The open government rabbit hole is getting pretty deep.

By their own admission, the New Mexico Department of Information Technology (DoIT) does not maintain a records retention policy separate from the “regulations” provided in the New Mexico Administrative Code (NMAC).

NMAC vaguely addresses broad terms like “transitory” and “non-record” but does not specify any length of time that records ought to be accessible.

As an example, hospitals are legally obligated to maintain specific policies that explicitly identify the relative importance of certain documents, the corresponding periods of time that those documents have to exist, and the process by which the documents are disposed of after the time of the retention period has elapsed. And HIPAA is pretty clear that there are fines associated with improperly retained documents.

Without good policies in place, employees are left without direction and chaos ensues. Well, Michelle Lujan Grisham’s administration has cried havoc and let slip the dogs of perplexity.

In an official Inspection of Public Records Act (IPRA) request to DoIT, I specifically sent a copy of the Document Retention Guidance currently being disseminated by the legal department of Governor Michelle Lujan Grisham’s administration. I asked if DoIT has their own policy related to document retention. They provided the link to the NMAC section that addresses records management requirements for electronic messaging.

When asked specifically for the policy that dictates the retention of records, they responded that “DoIT does not currently have a records retention policy”.

A behavioral pattern is developing. Over a dozen state agencies are using Microsoft Teams and those same agencies employ the executive branch policy of automatic deletion after a peculiarly and exceptionally short retention period, previously reported as 24 hours.

The absence of an official retention policy maintained by DoIT contradicted by the existence of legal guidance that “You may delete any text message that is a routine communication and is not ‘required to control, support or to document the operations of government’” is antithetical to the principles of open government. When in doubt, it seems that New Mexico agencies err on the side of deletion rather than retention.

If this sounds confusing, that’s because it is. But with actions like this, it is becoming increasingly clear that New Mexico government is obfuscating the obvious and trivializing the importance of open and transparent government.

According to the Albuquerque Journal, The City of Santa Fe is among about 25 U.S. cities that will be experimenting with universal basic income as part of a pilot program funded through the Mayors for a Guaranteed Income project.

The concept of a “Universal Basic Income” (UBI) that replaces traditional, top-down welfare programs with a government-provided “basic income” has been around for decades and even received support from free market adherents like Milton Friedman and Charles Murray.

Of course, while there are “UBI” supporters on the political right, the idea is to REPLACE other government welfare programs with a “basic” income. Santa Fe’s plan fails right away on that point. In fact, the COVID pandemic has been a bit of an experiment with “real world” UBI. As millions of Americans lost work, government stepped in with “stimuli” and supplemental unemployment payments that have gotten many people used to the idea of government cutting you a check regardless of whether you work or not.

A second big flaw in this “experiment” is that the money will come from voluntary sources, not taxpayers. Funding will come from Twitter co-founder Jack Dorsey, a group called Mayors for a Guaranteed Income project, and the Santa Fe Community Foundation. Having “free” money pay for a new welfare program may SEEM like what the government is doing now, but we are seeing the cost via inflation. Donor-driven UBI as in Santa Fe is just a nice gesture by donors.

Finally, the third major inherent issue is that the money is being targeted to help 100 people under age 30 who have children and are attending Santa Fe Community College.

Targeting certain groups to receive $400-$500 a month is a nice idea, but it’s obviously NOT “universal.”

The problem with UBI is that when it gets through the political process, it will not resemble the theory supported by Friedman and Murray. Among other problems will wind up supplementing, not a replacing other welfare programs.

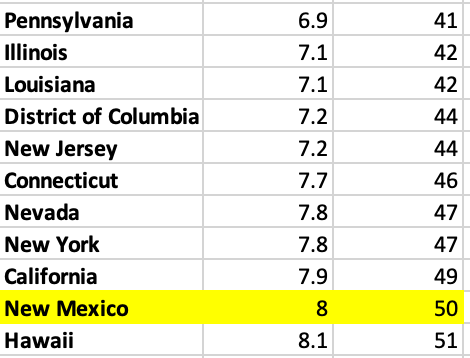

The new unemployment figures are out and states (like New Mexico) with Democratic Governors dominate the list of worst unemployment rates (state with Republican governors dominate the lowest unemployment states).

