The following appeared in the Albuquerque Journal on April 21st, 2024.

What if I told you that one federal government policy could do the following:

- Undermine Russia’s war against Ukraine (without the US spending a dime);

- Strengthen economic ties between the US and Asian and European nations;

- Reduce CO2 emissions;

- Increase US tax revenues and American jobs (including in New Mexico).

The policy I’m referring to is to allow American exports of liquefied natural gas (LNG). Thanks to American technological prowess the US is producing enough energy not only for itself, but for the world as well.

Sadly, that runs contrary to the Biden Administration’s efforts to undermine American energy dominance. Since January the Administration has maintained a moratorium on permits for US LNG export facilities. Reversing that policy is essential and would help to achieve each of the goals outlined above.

In 2014 none other than Democrat New Mexico Sen. Tom Udall wrote in a letter to President Obama, “a strong market signal from the United States that it is a willing future supplier of LNG, even if those supplies are not immediately available, would have profound, positive and immediate strategic implications.” That same year Udall co-sponsored legislation to speed up the review of LNG export facilities.

Not only was Udall a visionary, but his national security concerns have become more relevant with the ongoing Russian invasion of Ukraine and the fact that they are funding their war with energy revenues. Russia’s war effort could be hindered by reduced energy prices and reliable energy supplies from the US.

LNG isn’t just an issue for America’s allies in Europe. A recent story from Nikkei Asia highlights how completely off-base Biden’s policy is. According to the article, “Massive volumes of coal must be displaced through the 2030s and beyond across emerging Asia to achieve the region’s net-zero aspirations. This inevitably will mean substantial gas imports.”

“India, Vietnam, and the Philippines are among the fast-growing Asian nations that plan to increase the role of gas in their economies through LNG imports as a reliable complement to renewable energy investment.” On his recent visit to the United States one of the primary objectives of Japan’s prime minister was to restore US LNG exports.

According to one report, the cumulative contribution to US economic growth from the addition of more LNG plants will range from $716 billion to $1.267 trillion between 2013 and 2050. This revenue and job growth that comes with it has had no discernable impact on the price Americans pay for natural gas to heat their homes and operate their stoves.

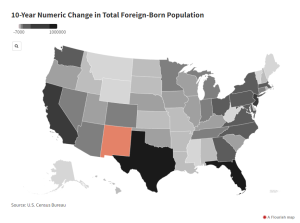

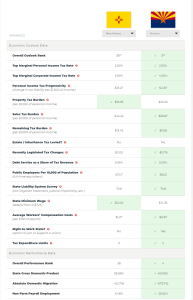

In fact, since New Mexico is among the biggest natural gas producing states in the nation (8th-largest), our State is one that will benefit the most from growing LNG exports and that will lose the most if Biden continues with this senseless policy.

Of course, it is also worth noting just how far we’ve come in the past decade. Tom Udall was seen as one of the Senate’s foremost advocates for pro-environment policies. He not only tolerated LNG exports, he advocated for them.

Where are New Mexico’s current senators, especially Sen. Heinrich who sees himself as the heir to Udall’s environmental vision? Heinrich has been silent on the issue at least his actively updated Twitter feed has been. That’s not a surprise because Heinrich actively opposes New Mexico’s oil and gas industries. Instead Heinrich chairs the “bi-cameral electrification caucus” in Congress and spends a great deal of his time attacking gas stoves while advocating for complete electrification of transportation (and the rest of our economy).

Sadly, while the US continues to reduce its CO2 emissions, Biden and Heinrich are willing to ignore ways the United States can use its LNG-production prowess to help Asian nations lower their CO2 emissions as well while buttressing America’s allies in both Europe and Asia.

The Biden Administration and Sen. Heinrich should, like Sen. Udall, be tireless advocates for LNG exports for environmental, foreign policy, and economic reasons because exports are a “win, win, win” for America and New Mexico.

Paul Gessing is president of New Mexico’s Rio Grande Foundation. The Rio Grande Foundation is an independent, nonpartisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility