The following opinion piece appeared in the Carlsbad Current Argus and several other papers on or around July 13, 2020.

Recently, a judge denied a request made by the Lujan Grisham Administration that the Yazzie lawsuit be dropped. That lawsuit claims that New Mexico’s K-12 system is “inadequate.” Many would argue that our K-12 system has long been “inadequate” due to the State’s poor outcomes.

We wholeheartedly agree that New Mexico’s education system has long been “inadequate,” though the issue is not a lack of funding. The ongoing COVID 19 pandemic has exposed the many inadequacies of our K-12 system as well. Parents (and when schools closed this spring, I had two children in public schools) were abruptly forced into the role of home-school teacher in March.

A return to “normalcy” is not on the horizon and that will truly challenge our K-12 system. In advance of the start of school in less than one month, the Public Education Department has presented us with a highly-restrictive proposed opening plan for the fall school year. The hybrid learning model (partially online and partially in-person) is a worthwhile effort, but even staunch advocates of online learning recognize that not all children learn well in a digital environment. That especially includes younger children.

The challenges of computer and broadband access in many parts of our State raise all kinds of additional questions and problems for students, parents, educators, and administrators alike.

The “virtual” experience this spring was cobbled together and disorganized. We hope for something better this fall, but with mask requirements for students and staff alike, social-distancing, and numerous other restrictions, there will be a big increase in demand for alternatives.

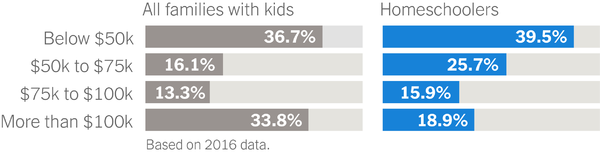

A recent RealClear Opinion Research survey of registered voters shows that support for educational choice show that 40% of families are more likely to homeschool or virtual school due to the lockdowns. The poll further found that 64% support school choice. In other words, home schooling, virtual learning, and private schools having more flexible learning models are all going to be explored and likely followed by increasing numbers of New Mexicans.

With so many New Mexicans looking for educational options or even taking on the task of educating their own children, shouldn’t the tax dollars they pay into the system follow the child? Shouldn’t parents have the resources made available to purchase computers and other curriculum materials for their children or, if they prefer, shouldn’t they be able to send their child to the school of their own choice? All of these choices involve major time and financial sacrifices by parents in tough economic times. Rather than penalizing these families, we believe the funding should follow the child and help them directly.

The Rio Grande Foundation has long advocated for school choice in New Mexico. But unions and the political establishment have stood in the way. With the advent of the COVID 19 epidemic we have seen a rapid disruption in traditional education techniques. Problems with our one-size-fits-all K-12 model have laid bare the true “inadequacies” of our educational system. The “old” model of students in one building in lines of desks will likely not return for some time and possibly forever.

The most innovative model available today is “Education Savings Accounts” or ESA’s. There are five ESA active programs in five states: Arizona, Florida, Mississippi, North Carolina and Tennessee. While the details vary by State the basic idea is to allow parents to withdraw their children from public district or charter schools and receive a deposit of public funds into government-authorized savings accounts. Those funds can cover private school tuition and fees, online learning programs, private tutoring, educational therapies, community college costs, and other higher education expenses.

ESA programs are less well-established than other “school choice” programs like charter schools, vouchers, tax credits, and home schooling, but the pandemic is a big problem and policymakers need to have big and innovative solutions. Now, more than ever, those solutions will not work for all students.

Paul Gessing is president of New Mexico’s Rio Grande Foundation. The Rio Grande Foundation is an independent, nonpartisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility