The Rio Grande Foundation often works with Think New Mexico. From RGF’s perspective Think New Mexico is a politically-centrist think tank working here in New Mexico. Sometimes we agree with them and sometimes we don’t, but their latest report is on K-12 education policy (an issue we work on) and, since New Mexico will be a “blue” state for at least another two years, it is more likely that centrist ideas rather than conservative ones will get traction in the Legislature.

There are 10 proposals, all of them are thoughtful and open to consideration. A few are questionable from RGF’s perspective such as adding time to the school year. It seems like a lot of schools waste a lot of time they already have in the classroom. We’d like to see evidence that more time will be used effectively. Going to a “balanced” school year also has merit, but for young people working summer jobs, it MAY not make sense. It would seem there should be options.

Improving teacher and principal training including residencies sounds like a great ideas, but again, we want to see data that this has been effective elsewhere and it needs to be tracked, if implemented in NM, in some ongoing way.

Small schools and districts make sense, but we’re not sure about smaller class sizes. Making it easier for charter schools to be organized and operate is also a good thing as would a more rigorous curriculum. We question whether student assessments can be depoliticized though. Same for revamping colleges of education.

Finally, improving school board quality seems like a good idea, but the additional training, disclosures, and transparency may make it even more difficult to find people willing to serve in some rural communities.

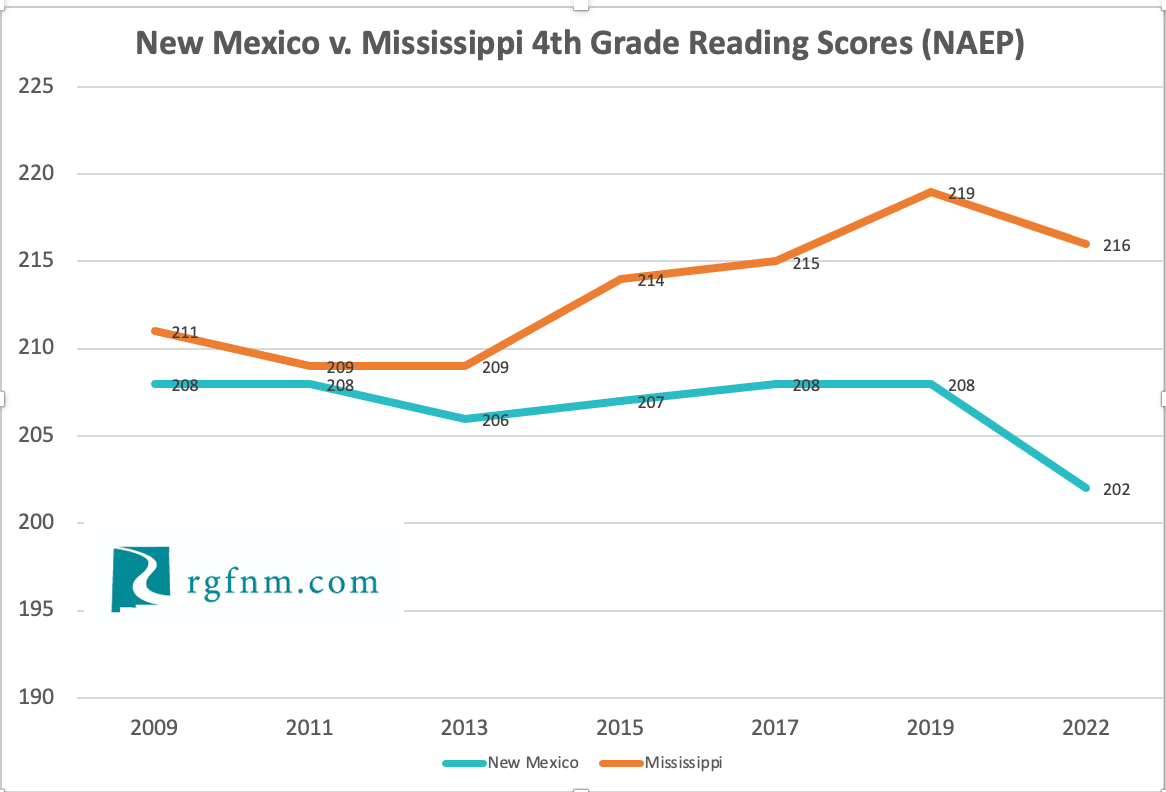

So, since RGF supports many of the recommendations in this report, why isn’t it OUR report? For starters, the report mentions Mississippi’s success in turning their education results around. We have what they did and see that as a simpler starting point. It is ALSO largely the same plan as what Susana Martinez TRIED to implement in New Mexico, but failed due to legislative opposition.

