RGF’s Paul Gessing critiques MLG’s COVID performance in ABQ Journal

11.02.2020

RGF has been critical of Gov. Lujan Grisham’s big-government economic policies from day one. What we never planned on was a global pandemic that has resulted in unprecedented power being concentrated in New Mexico’s executive office OR the use of that power to pick winners and losers in the State’s economy.

Needless to say, we have been critical of the Gov.’s approach to the Virus AND her willingness to shut down or drastically limit entire industries. The New Mexico media (along with the courts and Legislature) have given the Gov. tremendous leeway in her actions. The Albuquerque Journal article by Dan Boyd in which I am quoted at least DOES give critics a platform and asks some important questions, but the article both labels the Gov.’s response “science based” AND (in the print story) allows the Gov. to claim “I’m going to continue to be a truth-teller).

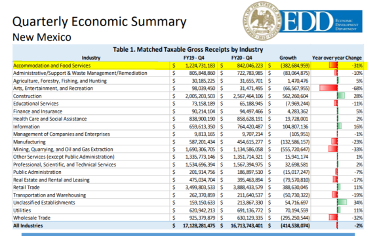

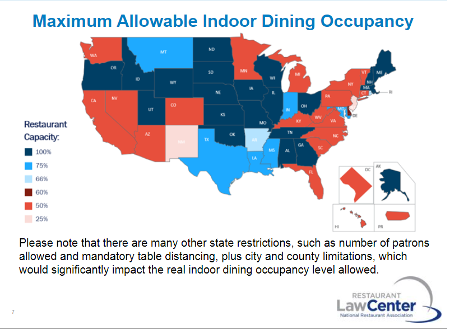

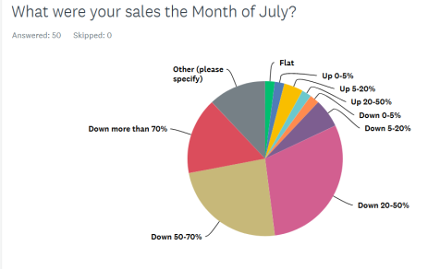

The fact is that the Virus is NOW spreading out of control while New Mexico remains economically and socially closed (and has been for nearly 8 months) to an extent not found in many other states at this time. My quotes from the Journal article are as follows:

Paul Gessing, president of the Albuquerque-based Rio Grande Foundation, a think tank that favors limited government and open markets, said he believes many New Mexicans have started to tune out the governor’s message.

“The economy has not been as much of a focus for the governor as I think it should have been,” said Gessing.

He also said it’s not realistic to ask New Mexicans to stay home for an extended period.

“I think people are reasonable and are doing their best,” said Gessing, who acknowledged the danger posed by the virus while arguing most people infected make a full recovery.

And, while Halloween was definitely different this year, as the parent of young children, we were not going to miss out on trick-or-treating. So, as you can see from the first photo (taken at an indoor church-sponsored event prior to Halloween) the Gessings are NOT anti-mask.  And, we (like many) rejected the Gov.’s “stay home” approach and came up with innovative, COVID-safe ways to embrace Trick or Treating in a safe manner.

And, we (like many) rejected the Gov.’s “stay home” approach and came up with innovative, COVID-safe ways to embrace Trick or Treating in a safe manner.

In addition to the audio podcast, the show is available in Albuquerque on Saturdays from 1:15pm to 2pm on Saturdays on the Rock of Talk AM 1600 or FM 93.7.

In addition to the audio podcast, the show is available in Albuquerque on Saturdays from 1:15pm to 2pm on Saturdays on the Rock of Talk AM 1600 or FM 93.7.

Given the Gov.’s approach to the Virus and increasing spread

Given the Gov.’s approach to the Virus and increasing spread

The following appeared in the Farmington Daily-Times on October 7 and several other newspapers.

The following appeared in the Farmington Daily-Times on October 7 and several other newspapers.