Occasionally, the evening news reports on people keeping more animals than they can handle. Other times, children of deceased parents are astonished by how much “stuff” their parents or grandparents hang on to only to leave piles of unwanted things to be thrown out.

The state of New Mexico is a hoarder. It hoards cash. One might think this is a good thing because, after all, isn’t keeping cash for a “rainy day” (such as a downturn in oil and gas) a good thing?

Not really. Government is not an individual. People work and save for a future when we cannot work anymore. Government “lives” forever, and massive pots of money under government control do not serve the interests of its citizens.

In fact, basic metrics associated with New Mexico have failed to improve after a decadelong oil and gas revenue boom that has largely fueled government spending and “saving.”

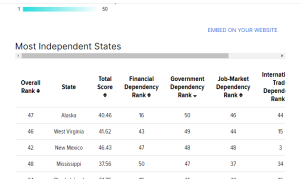

- New Mexicans suffer the third highest poverty rate among U.S. states.

- Our crime rate is among the very highest in the nation while our education outcomes are among the very worst.

- New Mexico remains mired in 50th (last place) in the Kids Count index.

- There are zero Fortune 500 companies headquartered in New Mexico.

- Our basic infrastructure (including roads like Interstate 40) is deteriorating.

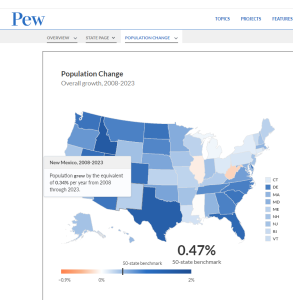

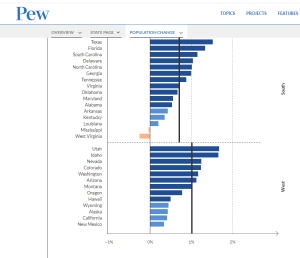

- New Mexico’s population is aging fast while overall population growth is the slowest in the American West.

At the beginning of 2024, New Mexico’s various permanent funds managed by the State Investment Council were valued at a whopping $50 billion. That is the third-largest fund among U.S. states and among the largest in the world. Thanks to its arcane capital outlay process, the state has an additional $4.5 billion sitting unspent in various capital outlay accounts.

And, of course, the last two years, New Mexico has had $3.5 billion annual budget surpluses. The oil and gas boom generating those surpluses shows no signs of slowing down. In fact, it was just announced that oil and gas brought in a mind-blowing $15.2 billion in fiscal year 2023 alone.

Rather than hoarding cash, New Mexico should return a bulk of the money to its people and businesses in the form of significant reductions to gross receipts and personal income taxes while corporate, capital gains and Social Security taxes could all be eliminated with ease. Government programs have failed to solve our social ills. It is time for a different approach.

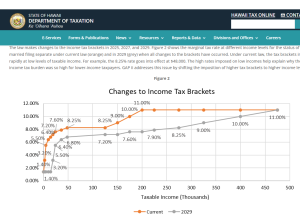

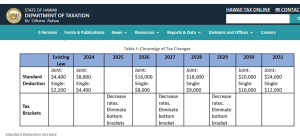

Even “blue-state” Hawaii just embraced bold tax reforms by dramatically reducing income tax burdens in the Aloha State. If Hawaii’s Democrats (operating without the benefit of oil and gas revenues) can embark upon serious tax reform, New Mexico certainly can when blessed by a massive oil and gas bounty.

In recent years, New Mexico has spent amply and even tapped into its permanent funds to address the state’s serious issues through new spending. That has failed miserably. The Legislative Finance Committee has stated that the $10 billion spent annually on welfare programs to fight poverty has not moved the needle.

The size of New Mexico’s surplus this coming year is unknown, but it will be large, even as state spending continues to rise rapidly. New Mexico should stop hoarding our money and instead return it to the people of New Mexico.

There are also rate reductions to Hawaii’s income tax although the top rate of 11% is far too high (at least fewer people will be paying it). Hawaii’s tax reform is not perfect. It is highly progressive, but it is MUCH better than nothing or the slight tax reductions we’ve seen since the oil boom really kicked into gear.

There are also rate reductions to Hawaii’s income tax although the top rate of 11% is far too high (at least fewer people will be paying it). Hawaii’s tax reform is not perfect. It is highly progressive, but it is MUCH better than nothing or the slight tax reductions we’ve seen since the oil boom really kicked into gear.