This is no surprise to us at the Rio Grande Foundation has Gov. Lujan Grisham has enacted economic policies with little concern to actual economic growth. You can find the May data from the Bureau of Labor Statistics here. We have presented the data in different ways below.

Notably, in December of 2018, the month before Lujan Grisham took office, New Mexico’s unemployment rate was 4.7%. Utah’s was higher than it is now (3.2%). New Mexico’s unemployment rate has jumped by 70% under MLG.

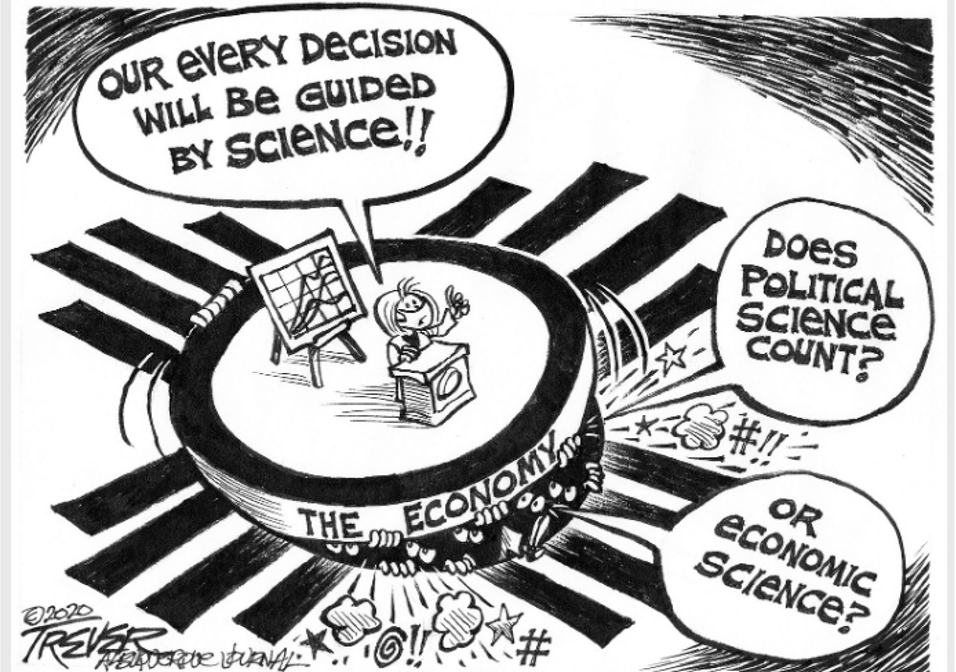

The Albuquerque Journal’s John Trever, of course, had it right from the beginning in this 2020 cartoon.

The Albuquerque Journal’s John Trever, of course, had it right from the beginning in this 2020 cartoon.

Despite Gov. MLG having claimed that “New Mexico will be totally open July 1” the reality is that New Mexico remains one of the strictest states in the nation in terms forcing masks on children. Predictably, as it stands now, when kids go back to school in early August they will be forced to wear masks (as will students in other “blue” states).

The following data are from Burbio which has done invaluable work tracking various COVID-related rules. Not surprisingly, all of New Mexico’s neighbors DO NOT have mask mandates while a majority actually ban locally-imposed mandates. With the Biden Administration pushing 12 year olds to be “vaccine ambassadors” to their fellow 12 year olds, there seems to be little question that the Gov. will keep masking our kids until she is told not to by the Biden Administration or CDC (despite the absurdly-low virus death rate among healthy children).

NM didn’t quite get to its 60% vaccination rate, but the Gov. says NM will be “totally reopened” on July 1. This is welcome news, but it’s also not really true (not for our children, yet).

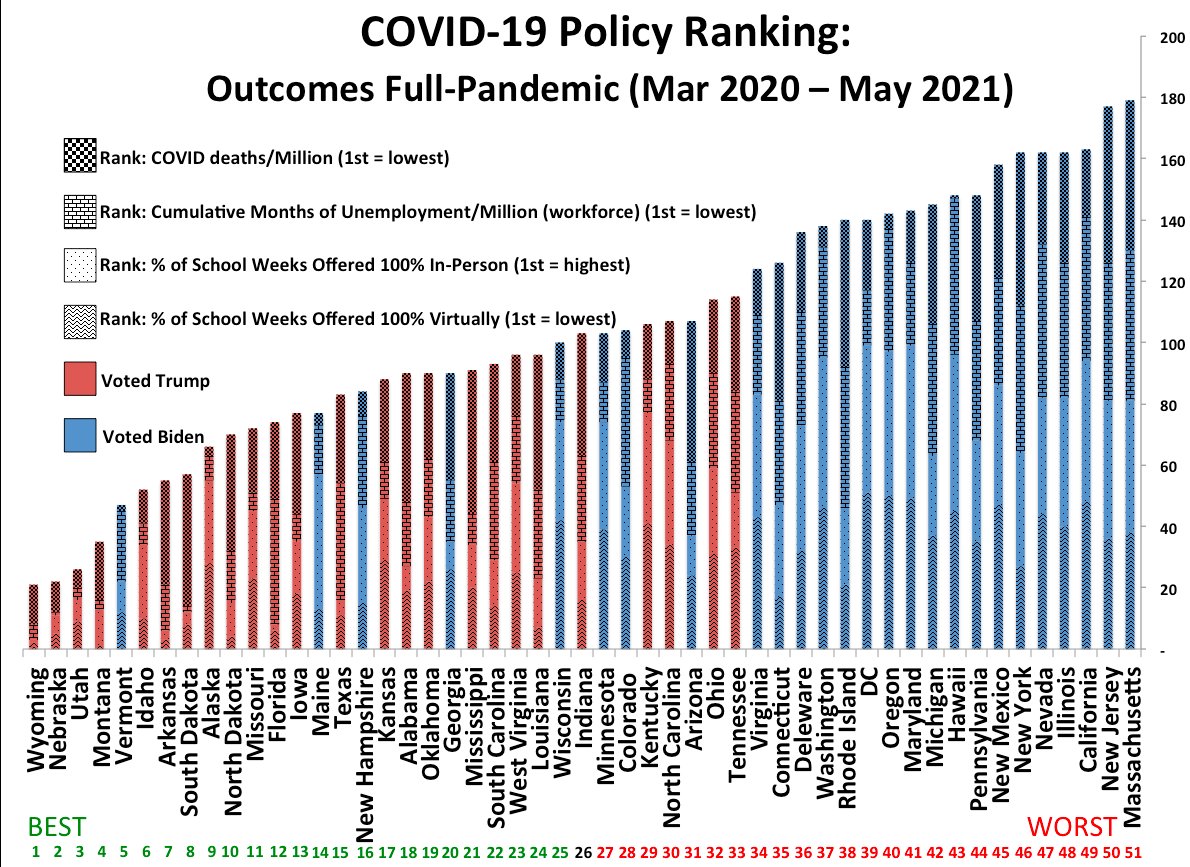

Now that COVID IS receding as an issue, the debate will be over Gov. MLG’s performance during the pandemic. Paul cites a national report to show why he believes she did a poor job.

Speaking of COVID performance, NM’s Education Secretary Stewart recently took a “victory lap” on COVID 19. Again, the data don’t seem to back him up.

The Biden Administration wants your kids (as young as 12) to push their friends and families to take the vaccine.

One of the largest and most prominent hotels in New Mexico is totally shuttered.

Did a federal judge just unleash a new era of energy-driven prosperity in New Mexico?

While the State of New Mexico and its citizens may benefit from oil and gas jobs, MLG wants to impose ethanol and other supposedly “green” fuels on drivers during the next legislative session.

The Kids Count Report co-released by the Annie E. Casey Foundation and Voices for Children has at least partially been released (we had trouble accessing the full report). The Albuquerque Journal had a story and the most relevant chart (below). New Mexico has moved up slightly to 49th overall from 50th in the previous report. Of course, Gov. Lujan Grisham proclaimed this a “success.”

As we’ve stated in the past, the report itself is reasonably sound, but as with most such reports, but interpretations vary based on the political inclinations of those looking at the data. It is no surprise that the Gov. and Voices embraced even a tiny uptick. And, with the COVID 19 pandemic looming in next year’s data and New Mexico students suffering massive educational losses, it will be interesting to see what happens with the report itself and especially New Mexico’s results.

Recently, RGF’s president was walking downtown and noticed the Hyatt Hotel downtown was completely closed to the public. Physical entry to the property was impossible and his phone calls were not returned.

Ultimately, it came to light thanks to an Albuquerque Journal article that the hotel was closed due to a lack of convention business AND that the City of Albuquerque had filed tax liens against several properties for lack of payment of lodgers taxes. The Rio Grande Foundation has expressed concerns in the recent past about lodgers taxes and agrees that reform is needed, BUT if the business is collecting the tax from its customers, they should be remitted.

Check out the story here and by clicking the image below:

It has been hot and mostly dry throughout New Mexico this June. After a pleasant and relatively cool (at least in Albuquerque) Memorial Day weekend, the heat has been on and the rain has been scarce. This is a longer-term (and more complex) issue for Elephant Butte Lake and agricultural users, but you can bet that environmentalists and many New Mexico policymakers will push for even faster government-driven efforts to address “global warming.”

But, as noted in several media articles including this one from the BBC, China’s CO2 emissions now exceed ALL other developed nations combined.

And, while the US has continued to reduce CO2 emissions, especially in the pandemic year of 2020, China continues to move in the opposite direction. Point being that the US (and certainly not New Mexico) can and should move to be more efficient (including the adoption of nuclear energy), but cannot reduce CO2 emissions without dramatic action by China.

Of course, most supposedly “green” politicians here in New Mexico would rather enact destructive economic policies here at home than push China to reduce CO2 emissions.

We at the Rio Grande Foundation try to stay on top of the numerous economic changes and issues taking place around both the Albuquerque metro and the State. Recently, on a walk through downtown Albuquerque, the Foundation’s president noticed that the Hyatt Hotel downtown was closed. No bellhop out front, no one at the reservations desks, no lights on, and the doors are closed. Check here for yourself.

We also called them and attempted to contact Heritage Hotels which apparently manages the property now.

With downtown Albuquerque struggling mightily STILL post- COVID and post-riots, the future of this hotel is of great interest.

UPDATE: Per the Albuquerque Journal, the Hyatt downtown is one of several hotels that has a lien against it from the City of Albuquerque. It has been shut down due to the lack of convention traffic in downtown Albuquerque.

We have often disagreed with New Mexico’s “powers that be” regarding their handling of COVID, but this recent opinion piece by Education Secretary Ryan Stewart is particularly shocking.

The gist of the piece involves Stewart celebrating his Department’s “accomplishments” during the era of COVID 19. Whether it means “keeping people safe” or training staff in COVID-safe practices, Stewart’s article is basically one big pat on his own back.

Of course, New Mexico students lost more classroom time than students in all but 5 other states due to policies imposed by Gov. MLG and his Department. He doesn’t even mention educational outcomes or results, partially because the Administration has eliminated most testing.

Remember, according to the “progressive” New Mexico Voices for Children, New Mexico ranked 50th on education BEFORE the pandemic.

On this week’s interview, Paul sits down with Sandoval County Commissioner and gubernatorial candidate Jay Block.

Paul and Jay have worked on a number of pro-freedom issues, notably local “right to work” ordinances that were ultimately adopted in 10 of New Mexico’s 33 counties (including Block’s home County of Sandoval which adopted the ordinance first). Paul queries Jay on a number of other issues relating to his priorities for New Mexico, its economy, and the track record of current Gov. Lujan Grisham.

This week a federal judge (much to the consternation of radical environmentalists) voided the Biden Administration’s moratorium on oil and gas permitting on federal lands. The news so far in 2021 for New Mexico and the oil and gas industry had been mixed, but this decision, if it holds, could make 2021 a watershed moment for New Mexico’s most important industry.

So, as long as Gov. Lujan Grisham continues her unstated policy of placating her environmental supporters through the Energy Transition Act and pushing for a “clean fuel standard” while not attacking the Industry directly, New Mexico’s oil and gas industry could be a growth industry both in terms of jobs AND in terms of tax revenues for the State for the foreseeable future.

Gov. Lujan Grisham claims that based on its relatively high vaccination rate, she is doing a good job of battling COVID 19.

The Rio Grande Foundation on the other hand has long held that Gov. Lujan Grisham has done a poor job of handling COVID 19.

