The following appeared in the Albuquerque Journal on Sunday October 12, 2025.

On this fall’s ballots in addition to votes for mayor, city council and school board, local voters will be asked to decide on a $350 million bond for Albuquerque Public Schools. These bonds (another name for debt which is typically used to pay for construction and other infrastructure) usually pass, but I hope voters will take a moment to consider whether the district really needs this year’s massive bond measure.

The student population at Albuquerque Public Schools continues to plummet. Student enrollment has dropped by more than 20,000 since 2016, going from approximately 85,336 in the 2016 fiscal year to an estimated 64,995 in the 2025 fiscal year. Along with spending growth at the state level, the decline in its student population has led to massive spending growth on a per-pupil basis which now sits at around $35,000 per student per year.

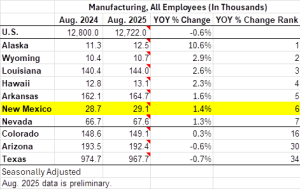

Demographers see no sudden increase in the number of young people attending school in New Mexico or APS specifically. That’s in part because birth rates nationwide are down and show no signs of reversing course anytime soon. There has been a particularly pronounced decline in the number of young people in New Mexico from 2020 to 2024. During that time frame New Mexico saw the second-biggest decline among U.S. states in its 0-18 demographic, according to the Census Bureau.

Further, while APS has made some strides under the current superintendent, Gabrielle Blakey, in recent years, the district continues to struggle to provide academic results. This has led to an increase in home schooling and the pursuit of other options by many families.

While we applaud the efforts being made by the superintendent and school board to turn APS around, it is high time for the district to get serious about consolidating and closing old and unneeded schools. After all, a 20% drop (with a further decline expected) should free up buildings and other infrastructure to repurposing at great savings to taxpayers.

One big-ticket item that will be added if the bond is passed is a $40 million new special needs education facility on the West Side as well as a new career technical education training facility. Why not repurpose existing assets for these needs instead? Of course, the district is also planning to spend another $40 million of the expected bond money to improve HVAC systems and put refrigerated air units in schools.

That’s not a bad idea, but why are we spending millions of dollars to add fancy new air-conditioning units on half-empty schools? The same is true for security upgrades and numerous other items contained in this bond.

Closing schools isn’t politically popular with certain parents, but that is why the entire community, not just APS parents, are being asked to vote on this bond. Of course, parents aren’t the only ones paying property taxes, either. Whether you think APS is heading in the right direction overall or whether you think they have a long way to go, the district will only act to more efficiently use its capital dollars if voters (especially taxpayers) push them to do so. This isn’t about harming students or preventing them from putting air conditioning in schools, it is about common sense stewardship of taxpayer dollars. Voters should be very skeptical of APS’ $350 million bond request.