The following appeared in the Santa Fe New Mexican on Sunday, September 22nd, 2024

![]()

Like clockwork, every presidential election we see a new set of attacks on the Electoral College. The Electoral College is the system by which the United States has elected every president since the founding. As you may be aware, the Electoral College was the result of compromise among the Founding Fathers to resolve conflicting interests among the colonies that ultimately agreed to adopt the U.S. Constitution, thus becoming the first 13 American states under the Constitution.

While the Electoral College has several components, the most salient to voters is the fact that instead of a popular vote, each state’s overall influence is calculated based in part on population and in part on simply being a U.S. state. New Mexico receives five votes in the Electoral College (of 538 in total) because it has two U.S. senators and three representatives in the House. California has 54 electoral votes for its 52 members of Congress and two senators, while Texas has 40 electoral votes for its 38 members of Congress and two senators.

Of course, a state’s total number of House members is based on population while every state has two U.S. senators. In other words, states’ influence over who wins the presidency is based heavily on population, but with extra weight given to those states that, like New Mexico, have smaller populations.

There are numerous benefits to this approach that may not be apparent to the average voter.

- Candidates need to appeal to voters across the nation, not just in a few heavily populated areas.

- While there is no fail-safe solution to voter fraud, the Electoral College reduces the potential for such harm by containing it in a few “swing” states. Politicians in California or Texas can’t manipulate the process to “run up” vote totals for their preferred candidates.

- While recent rule changes (like mail-in voting) in some states have created problems in this regard, voters have a much clearer understanding of who wins the presidential election sooner than they would in a national popular vote where every vote nationwide must be accounted for to declare a winner (in a close race).

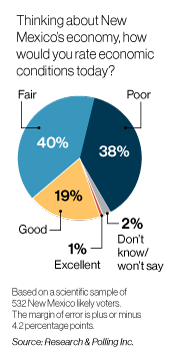

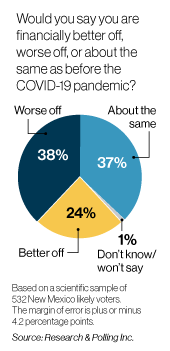

These are all good reasons to stick with the Electoral College, but there is another: New Mexico is a small state when it comes to population. And, while it has moved dramatically to the left (having become reliably “blue” in recent years), it wasn’t long ago that New Mexico was considered a swing state in presidential politics. Candidates from both parties visited the Land of Enchantment because our five votes in the Electoral College made a difference.

New Mexico is more likely to see interest among presidential candidates under the Electoral College.

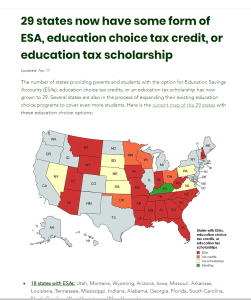

Sadly, while the Electoral College shows no signs of being discarded, New Mexico is one of 16 states dominated by Democrats who have adopted legislation to abolish the Electoral College.

Fortunately, outside of New Mexico and these other reliably “blue” states, momentum to ditch the Electoral College has gained little traction.

In the run-up to Election Day, the Rio Grande Foundation is hosting events to further educate New Mexicans on the merits of the Electoral College. Trent England is the head of Save Our States. The organization’s mission is to defend the Electoral College and to make the case for constitutional federalism. England will be speaking at an event sponsored by the Rio Grande Foundation in Clovis on the evening of Oct. 2 and in Albuquerque at a luncheon Oct 6. More information including time, location and price is available at riograndefoundation.org/events.