In fact, we laid out an alternative approach to the Virus back in April of 2020 that was entirely ignored by the Administration. And, MLG continues to engage in absurd policies like forcing student-athletes to wear masks. New Mexico is the ONLY state to currently do that.

A new report from Emily Burns at The Smile Project places New Mexico 7th-worst overall. The data used are below and include death rates, unemployment, and lost schooling. There are other ways to rate overall COVID performance, but the chart below does a solid job.

By those standards, New Mexico’s Gov. is hardly doing a good job on COVID 19.

The United States Federal Government mandates retention rules for private sector entities. This is prevalent in the Health Insurance Portability and Accountability Act (HIPAA).

Section 164.316(b)(1) HIPAA requires that organizations:

“(i) Maintain the policies and procedures implemented to comply with this subpart in written (which may be electronic) form; and (ii) if an action, activity or assessment is required by this subpart to be documented, maintain a written (which may be electronic) record of the action, activity, or assessment.”

Section 164.316(b)(2)(i) also says:

“Retain the documentation required by paragraph (b)(1) of this section for 6 years from the date of its creation or the date when it last was in effect, whichever is later.”

Even the Internal Revenue Service (IRS) requires retention of individual tax returns and related documents for 3 years:

“Keep records for 3 years if situations (4), (5), and (6) below do not apply to you.”

If the government has the authority to mandate records retention requirements for private entities, we the people ought to invoke our authority to require reasonable records retention periods from our government.

Is 24 hours reasonable? The Rio Grande Foundation does not agree.

As such, the Foundation has filed a complaint with New Mexico Attorney General Hector Balderas after recent discovery of the executive retention policy of Michelle Lujan Grisham’s administration. In January of 2021, the executive branch issued a directive mandating automatic records deletion of all instant messages sent through the state’s messaging platform after 24 hours.

We find this to be an egregious assault on openness and transparency in government and implore the Attorney General to take immediate action.

You can find a copy of the original complaint here.

Albuquerque’s homeless situation continues to spiral out of control while some “leaders” want to institutionalize “homeless” encampments around the City in yet another effort to make homelessness an even greater problem. Mayor Keller has also proven himself to be woefully unprepared to address the problem.

Driving from I-40 to Downtown is one of the “best” ways to see what is happening for yourself although almost every intersection in town has people asking for money. These photos were taken on the afternoon of June 15, 2021.

Catnap under the I-40 bridge:

Would YOU take your family to Coronado Park?

On this week’s conversation, Paul and Wally discuss several important news items that the media got wrong in advance of the 2020 election.

Sen. Joe Manchin opposes ending the filibuster and the passage of the awful HR 1 through Congress.

24 New Mexico Democrats support Biden’s moratorium on federal oil and gas permitting. At the same time, New Mexico’s revenues are up $350 million thanks largely to oil and gas and the price being over $70 a barrel. The industry continues to thrive despite the number of drilling rigs being down. Biden is also opposed to oil and gas in Alaska and the Keystone XL pipeline is dead. Paul and Wally discuss the issues w/ oil and gas.

RGF was recently censored by Youtube.

Richard Branson wants to launch out of Spaceport America as soon as Independence Day weekend to beat Jeff Bezos to space.

Is inflation back? Free buses in Albuquerque and Enchant Energy will experience delays as it moves to implement carbon capture technology to keep San Juan Generating Station open.

Finally, Paul was recently in Idaho to meet with occasional Tipping Point guest Grover Norquist.

The following (below the image) is the text of an email received today from President Biden’s US Department of Education. Regardless of your position on the vaccines themselves, pressuring children as young as 12 years old to get a vaccine for an illness that really doesn’t impact healthy children is absurd.

Our children should NOT be forced to wear masks RIGHT NOW as they play sports in 100 degree heat. They shouldn’t be masked when they return to school this fall. Furthermore, the creation of a COVID19 Student Corps is an insidious effort to push an unnecessary vaccine on our children.

In her ongoing effort to placate radical environmentalists while not directly attacking New Mexico’s oil and gas industry, Gov. Lujan Grisham announced yesterday that she would be putting the “Clean Fuel Standard” legislation on the “call” for the 30-day session that kicks off in January of 2022.

