A slightly shortened version of this opinion piece was published in the Albuquerque Journal on March 20, 2022. A chart illustrating Albuquerque’s spending is found below the text.

Elections have consequences. After four years of “progressive” leadership by Mayor Keller and a left leaning city council, the election of November 2020 saw a more center-right Council. While much attention was given to the fact that Tim Keller was reelected by a wide margin despite the City’s spiraling crime problem, Albuquerque voters didn’t actually vote for the status quo.

Now, we are starting to see a shift toward a more moderate approach to the issues from City Council. Better legislative proposals are in the pipeline, but with a 5-4 majority and a hostile mayor, getting these ideas past the finish line will be a challenge requiring grassroots support.

A starting point is reducing gross receipts taxes. Back in 2018, shortly after taking office, Mayor Keller and the new “progressive” council majority raised the (regressive) GRT by 3/8th of a cent. This was a major tax increase considering that the City’s overall GRT “take” before the tax hike was 2.375%. That made Keller’s tax hike a nearly 9% increase in Albuquerque’s rate.

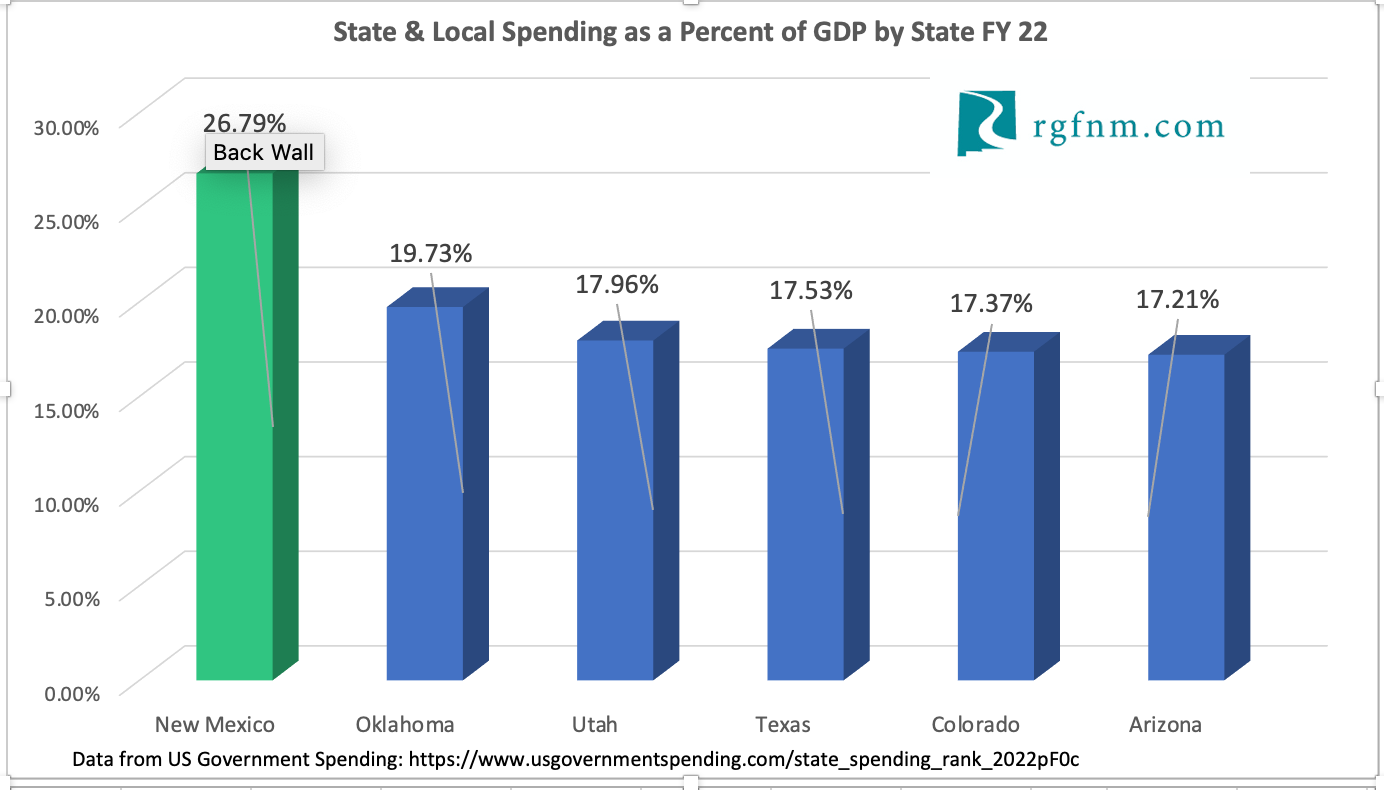

And, not surprisingly, that tax increased led to rapid spending growth in the City’s budget. Even when the annual budget freeze in the 2021 budget due to COVID 19 is included, the City’s budget is up 27 percent under Mayor Keller.

Unfortunately, when the City Council met recently to discuss Councilor Lewis’ plan to cut just 1/8th of a cent off the GRT (not the full amount added in 2018), Keller’s Chief Financial Officer Sanjay Bhakta claimed “this is the worst time possible” to cut taxes.

Considering that, among numerous other wasteful spending programs, the City has just undertaken a $3 million plan to make City buses “free” to riders (that’s on top of millions in annual transit subsidies), it would seem the City could do something to help residents who continue to be pummeled by rising inflation. Unfortunately, it seems that Mayor Keller and his Administration remain opposed to this reasonable tax reduction.

There are other exciting efforts underway to move Albuquerque in a more pro-freedom direction. The big question is whether Keller will stand in the way of everything or if he’ll choose his battles. For example, Councilor Bassan has proposed ending the City’s plastic bag ban which recently passed City Council.

The unnecessary and environmentally irrelevant ban on plastic bags makes daily life more difficult for thousands of Albuquerque residents. Those bags are often reused and can be recycled. They are hardly the environmental problem their opponents claim. According to Our World in Data, the entire continent of North America generates less than 1 percent of the “mismanaged plastic” on the planet.

If Keller and City Council really want to address the City’s serious litter problem, the legions of transients begging on street corners, camping throughout town, and leaving trash behind wherever they go would be a better place to start.

While a number of other important issues are being discussed at City Council that, if adopted, will move our City in a positive direction, no effort highlights the ideological shift better than the effort to restore market forces in public construction projects. Immediately after the 2020 election, a bill was rammed through Council by liberals and the trade unions to mandate that public construction projects use union labor.

Estimates are that such unfair laws called “Project Labor Agreements” boost taxpayer costs by 14 percent. A bill is now working its way through the current Council to repeal that law and instead allow all workers and contractors regardless of union membership to bid for city construction projects.

Albuquerque is a great and beautiful city, but its management has left a lot to be desired in recent years. The current City Council is standing up to big government and special interests. They deserve your support.

Paul Gessing is president of New Mexico’s Rio Grande Foundation. The Rio Grande Foundation is an independent, nonpartisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility