Commuting to downtown Albuquerque

05.10.2021

Over the winter the RGF took a drive through various “scenic” areas of Albuquerque. The short clip below is what you might see on a typical commute into downtown.

Over the winter the RGF took a drive through various “scenic” areas of Albuquerque. The short clip below is what you might see on a typical commute into downtown.

The Rio Grande Foundation is happy to see Gov. MLG (finally) moving to reopen New Mexico by bringing more counties into the Turquoise (most free) level in her recently-released framework. But we have never bought into her concept and consider the data below one of the reasons why.

The Gov.’s framework is based on three basic data sets outlined below. Broadly speaking, for the first two (case rate and positivity) lower is better while a higher vaccination rate is better.

But, to indicate how senseless the entire system is, take a look at the three real-world counties below. Two of the three are “turquoise” while one of them is “yellow.” Which one is it? Does it make any sense whatsoever? We say no and explain below.

Check out the actual county data cut-and-pasted below. We don’t want ANY New Mexico county to be in a more restrictive category. In fact, we STRONGLY believe that Gov. Lujan Grisham should end the emergency order IMMEDIATELY. But, the data presented below (and above) show Roosevelt County (Portales area) to be in the least restrictive turquoise category while Chaves County (Roswell) is performing better on all three metrics and yet remains in yellow.

San Juan County (Farmington area), also in turquoise, has much higher case rates and test positivity, but does have a higher vaccination rate. What is driving the disparity? Who knows? It is hard to make sense out of a senseless system.

Recently the US Census Bureau published data on a variety of population issues. New Mexico’s Legislative Finance Committee apparently received the data early and had a paper with further analysis ready to go upon the Bureau’s release.

I have included a few charts from the paper below with additional commentary. Most notably New Mexico’s population growth grew quite slowly compared to its neighbors and even trailed the US as a whole.  The growth among various population groups is curious. The number of children and young people declined over the past decade, but saw some growth in the 25-44 year old age group. But, the number of 45-64 year olds who also tend to be at the peak of their earning potential and thus pay the highest taxes, declined. Not surprisingly New Mexico’s 65+ population grew faster than any other group by far.

The growth among various population groups is curious. The number of children and young people declined over the past decade, but saw some growth in the 25-44 year old age group. But, the number of 45-64 year olds who also tend to be at the peak of their earning potential and thus pay the highest taxes, declined. Not surprisingly New Mexico’s 65+ population grew faster than any other group by far.  Curiously, and unsurprisingly, migration to New Mexico was negative during the last decade. This is especially concerning because it shows that for all of its physical beauty and cultural uniqueness, New Mexico is not considered an attractive place to live by those who can choose to live anywhere in the US.

Curiously, and unsurprisingly, migration to New Mexico was negative during the last decade. This is especially concerning because it shows that for all of its physical beauty and cultural uniqueness, New Mexico is not considered an attractive place to live by those who can choose to live anywhere in the US.  Perhaps, one of the problems is that New Mexico struggles with high poverty rates? More troubling is the fact that New Mexico’s high poverty levels didn’t improve much over the last decade.

Perhaps, one of the problems is that New Mexico struggles with high poverty rates? More troubling is the fact that New Mexico’s high poverty levels didn’t improve much over the last decade.

On this week’s interview, Paul sits down with Ana Garner a New Mexico-based attorney with NM Stands Up! Garner and Gessing discuss the need for change in the way Gov. Lujan Grisham has controlled the State and its response to COVID 19.

The following appeared at National Review on May 4, 2021.

Nancy Pelosi’s majority in the House of Representatives continues to shrink. The recent swearing-in of Republican Julia Letlow of Louisiana has taken the House Democrats’ majority down to 218–212. This means that Pelosi has a mere two-vote governing majority with which to push the Biden administration’s big-government agenda.

The GOP will soon have another chance to reduce Pelosi’s margin for error when voters in New Mexico’s first congressional district (which includes Albuquerque and its environs) go to the polls to elect a replacement for Biden’s newly minted secretary of the Interior, Deb Haaland, a Democrat. Early voting begins today, while Election Day itself is June 1.