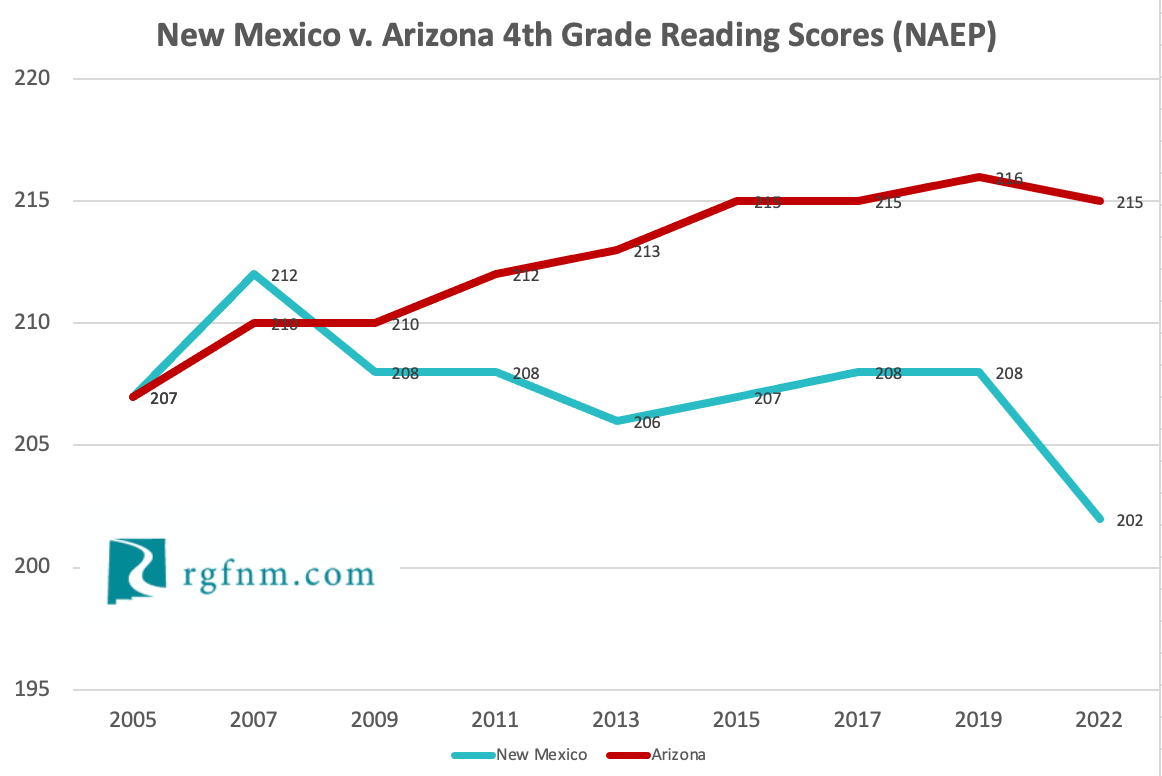

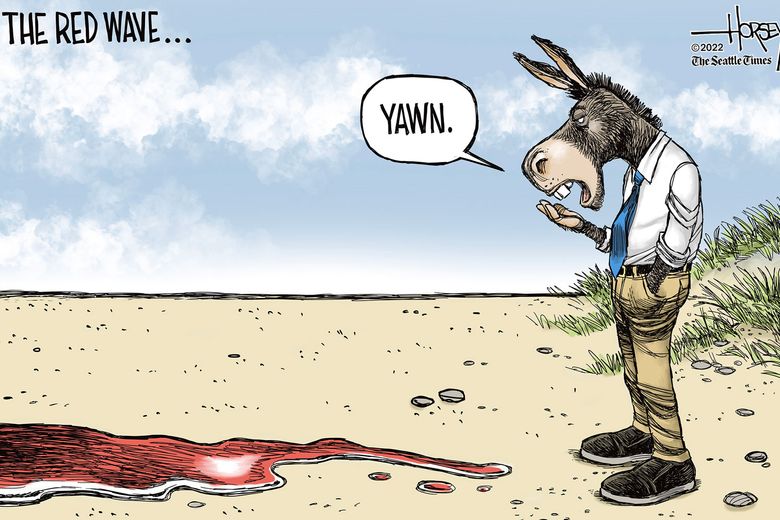

Finally, WE believe that this Legislature (and Gov.) are too beholden to the status quo unions to do anything substantial to improve K-12 education in NM. Sadly, that will require a sea change especially in the Legislature. Our view is that IF/WHEN that sea change comes, we’d rather just do what Arizona and West Virginia have done and allow education $$ to follow the child. Parental accountability is the best accountability.

That being said, Think New Mexico’s report is a solid and worthwhile contribution to the education reform conversation in New Mexico.