Take a minute to comment on New Mexico’s strategic plan

07.29.2024

At Rio Grande Foundation we plan for the future. We’re sure you do also. Thankfully, we probably do a much better job with our plans than the State. We encourage you to weigh in here on the State of New Mexico’s strategic plan. You have until August 31. It takes less than 5 minutes.

The Economic Development Department does a decent job of laying out six challenge areas which we have listed below (you can read about them in the full plan available here):

1. Lack of collaboration between economic development stakeholders

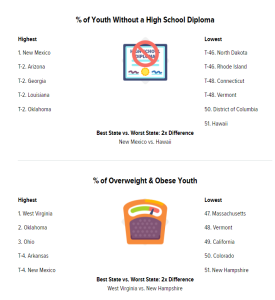

2. Difficulty attracting and retaining talent in urban, rural, and tribal communities

3. Misalignment between higher education and industry

4. Disengagement of socioeconomically disadvantaged communities in

planning processes

5. Public-sector dominance in New Mexico’s innovation ecosystem

6. Concentration of economy in a few key industries

It is hard to argue with them and we have made many points similar to those listed above. But, as usual, the solutions are lacking. What are OUR solutions? We don’t have much faith in state-driven economic development. We don’t know what the “next big thing” will be (and our politicians are MORE clueless and much more politically motivated to choose their own preferred industries).

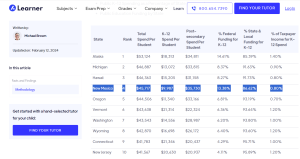

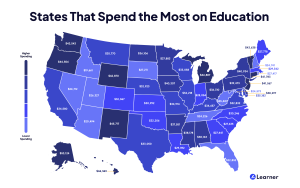

What we know is that New Mexico’s tax structure stinks. The gross receipts tax is an unparalleled jobs and economic growth killer. It needs to be made into a sales tax immediately. Our income tax is an obstacle to growth and economic productivity and should be eliminated as well. Our education system is a disaster and needs to be reformed with a healthy dose of school choice and accountability. Finally, unforced errors like EV mandates, the costly Energy Transition Act, and New Mexico should embrace “Right to Work” and get rid of its costly “Davis-Bacon” prevailing wage law.

If those policies were embraced in Santa Fe by the Legislature and Gov. we’d break through many of the “challenge” areas outlined above, but that would require politicians to stop favoring those who fund their campaigns rather than New Mexicans as a whole.

Again, take a minute and submit your comments to the Economic Development Department here.

Note, I had an issue submitting the form in Google Chrome, but it worked in Internet Explorer.

Our specific comments are below:

The State’s strategic plan makes many important points about challenges facing New Mexico. Sadly, government economic development officials have a terrible track record of predicting future trends and attracting businesses that will be successful. Instead, government should focus on basic economic reforms.

The gross receipts tax is an unparalleled jobs and economic growth killer. It needs to be made into a sales tax immediately. Our income tax is an obstacle to growth and economic productivity and should be eliminated as well. Our education system is a disaster and needs to be reformed with a healthy dose of school choice and accountability. Finally, unforced errors like EV mandates, the costly Energy Transition Act, and New Mexico should embrace “Right to Work” and get rid of its costly “Davis-Bacon” prevailing wage law.