The district is classified by many in the national media as a “blue” district that should safely remain in Democratic hands, and as recently as November 2020, Haaland defeated Republican challenger Michelle Garcia Holmes by an overwhelming 58–42 percent margin. The seat was previously held by New Mexico’s current Democratic governor Michelle Lujan Grisham, and before that, now–senator Martin Heinrich, also a Democrat.

But Republicans have faced challenges in candidate recruitment in recent years in this congressional district. The last time they had a truly top-notch challenger was in 2010, when Jon Barela lost just 52–48 to Martin Heinrich, and in 2009 Heather Wilson, a Republican, held the seat, having done so for a decade. With this race being the sole topic of a special election and so much at stake in Washington, this could be a much more interesting contest than outsiders expect.

The candidates to replace Haaland could not be more different. While there is a serious independent contender and the Libertarians technically have major-party status, the Republican and Democrat contenders are state legislators with long histories of voting on important policy issues. Republican senator Mark Moores has been in the New Mexico Senate since 2013. In addition to his prior experience as a staffer for various Republican officeholders Moores played offensive line for the University of New Mexico Lobos.

Melanie Stansbury, on the other hand, was unknown in the state until she ran for the New Mexico house in 2018. Her prior political experience was in the Obama administration’s Office of Management and Budget.

The legislative track records of these two candidates are also drastically different. For starters, Stansbury strongly believes that New Mexicans should have their tax burdens increased rather dramatically.

In 2019, she voted for HB 6, which subsequently became law. Among other provisions, the bill increased taxes on auto sales, imposed taxes on Internet purchases, and increased New Mexico’s personal income tax. Ironically, this tax hike took New Mexico’s top personal income-tax rate from 4.9 percent (set by former Democratic governor Bill Richardson and the Democrat-controlled legislature) and brought it up to 5.9 percent. Moores voted against the tax hike, but it was subsequently signed into law by Governor Lujan Grisham, despite the state having a surplus in excess of $1 billion at the time.

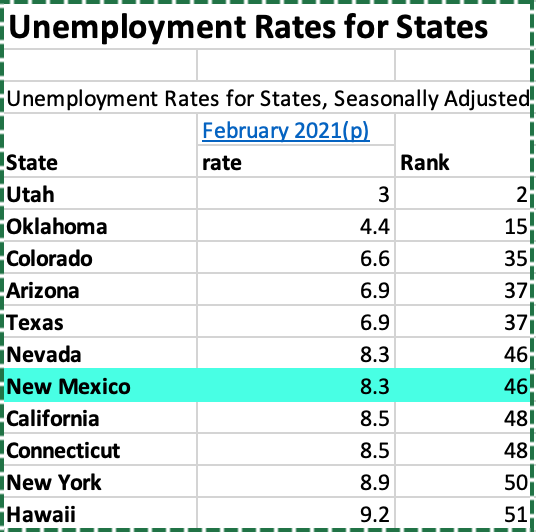

In their most recent legislative session, the New Mexico legislature was back to raising taxes, and Stansbury was more than happy to go along. Despite the COVID-19 pandemic and a state unemployment rate that remains among the worst in the nation, the combined forces of New Mexico’s resurgent oil and gas industry and the massive economic stimuli out of Washington again put the New Mexico budget comfortably in surplus territory.

Nonetheless, Stansbury and other Democrats in New Mexico’s legislature voted for and passed numerous tax hikes. HB 122, which failed after House approval, was subsequently folded into SB 317 and ultimately signed into law. Stansbury voted for the bills both times. The bills increase a tax imposed by the state on health-insurance premiums from 1 percent to 3.75 percent — a tax increase of 275 percent. Moores voted against the tax hike.

As if that were not enough to illustrate the stark difference between these candidates, Stansbury joined her Democratic colleagues in the New Mexico House to push even more egregious tax legislation in the form of HB 291. This bill which passed the House with Stansbury’s support would have again increased New Mexico’s personal income tax, this time to 6.5 percent, but (more problematically) would have revised the state’s personal income-tax structure to make the higher tax rates kick in at much lower income levels than under current law.

