs) had previously signed on voluntarily to California’s Advanced Clean Cars II regulations. These regulations (if continued) would have required automakers to increase the proportion of zero-emission vehicle sales year by year, with a 43 percent mandate starting in 2026.

Back in May, Congress passed (and Trump signed) legislation to eliminate California’s mandate. But, according to new data from the pro-EV trade group Alliance for Automotive Innovation, EV sales were already slowing dramatically by the first quarter of 2025. In fact, in Q1 of 2025, auto buyers didn’t just slow the growth of EV purchases, they shifted back to gas vehicles in overwhelming numbers.

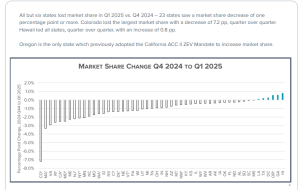

This was true in mandate states like New Mexico and across the country. In fact, according to the chart below, the only state to mandate EVs that saw an increase over the fourth quarter of 2024 was Oregon. All but six states lost market share in Q1 2025 vs. Q4 2024, and 23 states saw a market share decrease of 1 percentage point or more. Colorado lost the largest market share with a decrease of 7.2 percentage points, quarter over quarter.

The first quarter of 2025 began before Trump took office and ended at the end of March. Legislation overturning California’s mandate didn’t pass Congress until May. Why did EV sales slow so dramatically at this point? It is hard to say. The fact is that numerous federal and state subsidies for EVs remain in effect.

The following information provided by New Mexico’s Environment Department highlights some but not all of the federal and state EV subsidies still available (as of August) in New Mexico: Under current federal policy, tax credits of up to $7,500 for the purchase of new EVs and up to $4,000 for used EVs are available through September 30, 2025.

Buyers can also get a tax credit of up to $1,000 to help cover the cost of purchasing and installing a residential or commercial EV charging station. This federal tax credit is available through June 30, 2026.

On top of those federal subsidies, New Mexico offers a tax credit of up to $3,000 for the purchase or lease of a new or used qualifying vehicle and a tax credit of up to $25,000 for the purchase and installation of EV charging units. New Mexico’s subsidies and mandates remain in full effect and are augmented by recently enacted building codes that require EV charging stations and/or infrastructure in new construction.

New Mexico is hardly alone. Nearly all states offer some subsidy for the purchase of EVs or EV charging stations.

Have we hit “peak” EV at this point? Only time will tell. Perhaps the Q1 data were an indicator that in the absence of overwhelming federal and state incentives, EVs remain a niche product. Or, maybe the uncertainty of federal policy changes caused prospective buyers to put their EV purchases on hold for the time being. If anything, though, the prospect that subsidies might be removed would be expected to accelerate sales.

It is always possible that if Trump is succeeded by a more EV-friendly president and a Democratic Congress, federal EV subsidies and mandates would be reintroduced nationwide. But for the time being, vehicle purchasers across the nation are free, subject to what they can afford, to choose for themselves the type of car they want to purchase, thanks to legislation passed by congressional Republicans and signed by President Trump. Despite federal subsidies that remain in place for the time being and additional incentives offered by numerous states, EV sales have at the very least leveled off and may be on a longer downward trend.

Instead of having politicians trying to force the vehicles they want on an unwilling public, auto manufacturers will be able to provide motorists with the cars they want and need. If EV technology improves, perhaps they will again see rapid growth in market share. Or, maybe hydrogen or some other technology will ultimately be seen as superior. It is worth noting that internal combustion vehicles continue to improve their efficiency as well. One report found that fuel efficiency has increased 35.4 percent over the past 20 years.

Whatever happens to the future of EVs, they should compete on an even playing field with other vehicles. Ideally, that would mean states eliminating their subsidies as the federal government’s go away. Furthermore, particularly due to their weight (which is typically heavier than that of conventional cars, meaning greater wear and tear on roads and bridges) and the fact that they do not pay gas taxes (which in turn fund road construction and maintenance), EV owners should be required by state policymakers to pay toward the upkeep of roads (rather than foisting that responsibility solely onto the drivers of gas-powered vehicles). Democrats in New Mexico’s legislature proposed a $120 annual road-maintenance fee for EVs last year, but it was killed in committee.

Most opponents of EV mandates and subsidies never had an issue with EVs. They just felt that (predominantly) left-wing policymakers were using the heavy hand of government to force a costly technology onto consumers before it was ready for prime time and in return for often exaggerated environmental benefits. Thankfully, the federal government has abandoned or is in the process of abandoning those policies. States should follow suit by leveling the playing field.