While the folks at Voices for Children desperately try to spin New Mexico’s horrendous results in the annual Kids Count report, we are much more interested in finding out how New Mexico’s performance is improving, worsening, and whether the variables in question make sense or not.

Here we go through all 16 variables and our take if needed (you can view the pages for yourself below):

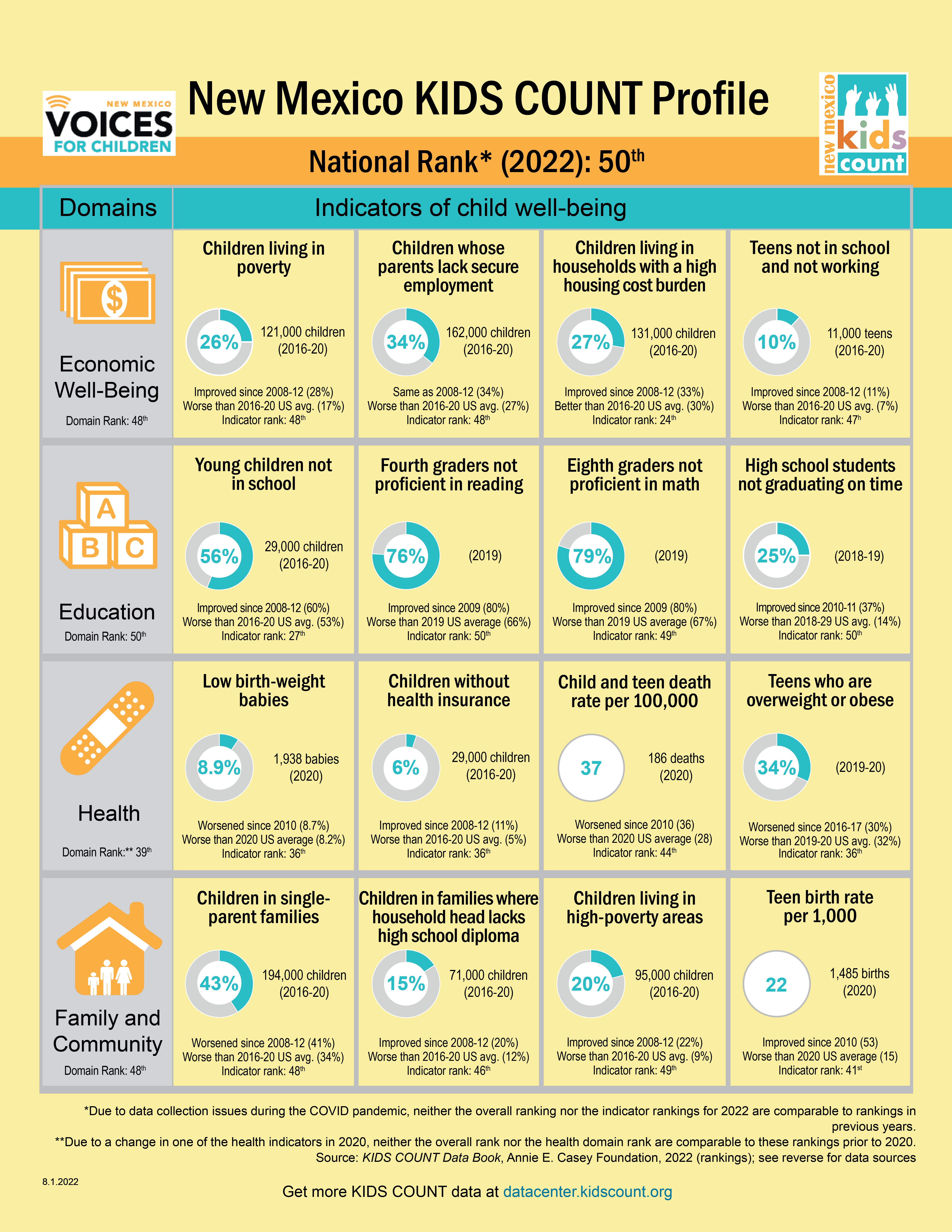

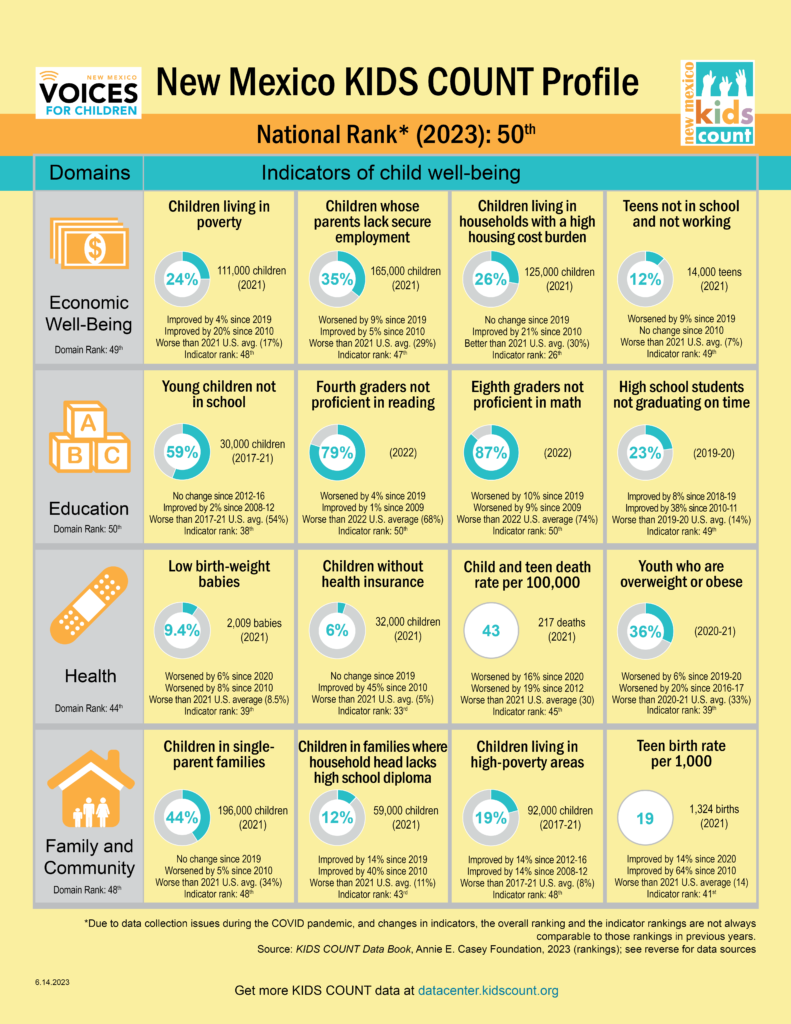

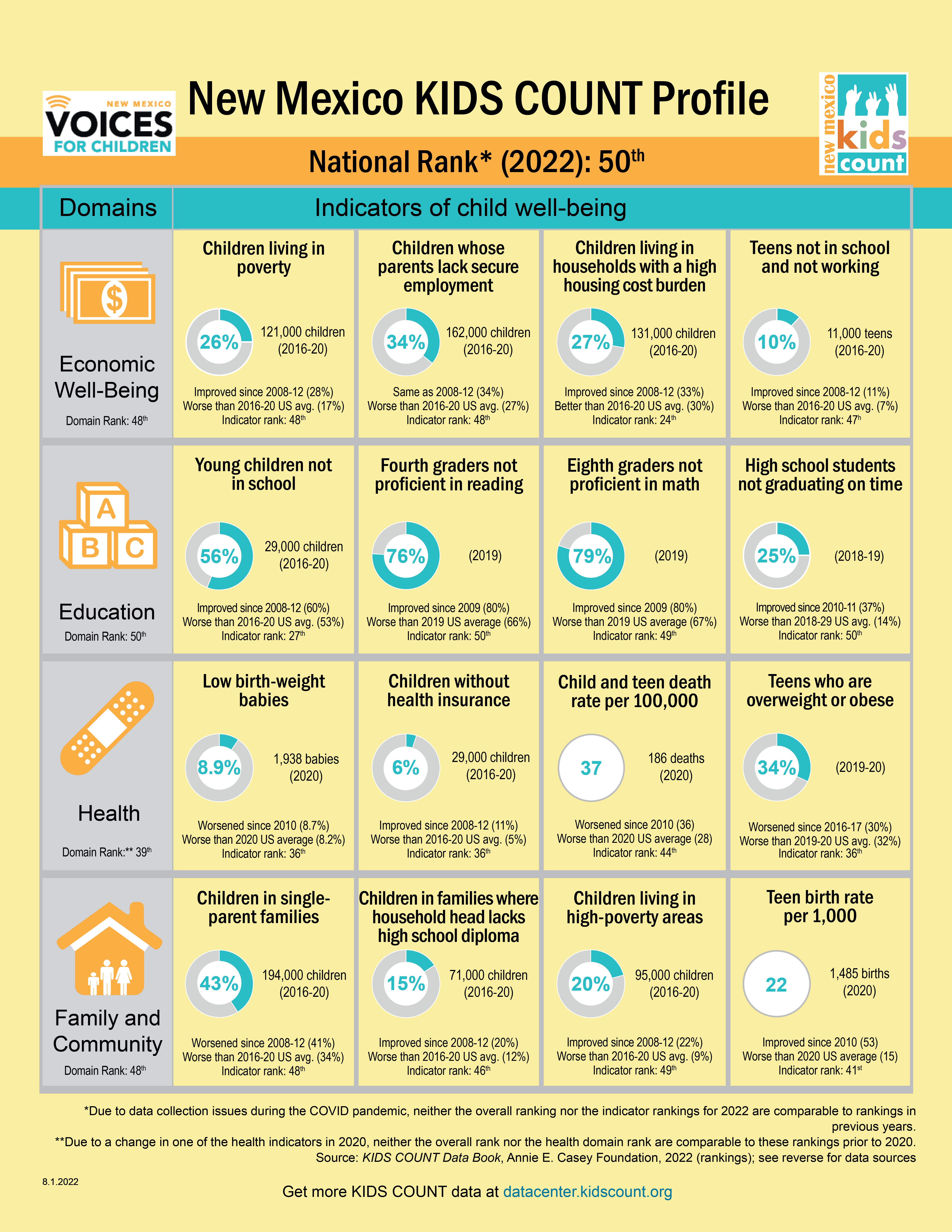

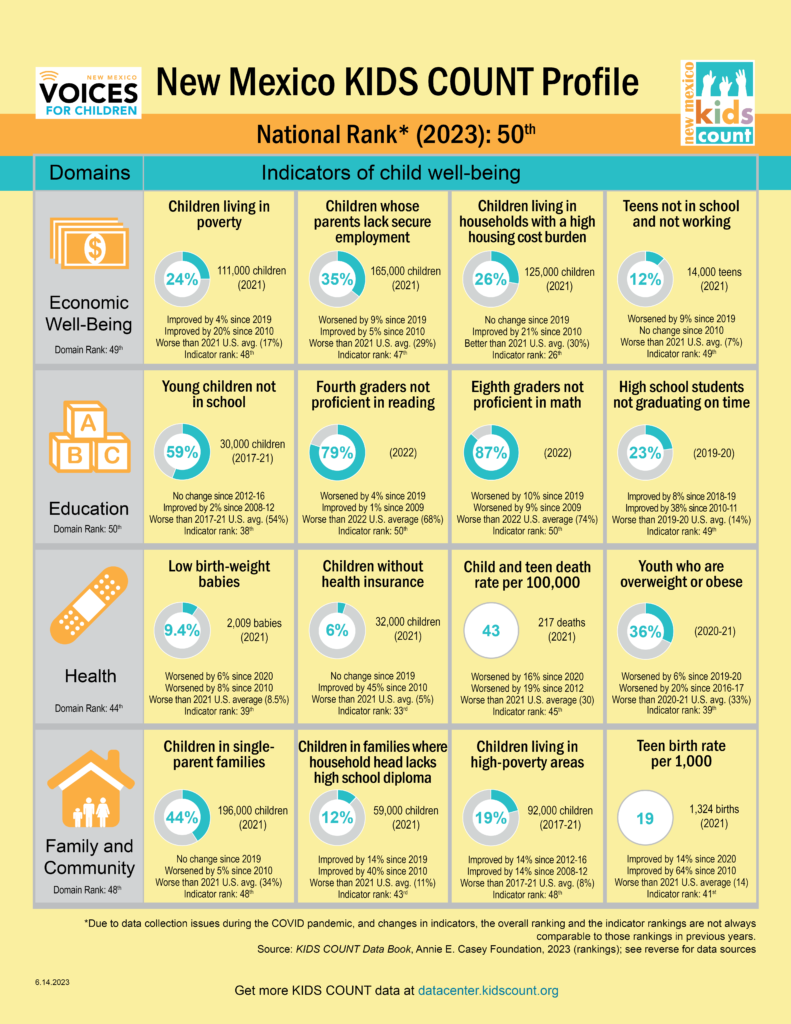

1) Children in poverty improved in 2023.

2) Children whose parents lack secure income worsened in 2023.

3) Children in households with a high housing cost improved in 2023.

4) Teens not in school and not working worsened in 2023.

5) Young children not in school worsened in 2023. While surprising considering New Mexico’s embrace of universal preschool for 3 and 4 year olds, this data point is based on the assumption that 3 and 4 year old children should be in school. We disagree and find this variable lacking in relevance.

6) Fourth graders NOT reading and eighth graders not proficient in math both worsened with results being especially concerning and stark for 8th grade math.

7) High school graduates not graduating on time improved, but we find this variable of dubious relevance due to ever-changing graduation requirements.

8) Low-birth weight babies worsened.

9) Children w/o health insurance stayed same.

10) Child/teen death rate per 100,000 worsened dramatically. Both COVID and lockdowns undoubtedly played a part.

11) Overweight youth worsened. COVID lockdowns undoubtedly played a part.

12) Children in single parent families worsened.

13) Children in families where household head lacks high school diploma improved.

14) Children living in high poverty areas improved.

15)Teen birth rate improved.

Overall, six metrics improved since 2022 while nine fell. Two of the metrics (young children not in school and HS graduation) are questionable in their merits). Undoubtedly of greatest concerns is the poor educational performance of 4th and especially 8th graders despite massive infusions of tax dollars.