On top of this, the proposal Stansbury endorsed would have allowed property-tax assessments to increase by up to 10 percent annually if the property was not occupied by the owner. The current cap in New Mexico limits annual increases to the already-substantial rate of 3 percent per year. The measure was intended to target Texans with second homes in New Mexico, but it would have applied to apartment and condo dwellers as well.

Fortunately for New Mexicans, cooler heads prevailed in the (also Democrat-controlled) Senate Finance Committee, which eliminated the tax hikes from HB 291 before the bill passed into law.

These are just the tax hikes endorsed by Stansbury in her three short years in the New Mexico legislature. During her time in office, she has voted to ban local governments from enacting “Right to Work” laws on the local level, and she voted for New Mexico to abandon the Electoral College, saying instead that it should dedicate its five electoral votes to whatever candidate won the popular vote. The latter would have dramatically diminished what influence small-population New Mexico has in presidential races for no benefit aside from her ideology.

Stansbury is a true big-government radical. Her advocacy of big government in the New Mexico legislature places her to the left of Nancy Pelosi. At a time when every race matters in a closely divided U.S. House, conservatives cannot ignore this special election in a “blue” but winnable district.

The Rio Grande Foundation and New Mexico Business Coalition are among the organizations that have raised the alarm about “enhanced” unemployment benefits and how they are a big factor making it less attractive for workers to find employment than to remain out of the work force.

Albuquerque Mayor Tim Keller recently said that the City would “hold jobs for people until their unemployment runs out.”

You can see a story Channel 7 KOAT TV did on the issue below:

On this week’s podcast interview Paul sits down with David Clements. A libertarian-leaning law professor at New Mexico State University, David once ran for US Senate as a Republican, but he (like Paul) was not necessarily a fan of President Trump in his run for the White House in 2016.

Clements not only had a change of heart during Trump’s time in office, but he has actively engaged in tracking down many problems and issues with the 2020 election. David has also spoken out publicly against “critical race theory” and efforts to stifle free speech in the halls of academia. Don’t miss this timely and informative interview! You can find out more about David and his numerous interviews and discussions at: https://www.theprofessorsrecord.com.

Golf was always a safe activity throughout COVID 19. We said as much in EARLY April of 2020. That didn’t stop Gov. Lujan Grisham from shutting courses down on March 20, 2020 and again shutting them down for two weeks in November.

The truth is outdoor activities were NEVER dangerous and scientists have acknowledged that.

The picture below was taken on May 1, 2020 at Paradise Hills Golf Course. Unfortunately, even under the Gov.’s latest orders (unless they change) when my daughter attends a golf camp this summer she’ll be forced to wear a mask OUTSIDE. Of course, golf is a relatively low-impact sport, other student athletes like cross country runners will continue to face mask requirements for no good reason. Gov. Lujan Grisham CONTINUES to not follow the science.

KOB TV Channel 4’s Chris Ramirez recently sat down with CD 1 Congressional candidate Melanie Stansbury. Interestingly enough she says that turning around New Mexico’s economy is a top priority. Set aside what she can do about this issue, it is hard to square her economic concerns with her votes in the New Mexico Legislature.

See the postcards below, but note that she voted for a major tax hike (HB 6) in 2019 and three times in 2021 including TWICE for a tax hike on health insurance in 2021: HB 122 and SB 317 and HB 291 which would have raised income taxes and allowed for massive property tax hikes.

Contact Sarah directly at the email address below for more information:

Gov. Lujan Grisham has AGAIN altered her deeply-flawed COVID reopening plans. The good news is that she has “liberalized” the county rules so most counties will be in green or turquoise by this Friday. Also, masks will no longer be required outdoors which is a good thing.

Finally, the state will lift most restrictions, including capacity restrictions, when it hits 60 percent of those age 16 or older who are vaccinated, which the state projects will happen by the end of June.

NM is maintaining it’s requirement for masks during youth sports specifically because children are not eligible to be vaccinated. That’s an abomination.

