The following appeared in the Las Cruces Sun News on Sunday, March 28, 2021. UPDATE: Originally the article stated there was a production moratorium on federal lands. There is “only” a moratorium on new permits.

New Mexico is in one of the most unusual economic times in its history. Profound forces have impacted our State over the last year in unforeseen ways.

-

- The Gov. and COVID shut down much of our State for much of the past year. COVID is declining, but New Mexico remains among the most locked-down states in the nation;

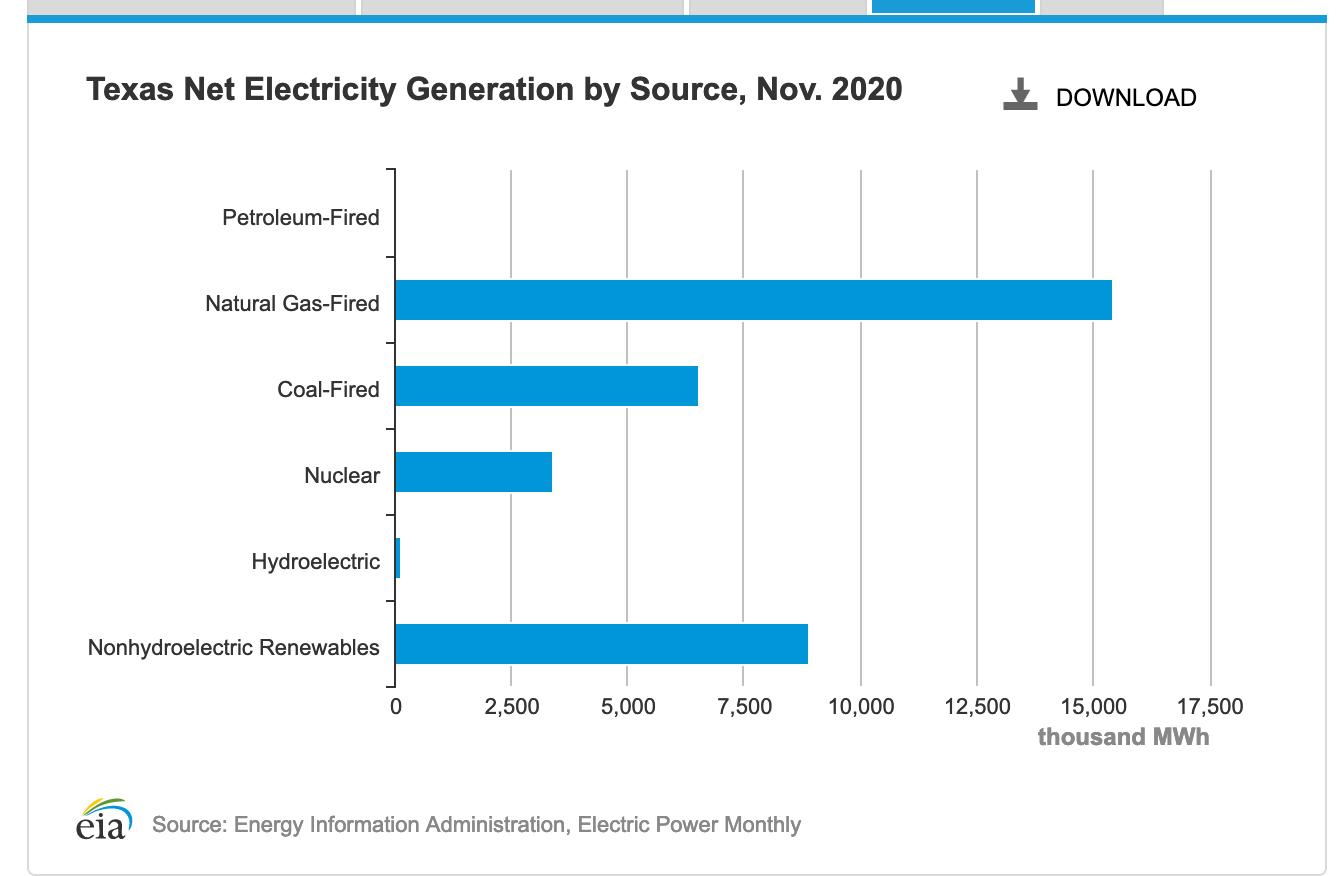

- Oil and gas prices plummeted last April due to the pandemic and an international price war, but have come roaring back and produced $300 million in “new” money and a budget surplus;

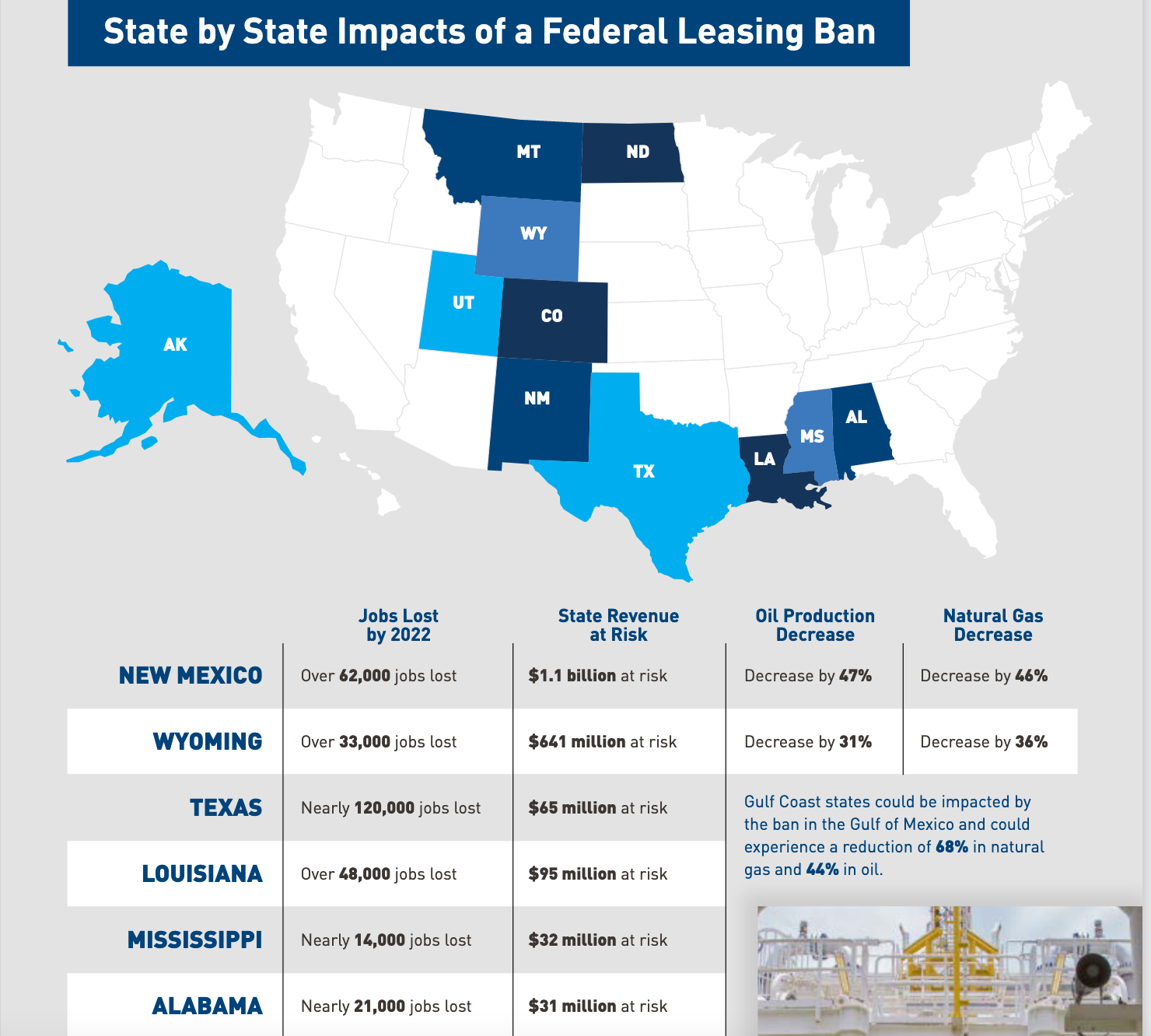

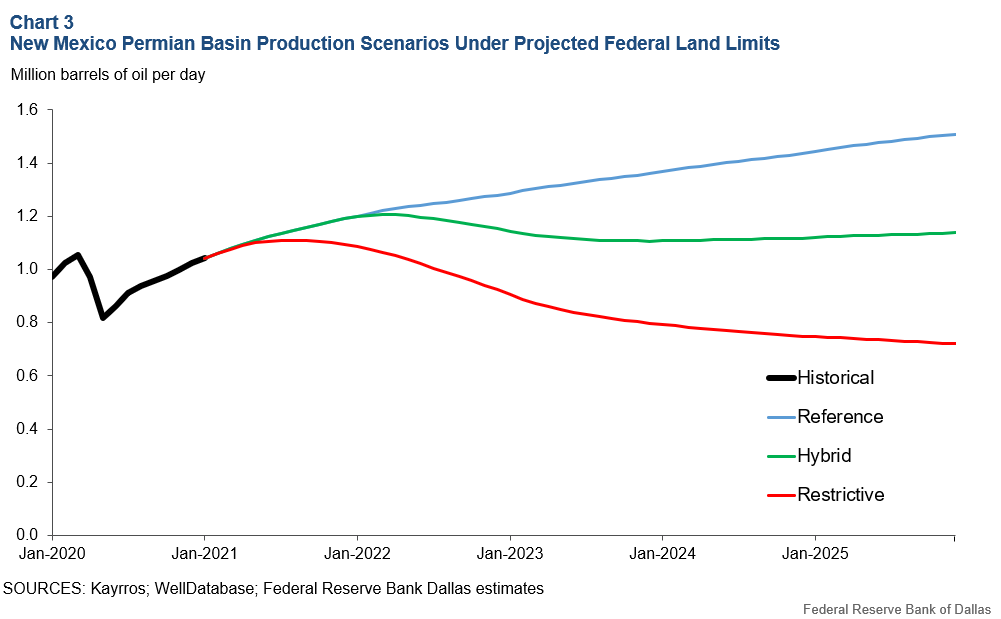

- Democrats in Washington recently passed a $1.9 trillion dollar “stimulus” that will dump an astounding $9 billion on New Mexico State and local governments. Meanwhile the Administration’s moratorium on oil and gas permits on federal lands will cost our State more than $700 million over the next few years according to Gov. Lujan Grisham;

- While New Mexico governments are awash in money, businesses are struggling to recover. The State’s unemployment rate is 8.7 percent, 4th-worst in the nation.

To say we are living through unpredictable times would be an understatement. Oil and gas have always been volatile but are now more unpredictable than ever. This reflects broader economic uncertainty, but with the Biden Administration targeting the Industry, the Legislature must diversify our economy (this does not mean simply new sources of government revenue).

The unprecedented stream of federal spending flowing into our state is currently augmented by a flow of people. Housing markets are tight in most of our cities as Americans from big, expensive, states like California embrace remote work or simply move to states like New Mexico where they can spread out and buy a house for a lot less money.

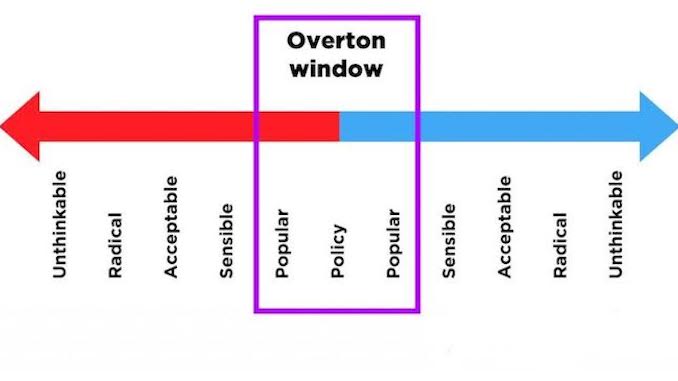

Current trends are favorable, but long-term economic prosperity requires enacting policies that make the State more attractive as a business destination. The 2021 Legislature had a few successes but ultimately failed to enact policies that will bring long-term prosperity to New Mexico.

Despite a big budget surplus, the Legislature raised taxes on health insurance (SB 317). They imposed a new sick leave mandate on businesses, including small ones (HB 20). And, passage of HB 4, the misnamed “Civil Rights Act” will impose massive new legal costs on New Mexico governments without actually improving policing or protecting civil rights.

There were bright spots. HB 255 reformed New Mexico’s liquor licensing to make it easier for bars and restaurants long-term. HB 177 passed which allows New Mexicans to start micro-businesses by making non-perishable food items in their homes for sale.

But the gross receipts tax and its taxation of busines inputs and services remains a stumbling block for businesses. New Mexico also remains among a relatively small group of states that tax Social Security. No significant tax cuts or reforms were adopted. Also, no widespread reform of burdensome regulations (like the State’s “prevailing wage” law that artificially increases costs on public works) projects was enacted.

Some will argue that (after a decade of trying) tapping the Permanent fund to boost various education programs will help improve our workforce, but the track record of governments (including New Mexico’s) spending more money to boost education outcomes is spotty at best. Empowering parents and families with the resources needed to choose the educational option that is right for them (especially after a year of Zoom education), is more likely to succeed and at a fraction of the cost, but legislation to that effect was quickly defeated this session.

Microchip manufacturer Intel just announced that it is investing $20 billion in neighboring Arizona to build two new facilities. Such “economic diversification” is exactly what we need and what the Gov. and Legislature claim to want. Until the Legislature gets serious about reforming our economy we’ll continue riding the wave of luck, boom and bust in the oil patch, and Washington debt.

Paul Gessing is president of New Mexico’s Rio Grande Foundation. The Rio Grande Foundation is an independent, nonpartisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility

/s3.amazonaws.com/arc-wordpress-client-uploads/sfr/wp-content/uploads/2018/11/13185658/News2-SB-MAIN-Pot-Round-House.jpg)