The following is a guest article from Carol Wight, CEO of the NM Restaurant Association.

So much has changed for all of us in the last six months. It is time to take a look at the raw numbers of the restaurant industry.

To be sure, restaurants are taking the virus seriously. They are cleaning, sanitizing, social distancing, following the CSP’s, and wearing masks. The safety of restaurant employees and customers has been and always will be our top priority in restaurants.

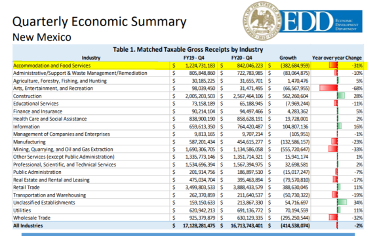

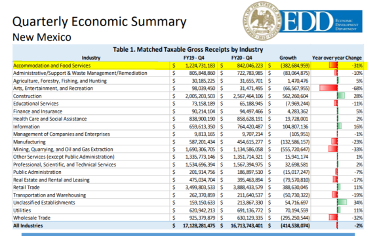

Unfortunately, the economics are not in our favor. According to the New Mexico Economic Development Department’s quarterly summary, the accommodation and food service industries have lost $574 million since January. This is a 31% decrease from 2019.

The leisure and hospitality industries continue to report the most massive employment losses in the State, with a drop of 25,200 jobs—a 24 percent decrease from last year. It’s heartbreaking. Our employees are like our family. Layoffs may be the hardest thing we have had to do throughout this disaster. These layoffs don’t just affect our workers. They include their families that rely on their income for support.

The leisure and hospitality industries continue to report the most massive employment losses in the State, with a drop of 25,200 jobs—a 24 percent decrease from last year. It’s heartbreaking. Our employees are like our family. Layoffs may be the hardest thing we have had to do throughout this disaster. These layoffs don’t just affect our workers. They include their families that rely on their income for support.

A national survey of restaurant owners shows that we stand to lose one-third of our restaurants by the end of the year. That’s 1,155 New Mexico Restaurants. It’s heartbreaking to see life-long restaurateurs like Edna and Rudy Ortega of Ortega’s in Albuquerque walk away from their business of 30 years through no fault of their own. This virus takes no prisoners. There are far too many stories like the Ortega’s even to begin to share them here.

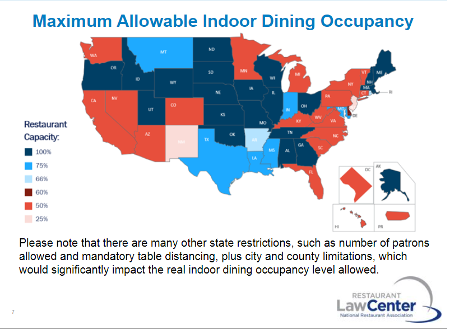

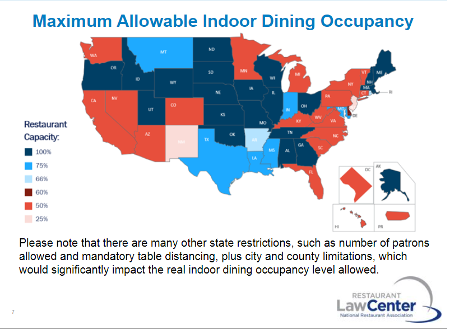

Despite meeting many of the (ever moving) gating criteria, NM continues to have some of the most economically restrictive policies during this pandemic. New Mexico is surrounded by states with indoor dining capacities, much more generous than NM.

At this time, NM only has a COVID policy with an intermittent economic policy. As a small business, you can’t succeed and grow, much less survive, without an economic plan. We need to know what is going to happen next, and it has to happen fast. Financial assistance and safeguards need to be a part of our State’s plan if our industry will ever be able to “come back.”

At this time, NM only has a COVID policy with an intermittent economic policy. As a small business, you can’t succeed and grow, much less survive, without an economic plan. We need to know what is going to happen next, and it has to happen fast. Financial assistance and safeguards need to be a part of our State’s plan if our industry will ever be able to “come back.”

We are not in tune with the rest of the country. Before moving our indoor dining capacity to 25%, only two other states were closed. New Jersey and California have a much more robust economy to begin with and a better chance for recovery. As it stands now, only one other State is at a 25% capacity for indoor dining. If you look at the remaining 48 states, ALL are open to at least 50% capacity, with half of those being open at full capacity.