This is mostly good news, but the fact that we’ve seen yet another massive change to the playing field is a pretty strong indicator that science is not driving the process. Of course we knew that already, but it is important to know and remind people that the new rules are just as arbitrary as the old ones, even if the new ones are a bit better.

For better or worse the virus itself is no longer the issue. The Gov. is pushing vaccination.

The list of awful New Mexico legislators is a long one. You can find more about Rep. McQueen and his big-government voting record here.

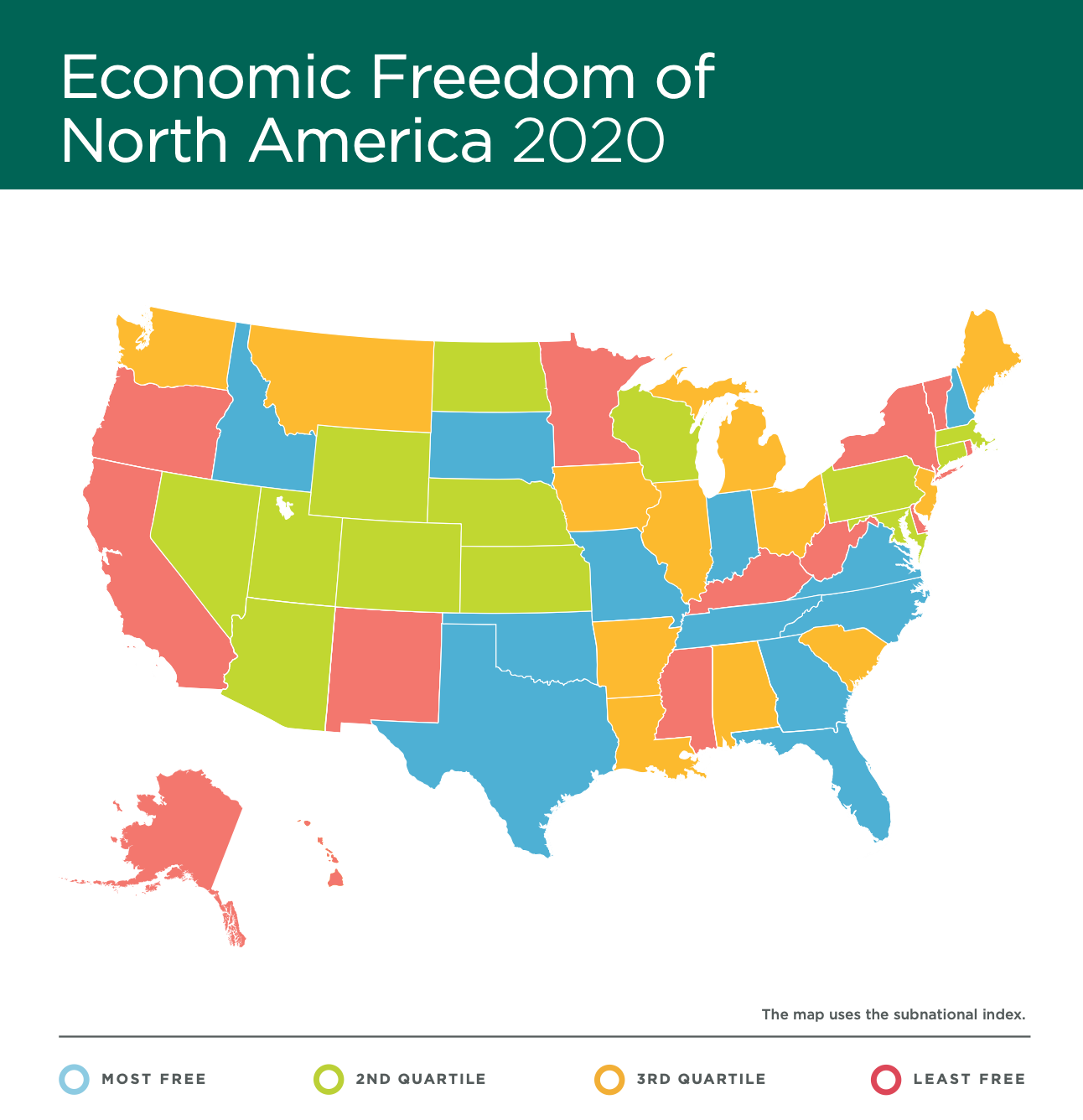

When the House GOP took to Twitter to rightfully point out that New Mexico remains a donut hole of bad economic policy in the American Southwest, Rep. McQueen responded with a Tweet of his own blaming none other than Susana Martinez for the last decade’s failings. Of course, New Mexico ALSO has one of the highest unemployment rates in the US. I’m sure Susana Martinez can be blamed for that as well.

McQueen is a sitting member of the New Mexico House. Does he not know who makes the laws in our State? (Hint, it’s the Legislature).

I wonder who was Governor most of the last decade? 🤔 pic.twitter.com/WTdFepdMgN

— Matthew McQueen (@mcqueenfornm) April 28, 2021

The local business community is small and often reliant on the federal government. Thus, when it comes to big policy issues they have a long history of getting pushed around.

But sometimes bad decisions and self-inflicted policies lead to bad results. Take the latest push for yet another tax hike on local lodgers being pushed by…local lodgers. The idea behind the tax is for the City to use the funds generated to market the City and its attractions to drum up business. Why this couldn’t be done by interested local hoteliers directly instead of using the City to force others to “play ball” by imposing a tax is lost on me.

More importantly, it’s as if the folks at Visit Albuquerque haven’t got memories. Do these people not remember late 2019 (way back in pre-pandemic times) when Mayor Keller used the money generated by the hotel tax for all kinds of non-tourism priorities?

As Pete Dinelli notes in his blog post above, the Mayor’s “sports tourism” uses of the lodgers’ tax money wasn’t exactly geared toward actual tourism:

• $10 million to improve Los Altos Park, including new softball fields, a BMX pump track and concession improvements.

• $3.5 million for a soccer complex

• $3.5 million for the Jennifer Riordan Spark Kindness Complex (a West Side baseball venue formerly known as the Albuquerque Regional Sports Complex).

• $2.5 million to buy property for balloon landing sites.

• $2.5 million to replace the city’s 16-year-old indoor track currently used by the University of New Mexico and for track and field competitions.

• $2 million for a “multiuse trail” linking East Downtown to Downtown.

• $1 million for Isotopes Park upgrades, such as netting and field improvements. The Isotopes Park upgrades include nets to protect young children and families during games and field improvements to provide for an easier transition from baseball to other uses including concerts.

• $500,000 for a “Northwest Mesa gateway.”

Here’s some unsolicited advice for the folks at Visit Albuquerque: if you want it done right, do it yourself. Don’t impose another tax on your customers only to have that money spent on projects that are only tangential at best to generating tourism.

UPDATE: According to the folks at Visit Albuquerque THIS money will be under control of the non-profit that manages the tourism campaign. We’d vastly prefer this effort NOT involve government and taxation, but perhaps this particular program will not fall prey to government.

New Mexico’s public colleges and universities are required to provide various public records. Unfortunately the process of requesting many of those records is onerous. That’s where the Rio Grande Foundation comes in.

We have requested, received, and published public payroll records and contracts for the relevant school leaders of each school for most of New Mexico’s colleges and universities. You can find that information here.

To their credit, University of New Mexico publishes its payroll records here.

On this week’s podcast conversation Paul and Wally discuss:

Albuquerque Public Schools enrollment continues to plummet and, with COVID 19 this past year more families than ever are choosing to pay for private alternatives, home school their kids, or make the difficult and expensive decision to leave the District entirely.

While the District cries to the media about how much money they stand to lose due to all the students fleeing the District, thanks to federal stimuli, state budget largesse, AND those students leaving, the District will likely see per-pupil spending skyrocket in the next few years.

Already APS spent an astonishing $18,594 annually per student during the school year prior to the Pandemic (you can find APS’ 2019-2020 budget here). Below are charts pulled directly from the budget to illustrate the point: Divide the total budget $1,475,755,646 by the student population of 79,363 to get: $18,594 spent annually per student.

