The following appeared at National Review’s website on December 25, 2020

We have known for decades the extent to which progressives dominate Hollywood. In the age of social media, Hollywood celebrities waste no opportunity to show that they stand with the poor, the downtrodden, and the righteous. But they have a way of showing themselves up as the hypocrites we already know that they are.

Let’s start with “fracking.” Fact: a few years ago, more than 100 Hollywood A-listers signed on to an effort under the banner of Artists Against Fracking to ban hydraulic fracturing. Yet it’s no secret that many of Hollywood’s numerous well-heeled opponents of “fracking” have something of a weakness for private planes and, even in their humbler moments, for large SUVs. It’s not much of an exaggeration to think that some of them probably gobble up more energy in a day than average Americans do in weeks.

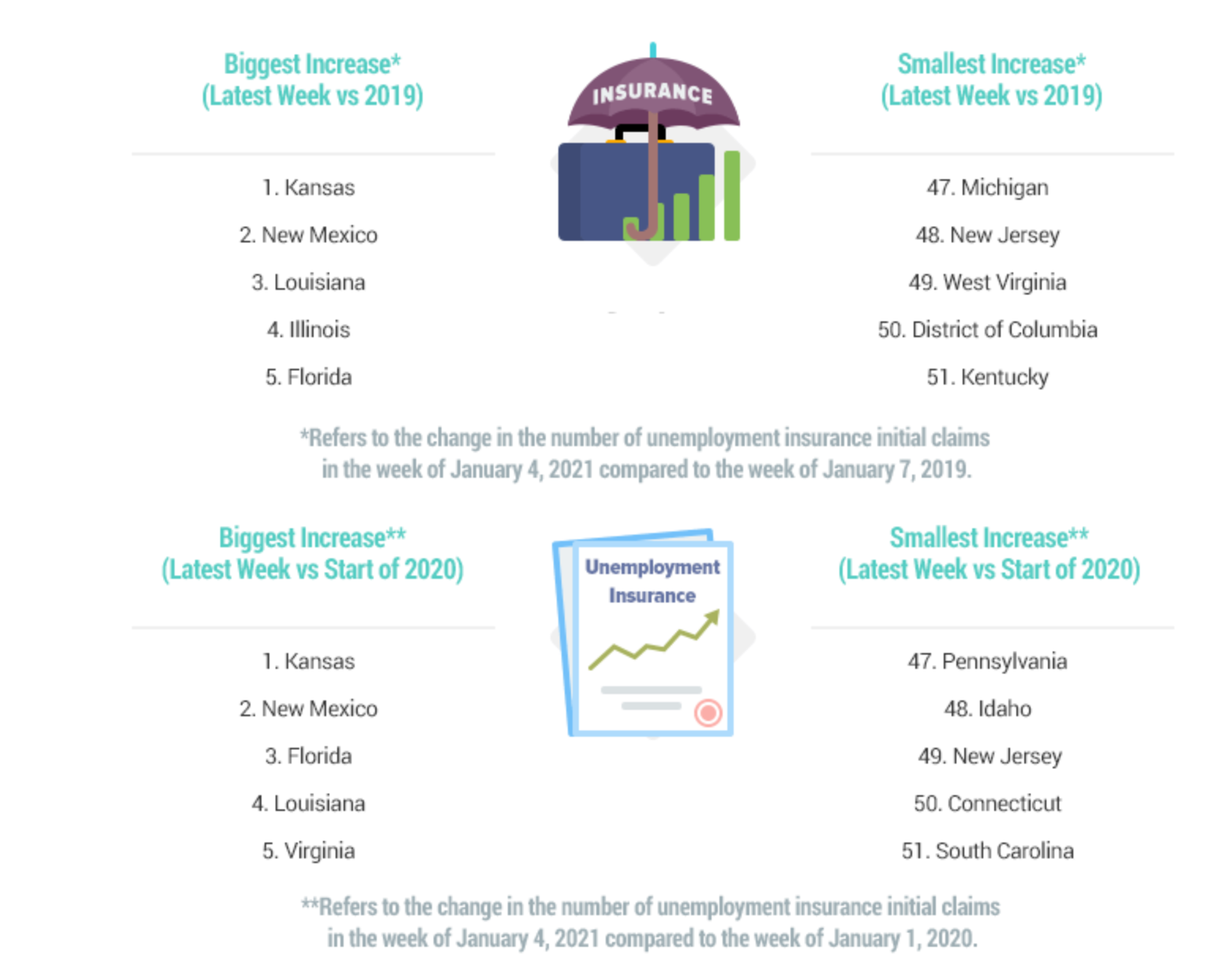

But without hydraulic-fracturing technology, oil and gas production in my home state of New Mexico would almost completely dry up. This industry has made New Mexico a major energy producer, a crucial source of revenue and jobs for a state widely recognized as one of the poorest in the country. Fracking has safely opened massive new energy deposits with production concentrated in the Permian Basin, located in southeast New Mexico and shared with Texas. In fact, New Mexico is the third-largest oil-producing state, with over 1 million barrels per day at the end of 2019. One-third of the state’s entire budget is generated by the industry.

Too bad. If the nation follows the advice of Hollywood’s anti-fracking activists, a poor state and its poor residents will be denied the benefits of an important natural resource and simply go without. While fracking remains legal (for now) in New Mexico, Hollywood’s hypocrisy goes far beyond merely advocating against this technology: some of its leading companies have found a way to suck up tax revenues right here in New Mexico that would otherwise be spent on public schools, health care, and other government services.