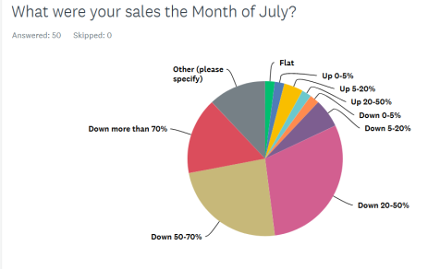

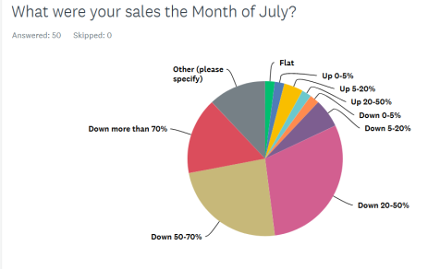

According to a recent survey of New Mexico restaurants, 54% reported sales being down from 20 to 70%. 16% of restaurants noted sales down over 70%.

Most restaurants reported that they could only accommodate 30% of the previous year’s customers due to social distancing and restrictions.

Most restaurants reported that they could only accommodate 30% of the previous year’s customers due to social distancing and restrictions.

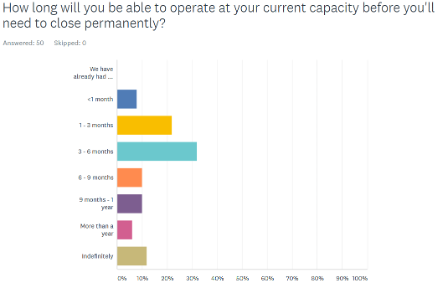

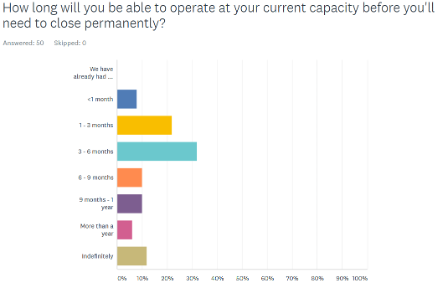

In a recent survey done by the New Mexico Restaurant Association, one-third of restaurants only have three months until they will have to close permanently, and another 30 percent would have to close permanently in six months.

Where does that leave us? Winter is coming. Survival on 25% capacity is near impossible. Increased costs as a result of the pandemic have hit all of us hard. We have asked, through channels, that the Governor open restaurants at 50%. We are doing our part by offering that with this increase, restaurants will close at 10:00 pm and we will support that all restaurants will need to get the NM Safe Certified Training as a prerequisite to open at 50%.

Where does that leave us? Winter is coming. Survival on 25% capacity is near impossible. Increased costs as a result of the pandemic have hit all of us hard. We have asked, through channels, that the Governor open restaurants at 50%. We are doing our part by offering that with this increase, restaurants will close at 10:00 pm and we will support that all restaurants will need to get the NM Safe Certified Training as a prerequisite to open at 50%.

What can YOU do?

Follow the CSPs. Wear your mask. Contact the Governor to let her know you and your family are ready and willing to get back to our dining rooms.

Support the restaurants in your area NOW at this reduced capacity so that they can survive long enough to have hope that our state leaders will increase capacity to 50% sooner rather than later.

And, we (like many) rejected the Gov.’s “stay home” approach and came up with innovative, COVID-safe ways to embrace Trick or Treating in a safe manner.

And, we (like many) rejected the Gov.’s “stay home” approach and came up with innovative, COVID-safe ways to embrace Trick or Treating in a safe manner.

In addition to the audio podcast, the show is available in Albuquerque on Saturdays from 1:15pm to 2pm on Saturdays on the Rock of Talk AM 1600 or FM 93.7.

In addition to the audio podcast, the show is available in Albuquerque on Saturdays from 1:15pm to 2pm on Saturdays on the Rock of Talk AM 1600 or FM 93.7.

Given the Gov.’s approach to the Virus and increasing spread

Given the Gov.’s approach to the Virus and increasing spread

The following appeared in the Farmington Daily-Times on October 7 and several other newspapers.

The following appeared in the Farmington Daily-Times on October 7 and several other newspapers.