APS spends a lot of money for terrible results. It is getting even more money from state and federal sources in the years ahead. Sorry Nelly, It must (not) be about the money.

The following chart from APS says a lot about the State of the District itself, but also about the stagnant population of New Mexico which is seeing overall declines in the number of young residents.

The REAL student population declined by 5,200 (including two students in the Gessing household) but the media helpfully attributed “only” 4,000 of that decline to COVID. Of course, even that is an oversimplification as many students (including ours) left the District because of the State’s political handling of COVID, not COVID itself.

Oddly enough, APS which will likely see further per-pupil budget increases managed to whine about the budget impact of the number of students fleeing their schools. There is no public discussion of allowing the money to follow the students.

Furthermore, this drop was hardly unexpected. If the APS School Board was interested in turning this sorry situation around, perhaps they should have added some kind of incentive to that effect to his contract.

While Americans continue to (generally) move South and West, New Mexico sticks out as a bastion of slow population growth among its fast-growing neighbors. It is hardly surprising that the charts (population growth from the US Census and Economic Freedom from the Fraser Institute) below match up rather well.

After all, while Americans obviously like warm weather and the beauty of the American West they also need employment and don’t usually want to pay high taxes. Needless to say the list of wants can become quite long but the aforementioned are SOME of the major factors in recent population shifts.

Recently, a letter-writer wrote in to the Santa Fe New Mexican in response to an RGF commentary to make the following statement: (Gessing’s) charge that

“New Mexico Democrats have controlled the Legislature for years” has no merit until the recent contests that turned out five conservative senators who were Democrats In Name Only. If Gessing has been disappointed in what Democrats could do while former Sen. John Arthur Smith barred the way to real reform, hold your breath, Paul. Change for the better is coming through.”

Here is a chart RGF put together illustrating that fact which is also below.

Was Sen. John Arthur Smith really a “conservative?” On the issues RGF cares about there has been little in the way of “conservative” Democrat influence in Santa Fe from John Arthur Smith or anyone else on the Democratic side of the aisle.

Back in 2015 then-Gov. Susana Martinez needed a mere three Senate votes to get a “Right to Work” law in New Mexico. Did John Arthur Smith vote for it? No. No Senate Democrats stepped up to vote for Right to Work.

In 2019 with a $1 billion surplus and as Chair of the powerful Sen. Finance Committee Smith supported a massive tax hike (HB 6). That same year Smith supported an 11% single-year budget increase. We could go on.

True, Smith opposed tapping the Land Grant Permanent Fund, was (perhaps) a moderate on abortion/life issues, and opposed marijuana legalization, but those hardly make him a “conservative” or a closet Republican.

And, while Smith and others have had some sway in New Mexico’s Legislature over the 91 years of Democrat dominance, the fact remains that New Mexico has been dominated by Democrat policymakers for nearly 100 years now. Our rankings as having the worst performing education system and being the most federally-dependent state in the nation must be considered part of that legacy of single-party rule.

The following appeared in the Las Cruces Sun News on Sunday, April 25, 2021

The City Council of Las Cruces is considering a ban on plastic bags, specifically those bags which are thinner than 2.25 millimeters thick. Restaurants may or may not be exempted from the statute, but banning plastic bags is not a viable solution to our solid waste challenges.

In fact, nearly all cities around the country and State of New Mexico including Albuquerque put their bag bans on hold for the duration of the COVID 19 pandemic. Albuquerque’s ban remains in place with no return date set.

Furthermore, while curbing the use of thin bags may seem like a reasonable policy, stores simply replace thin bags with thicker plastic bags as was done in Albuquerque. That shift led Albuquerque City councilor Pat Davis to say that he wanted to amend the City’s bag ban to also get rid of plastic bags that are thicker than 2.25 thousandths of an inch. The thicker bags were exempted from the law for the simple reason they are considered “reusable,” but Davis called the provision a “loophole.”

This discussion was going on in early March of 2020 which thankfully means it was never adopted. And, while the Centers for Disease Control has said that surface transmission of COVID 19 is extremely rare, that does not mean that banning plastic bags is a good thing for public health.