RGF’s Paul Gessing was quoted in the Santa Fe New Mexican as saying that, of course this mandate will increase costs to consumers because “there’s no such thing as a free lunch.” The Administration would like New Mexicans to think that somehow passing a new mandate to use less carbon-intensive fuel will be an economic boon to the State.

In reality, according to the State of Oregon’s own analysis, the “clean fuel standard” in that state cost approximately 4 cents per gallon. Of course, that analysis is from the State AND the program is not fully-implemented (which could increase costs). And, one of the prime “replacements” for gasoline is likely to be ethanol, the environmental and technological track record of which is spotty at best.

At the Rio Grande Foundation we LOVE it when we appear in media outlets thanks to writings of others. It means that we’ve hit a nerve and that people are paying attention. Unfortunately, papers don’t always give us an opportunity to respond, so we respond HERE.

The latest is a piece by “democracy activist” John House and it is in the Santa Fe New Mexican. The author calls it “A defense of the Gov’s pandemic actions,” but it really is no such thing. The author mostly wishes to discount the content of a deposition by Health Secretary Tracie Collins that we published online, but he doesn’t actually make any salient points. Instead he makes the red-herring argument that Sen. Cliff Pirtle and RGF believe that absent the Gov.’s lockdown policies, the economy would be “just fine.”

In reality, there would have been impacts from the Virus alone, but with locked-down New Mexico and other “blue” states having the highest unemployment rates and more open “red” states having the lowest, he clearly glosses over the impact of the Gov.’s policies. Just to be clear, New Mexico now has the 13th-highest death rate from COVID, so MLG’s lockdown policies haven’t exactly succeeded.

Way back in April of 2020, the Rio Grande Foundation outlined an alternative approach to fighting COVID 19 in New Mexico. We called it “Fairly Open.” It involved being fair with businesses and allowing them to innovate. It meant being open and transparent about the data being used and working to explain her decisions to the people of New Mexico. If House REALLY believes MLG did a good job on COVID he didn’t do a very good job of defending her.

Americans have not suffered from really high inflation rates for a generation. Notably, there is widespread agreement among economists across the political spectrum that inflation harms the poor disproportionately.

According to the following chart from the New York Times, inflation hit 5% in May. The annual rate hasn’t been 5% since 1990. What happens next is anyone’s guess, but there is no doubt that the kind of spending we’ve seen from the Biden Administration is largely to blame and unsustainable.

On this week’s conversation, Paul sits down with Jeffrey Smith of New Mexico Copper Company. After over 300 episodes of the show, this is the first time Paul has had a chance to interview someone from the non-oil-and-gas mining industry.

Jeff and Paul discuss the copper industry, the proposed Copper Flat mine that his company is working to get permitted, environmental issues in mining, and the particular importance of mining in Biden’s push for electric vehicles and “renewable energy.”

Government is really good at using copious quantities of taxpayer dollars to produce undesirable “products” at a high cost and having those products in turn rejected by the supposed “customers” they are meant to serve.

The City of Albuquerque has chosen to spend $3 million (above and beyond massive existing subsidies) to completely eliminate bus fares on the City bus system.

Albuquerque’s buses are deeply unpopular and have always been so, but ridership truly plummeted during the pandemic. Of course, despite massive government spending, transit ridership had been declining nationwide for years. The pandemic caused ridership to plummet.

The question is not whether “free” bus service will goose ridership (it won’t). Rather, the questions is whether transit will ever recover from new “virtual” and hybrid work patterns (and the emptying of Americans from urban centers).

The concept was concisely summarized by President Reagan in the quote below many years ago.

During a recent Tipping Point New Mexico podcast (still available in audio format and on Facebook) the hosts discussed the usual list of political news and events impacting New Mexicans. Among the topics discuss were mask requirements imposed upon student athletes, Gov. Lujan Grisham’s emails (and contrasting their deletion with the recent “dump” of Dr. Fauci’s emails), and we also discussed the unfortunate withdrawal of professional golfer Jon Rahm due to a positive COVID test.

Which of these (or other) topics caused Youtube to pull our video down? Hard to say. See the notice below. What is definitely of concern is the censorship practices of our big tech companies. That’s why we at RGF have been a proud member of the Free Speech Alliance which is organized and led by the Media Research Center.