In an effort to attain the glitz and glamour of Hollywood, New Mexico’s liberal politicians are handing out some of the most generous subsidies available anywhere to Hollywood film companies. That those companies tend to lean liberal is, of course, only a coincidence.

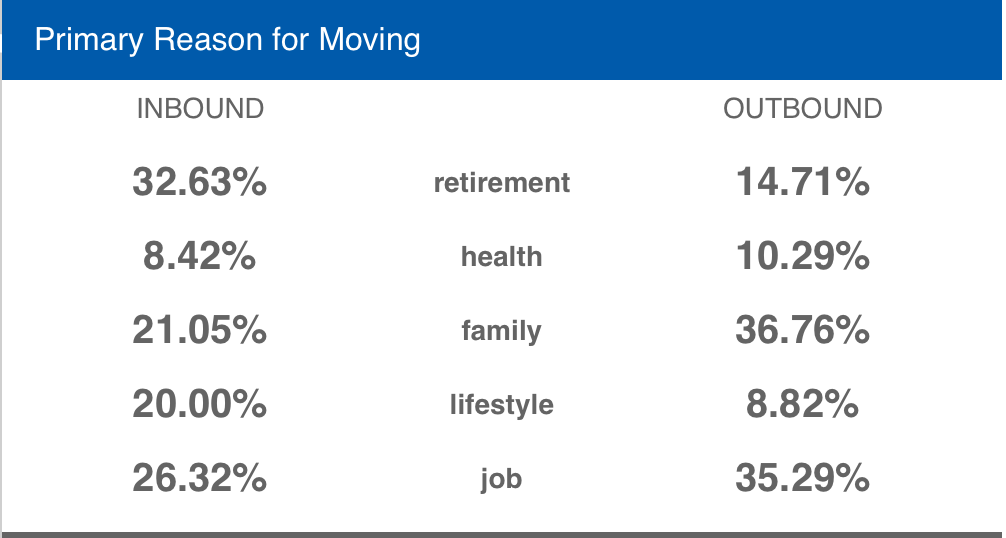

Netflix is the latest production company to bring significant operations to the Land of Enchantment. The streaming company recently announced that it would expand its operations in the state, spending an additional $1 billion in New Mexico over the next 10 years.

That sounds good, but however liberal it may be, the entertainment industry is still the entertainment industry, and the deal comes with a catch. Netflix may be spending in the state, but it will also be receiving a very generous incentive from the New Mexico taxpayer, something of an irony when one-third of the state’s taxes are paid by “wicked” oil and gas.

Netflix (like any film company that operates in New Mexico) is eligible to have 25 percent of its expenses reimbursed by the State. Better yet, the length of the company’s ten-year lease means it “qualifies” under state law to receive an increased reimbursement of 30 percent.

Just to be clear, if Netflix does indeed spend $1 billion over the next decade as it asserts, it could be entitled to checks from the New Mexico Treasury totaling $300 million. If 33.5 percent of New Mexico’s budget comes from oil and gas over that time period, Netflix alone will effectively be receiving $100 million directly from the oil and gas industry.

Of course, if the “keep-it-in-the-ground” wing of the Democratic Party prevails and bans fracking on New Mexico’s federal lands, the state’s oil and gas revenues could plummet, forcing the State’s other taxpayers to pick up more of the bill for Netflix or triggering some sort of crisis in its relationship with the company

Unfortunately, when it comes to subsidies for Netflix, $300 million is just the down payment. The state is also fronting another $17 million in direct incentives to Netflix while the City of Albuquerque is coughing up another $7 million. These funds come from something called the Local Economic Development Act (LEDA), commonly referred to as a “closing fund.” These are payments made by state or local governments to preferred industries. One might believe that in a state as poor as New Mexico (consistently among the nation’s poorest) that taxpayers picking up the bill for 30 percent of a profitable corporation’s business expenses would be enough.

As things seem at the moment, Netflix is going to continue to grow and over time it should create more jobs in New Mexico. That will generate all the usual headlines about how great the company is for the state and its economy, but it will come at a tremendous cost. That cost is not just in lost revenue, but in tax rebates borne primarily by state taxpayers. This subsidy is both unfair and unsustainable.

As one of Hollywood’s biggest businesses, Netflix is a member of that elite group of publicly traded stocks known as the FAANGs (Facebook, Amazon, Apple, Netflix, and Google). Netflix flaunts its rapidly growing profitability, but it is still prepared to consume massive taxpayer subsidies not only from one of the poorest states in the country, but from a state that can only afford to pay out those generous subsidies thanks to the revenues it receives from the oil and gas industry that so much of Hollywood condemns.

Senator Bernie Sanders is still a hero to many in the entertainment industry and, to be fair, he at least takes a principled approach to such corporate welfare. Unfortunately, the same cannot be said for many in Hollywood and Democratic politicians like New Mexico governor Michelle Lujan Grisham. She has locked our state in to paying Netflix outrageous sums of money over the next decade at a time of great uncertainty for New Mexico and its economic outlook and thrown away the key. That much of that uncertainty comes from her own party only piles irony upon irony.

Paul Gessing is president of New Mexico’s Rio Grande Foundation. The Rio Grande Foundation is an independent, nonpartisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility