The following opinion piece appeared in the Las Cruces Sun-News on Sunday, July 26, 2020:

As the head of New Mexico’s free market think tank and a frequent critic of New Mexico’s K-12 system, many are surprised to hear that my two school-age children have been in traditional public schools throughout their educational careers. That will change this fall due to COVID 19 and the policies being imposed by the State. According to numerous reports, parents across our nation are doing the same.

This crisis and our response to it is an opportunity for policymakers to reconsider how education works in the State of New Mexico. As a reminder, New Mexico has perpetually found itself among the lowest-performing education systems in the nation. Innovative thinking, especially policies that redirect funding to students as opposed to bureaucracies, could have positive impacts now and in the future.

While we at the Rio Grande Foundation are often critical of the powers that be in New Mexico education policy, this is not the case regarding COVID 19 and the reopening plans. In fact, our usual criticism is a systemic one and that is the situation here. The idea that one model of schooling makes sense for all students in normal times is faulty. Now, with such widely-variable views on COVID 19 and the appropriate response to it (not to mention the different educational needs for students of different ages and abilities) developing solutions that satisfy everyone is impossible.

For my family with elementary school aged children, the combination of mask wearing throughout the day and “social distancing” being imposed was a deal-breaker. And, while I support “virtual” or “hybrid” learning for some children, I simply don’t think the schools or educators are ready to deploy them on a large scale in an effective manner. We saw this firsthand in spring when the schools suddenly shut down.

Hopefully, school systems have better plans in place now, but the situation remains fluid and chaotic. New Mexico students are already behind due to lost months at the end of last school year. The chaos of masks in the classroom and a hybrid/virtual model that is completely new and unfamiliar to many students and teachers is not likely to lead to improved outcomes.

That is not just unfortunate: it is tragic.

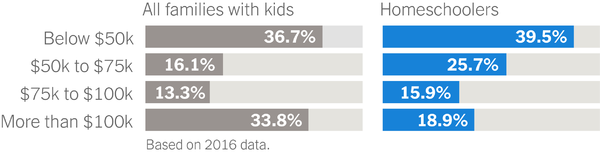

My family is blessed. We can make home schooling work and we’ve already spent considerable time preparing for this big change. Unfortunately, that is not the case for all New Mexico families, especially low-income and minority families.

The COVID 19 situation leaves no “easy” choices, but with so many New Mexicans looking for educational options or even taking on the task of educating their own children, shouldn’t the tax dollars they pay into the system follow the child? Shouldn’t parents have resources made available to purchase computers and other curriculum materials for their children or, if they prefer, shouldn’t they be able to send their child to the school of their own choice? All of these choices involve major time and financial sacrifices by parents in tough economic times. Rather than penalizing these families, we believe the funding should follow the child and help them directly.

South Carolina’s Governor just announced the state will use $32 million to fund low-income families directly this fall. The scholarships are worth up to $6,500 each. These are the solutions that should be happening in New Mexico. Families are paying taxes for a school system that in times of “normalcy” is considered “inadequate” (Yazzie lawsuit). With many limitations and adjustments being made now, that system and the families it serves now face greater challenges than ever before.

I truly feel for our children who have lost so much already. The Legislature and Governor have long claimed to care for our children. It is time to call their bluff and fund children, not bureaucracies.

Paul Gessing is president of New Mexico’s Rio Grande Foundation. The Rio Grande Foundation is an independent, nonpartisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility

Does this mean people are “masking up” and that the Gov.’s policies are working? The Gov. made that claim back in June when numbers looked to be going in the right direction, but there really isn’t any evidence of that. Neighboring states like Texas and Arizona are also seeing declines in cases and deaths.

Does this mean people are “masking up” and that the Gov.’s policies are working? The Gov. made that claim back in June when numbers looked to be going in the right direction, but there really isn’t any evidence of that. Neighboring states like Texas and Arizona are also seeing declines in cases and deaths.