A 2018 report from Loma Linda University used data from an experiment in which researchers purposely “contaminated” a reusable bag with a harmless form of a virus. A single shopper then went through a typical grocery store, and the research team tracked the spread of the virus.

Quoting directly from the executive summary of the report, “The data show that MS2 (virus) spread to all surfaces touched by the shopper; the highest concentration occurred on the shopper’s hands, the checkout stand, and the clerk’s hands.”

Additionally in 2012 epidemiologists from the Oregon Public Health Division and Oregon Health & Science University published a peer reviewed article in the Journal of Infections Disease that documented a reusable grocery bag was the point source in an actual virus outbreak in the Pacific Northwest.

For years, people have simply believed that people will wash their bags. But Loma Linda researchers found only 3% of bags get washed. That rate may be better post-COVID than it was before, but there is also a diminished environmental benefit to reusable bags – especially in our desert environment – if they have to be washed regularly.

Instead of the City of Las Cruces micromanaging consumers’ use of plastic bags, I recommend that residents concerned with plastic pollution recycle or reuse their plastic bags instead. Plastic bag recycling programs with bins outside of local big box stores seem to have been one of the many casualties of the pandemic. Hopefully these programs return soon.

Until then, the bags make great trash can liners and can be used to pick up pet waste. I take along a bag or two on my walks and use them to clean up the neighborhood by picking up trash or aluminum cans along the way.

This final point really highlights the need for individual responsibility. Plastic bags are what you make of them. Government mandates can’t make us “green,” rather it is our responsibility to be good stewards of the environment around us. There will always be “loopholes” in laws such as the thickness of the plastic bags handed out at stores. For good reasons restaurants also need plastic bags and other utensils.

If you don’t want or need a bag, you are the customer and can refuse them or bring your own reusable bags. Don’t force your views on those of us who are responsible and repurpose these bags for useful, even “green” purposes.

The Rio Grande Foundation is an independent, non-partisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility.

On this week’s podcast interview Paul sits down with Michael Johnson to discuss energy reliability both in Texas AND New Mexico.

Recently Texas suffered from serious energy reliability failures, but a decade ago many New Mexicans went without natural gas for days during one of the coldest times in recent memory. Michael Johnson is a New Mexican. He wrote the definitive report on what happened in New Mexico a decade ago.

Johnson, a member of ERCOT for several years in the ’90s, has also studied what happened in Texas and what caused the recent outages.

Johnson’s experience includes serving as the CEO of Conoco Gas and Power, the midstream business of Conoco Inc., and early 2000s, he was also Chairman of the Natural Gas Supply Association headquartered in DC for several years over the same period, which represents large natural gas producers.

In another installment in what has already been a big week for COVID science, the New York Times published the following which essentially debunks the case for mask wearing outdoors. Despite the lack of scientific justification for them Gov. Lujan Grisham continues to mandate masks for outdoor usage including student-athletes. The following is cut-and-pasted directly from the paper’s “Morning Briefing” April 22nd, 2021.

Of course outdoor mask wearing DOES have significant virtue-signaling implications.

On the latest Tipping Point New Mexico Paul discusses the fact that the CDC has now confirmed that he was correct in questioning “surface spread” of COVID over a year ago. Last year at this time Mayor Keller shut down Albuquerque playgrounds and parks. Paul and his family did not obey these restrictions and were criticized for it at the time.

NM has high unemployment and yet businesses can’t find workersbecause too many are getting checks for doing nothing.

Some “blue” states are making COVID rules permanent. Paul is concerned this could happen in New Mexico.

Scott Elder has a brand new contract at APS. Paul and Wally discuss the particulars and problems with the contract.

A new report finds the US Department of Interior (headed by Deb Haaland of New Mexico) is shortchanging NM on conservation funding.

The Biden Administration wants another $2 trillion “Stimulus” infrastructure via the so-called “American Jobs Plan.” Paul discusses the fact that most of the money Biden wants to spend in the bill is not infrastructure-related. He also outlines a few policy changes that COULD be addressed if Biden actually wanted to improve infrastructure in the US.