The following appeared in Eastern New Mexico News and other outlets throughout July of 2025.

If you haven’t heard already, over the 4th of July weekend, President Trump signed the so-called “Big Beautiful Bill” (BBB) into law. Setting aside the merits and demerits of the legislation, you have to hand it to President Trump and Speaker Mike Johnson for achieving the President’s goal of signing the bill by July 4.

Considering the complexity of the bill and the narrow majorities held by Republicans (with implacable opposition from Democrats), there was not much wiggle room for compromise or lost Republican votes. Needless to say, New Mexico’s hyper-“progressive” delegation universally opposed the bill, but so did Trump’s erstwhile ally Elon Musk and libertarian leading Kentuckians Sen. Rand Paul and Rep. Thomas Massie (both Republicans).

Paul and Massie voted in opposition to the plan due to insufficient spending reduction and the potential of the plan to increase the federal debt.

New Mexico Gov. Lujan Grisham and the entire Congressional delegation also unsurprisingly opposed the BBB. They didn’t oppose it for reasons of fiscal restraint. Rather, they opposed the bill because it cuts taxes and eliminates subsidies for so-called “green” energy and Medicaid.

Lujan Grisham called the bill “an abomination.” Rep. Vasquez said “It’s gonna devastate New Mexico’s health care system.” Other reports claim that the reductions to Medicaid spending growth could shutter half a dozen hospitals in the state.

In reality, the BBB doesn’t actually cut Medicaid. According to health care expert Michael Cannon, it slows federal Medicaid spending growth from an annual rate of 4.5 percent to 2.7 percent. It does this by eliminating some widely recognized gimmicks like provider taxes that both Joe Biden and the Obama Administration opposed. The new law also imposes enhanced work (including education and job training) requirements for Medicaid and SNAP (food stamp) recipients.

Whatever the impact of these plans, the fact is that Medicaid is long-overdue for reform. If New Mexico policymakers truly wish to keep these benefits flowing, they have every tool available to keep them in place.

Not only does New Mexico have a mind-blowing $61billion in various “savings” accounts. Just last year the Legislature created a new $2 billion “Medicaid Trust Fund” for the express purpose of shielding New Mexico’s Medicaid program from prospective cuts.

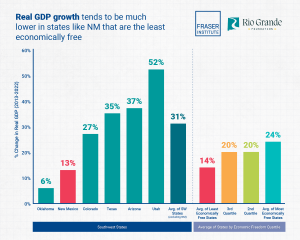

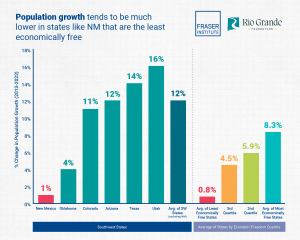

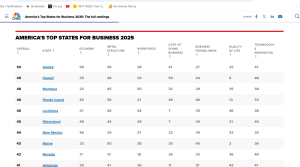

The Rio Grande Foundation opposed this legislation (SB 88). That’s because we believe New Mexico’s massive “savings” should be returned to the taxpayers to diversify the State’s struggling non-oil-and-gas private sector economy.

But, if the Legislature and Gov. want to restore federal spending cuts, they can certainly afford to do it. Federal welfare programs like Medicaid are found nowhere in the US Constitution. More importantly, as designed, Medicaid’s incentive structure is all wrong. It incentivizes states to game the system to bring in more federal money and disincentivizes recipients from seeking gainful employment and higher pay (lest they lose their benefits). New Mexico’s heavy dependency on Medicaid is also a major factor in New Mexico’s health care provider shortage.

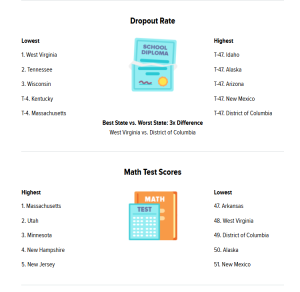

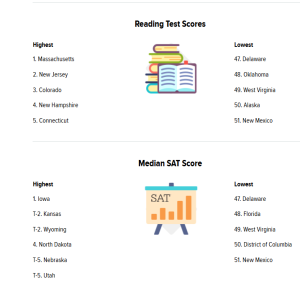

Even the overall health impacts of Medicaid are inconclusive at best. A June 25, 2025, headline from the liberal online news Source New Mexico stated, “New Mexico health outcomes fail to improve despite massive spending increases.” That is based on recent data from the Legislative Finance Committee. Those increases were largely thanks to Medicaid and they highlight the program’s questionable impact on patient outcomes.

Whatever the future holds for Medicaid and health care spending in New Mexico more broadly, the State has the resources to either continue existing programs or even improve upon the current situation. It’s time to stop whining and use our own considerable resources for the benefit of New Mexicans.

Paul Gessing is president of New Mexico’s Rio Grande Foundation. The Rio Grande Foundation is an independent, nonpartisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility.